CPSE ETF

| Details as on June 30, 2021 |

|

Equity - ETF

Type of Scheme

An Open Ended Index Exchange Traded Scheme

Current Investment Philosophy

The Scheme employs a passive investment approach designed to track the performance of Nifty CPSE TRI. The Scheme seeks to achieve this goal by investing in securities constituting the Nifty CPSE Index in same proportion as in the Index.

Date of Allotment

March 28, 2014

Fund Manager

Vishal Jain

Benchmark

Nifty CPSE TRI

Fund Size

| Monthly Average : | ₹ 15,164.03 Cr |

| Month End : | ₹ 15,054.07 Cr |

NAV as on June 30, 2021

| NAV as on June 30, 2021 | ₹ 26.1579 |

Load structure

| Entry Load: | Nil |

| Exit Load: | Nil |

| Standard Deviation | 7.95 |

| Beta | 0.97 |

| Sharpe Ratio | 0.01 |

| Note: The above measures have been calculated using monthly rolling returns for 36 months period with 3.36% risk free return (FBIL Overnight MIBOR as on 30/06/2021). | |

Portfolio Turnover (Times)

| Portfolio Turnover (Times) | 0.20 |

| Tracking Error@ | 0.61% |

| Creation Unit Size | 100,000 Units |

| Pricing (per unit)(approximately) | 1/100th of Index |

| Exchange Listed | NSE, BSE |

| Exchange Symbol | CPSEETF |

| ISIN | INF457M01133 |

| Bloomberg Code | CPSEBE IS Equity |

| Reuters Code | GOMS.NS & GOMS.BO |

Total Expense Ratio^

| Total Expense Ratio^ | 0.0095 |

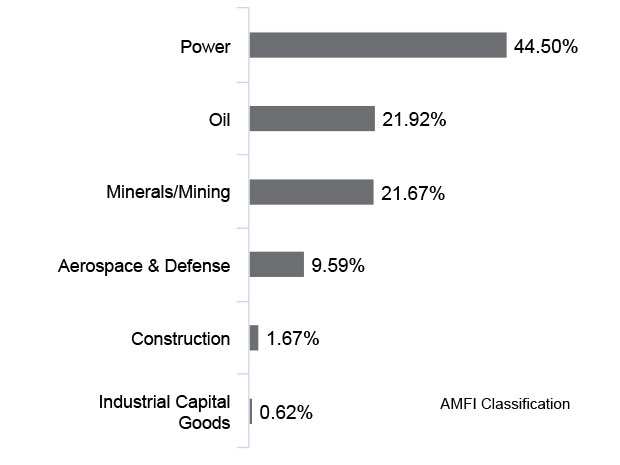

| Company/Issuer | % of Assets |

| Aerospace & Defense | |

| Bharat Electronics Limited* | 9.59 |

| Construction | |

| NBCC (India) Limited* | 1.67 |

| Minerals/Mining | |

| Coal India Limited* | 13.87 |

| NMDC Limited* | 7.79 |

| Oil | |

| Oil & Natural Gas Corporation Limited* | 19.38 |

| Oil India Limited* | 2.54 |

| Power | |

| Power Grid Corporation of India Limited* | 20.17 |

| NTPC Limited* | 20.10 |

| NHPC Limited* | 2.97 |

| Equity Less Than 1% of Corpus | 1.87 |

| Cash and Other Receivables | 0.03 |

| Grand Total | 100.00 |

*Top 10 Holdings

| Full market capitalisation (₹ Cr) | 647,793.76 |

| P/E | 8.41 |

| P/B | 1.37 |

| Dividend Yield | 4.54 |

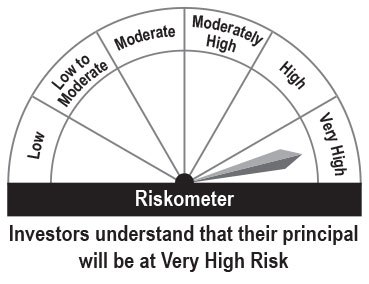

This product is suitable for investors who are seeking*:

• Long term capital appreciation

• Investment in Securities covered by the Nifty CPSE Index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

For scheme performance please click here. For Fund manager wise scheme performance click here.