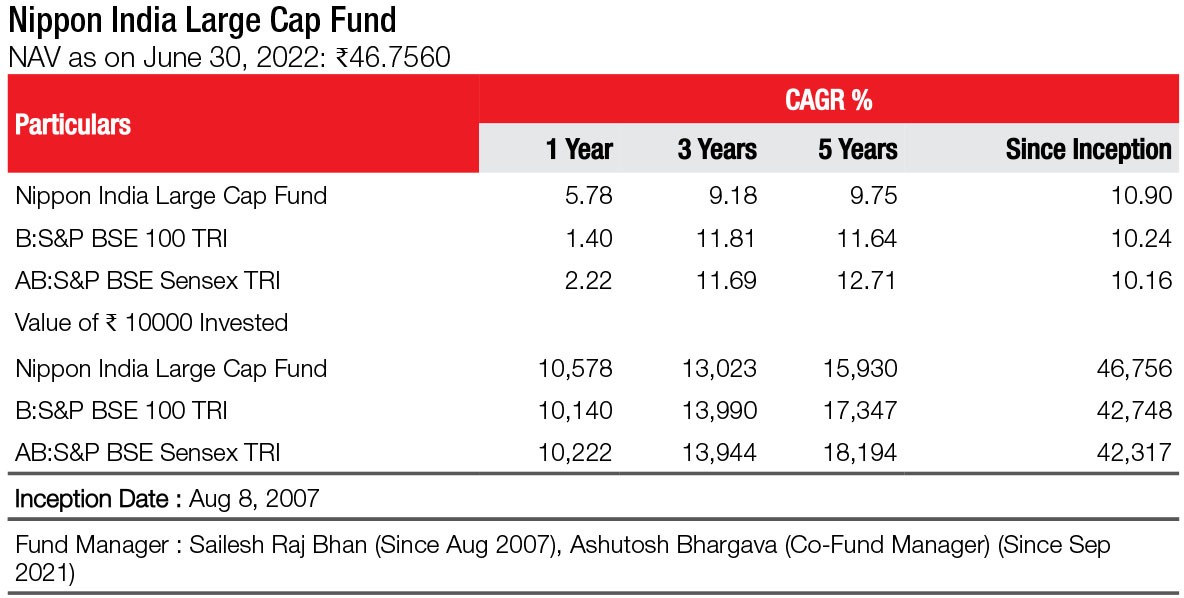

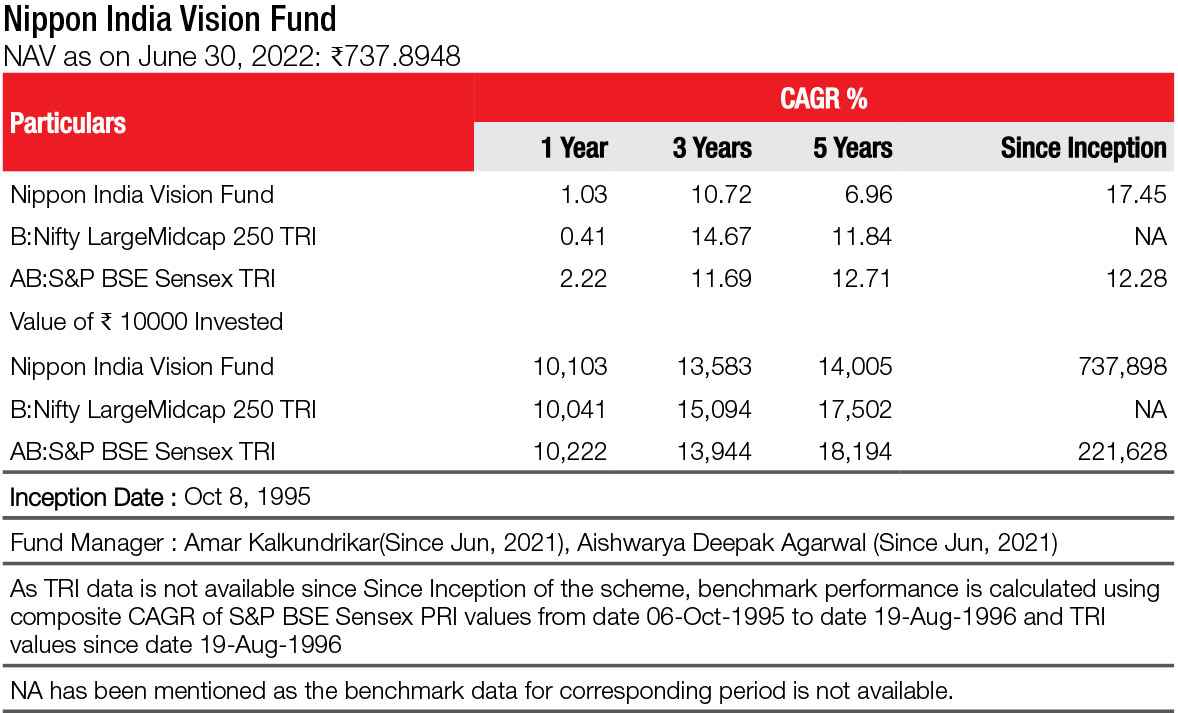

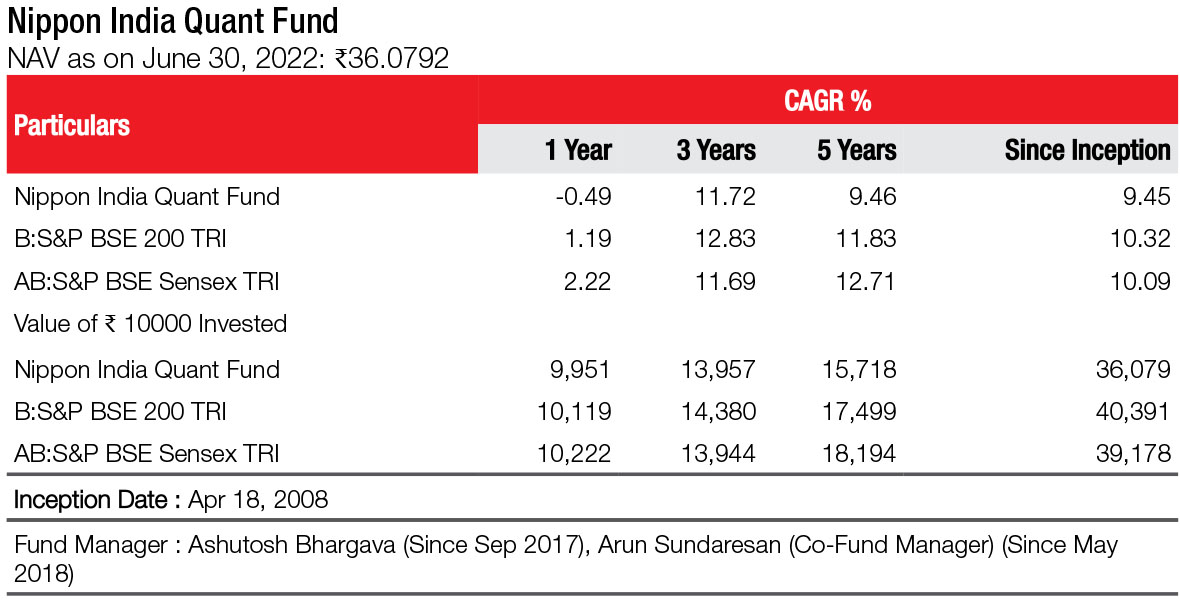

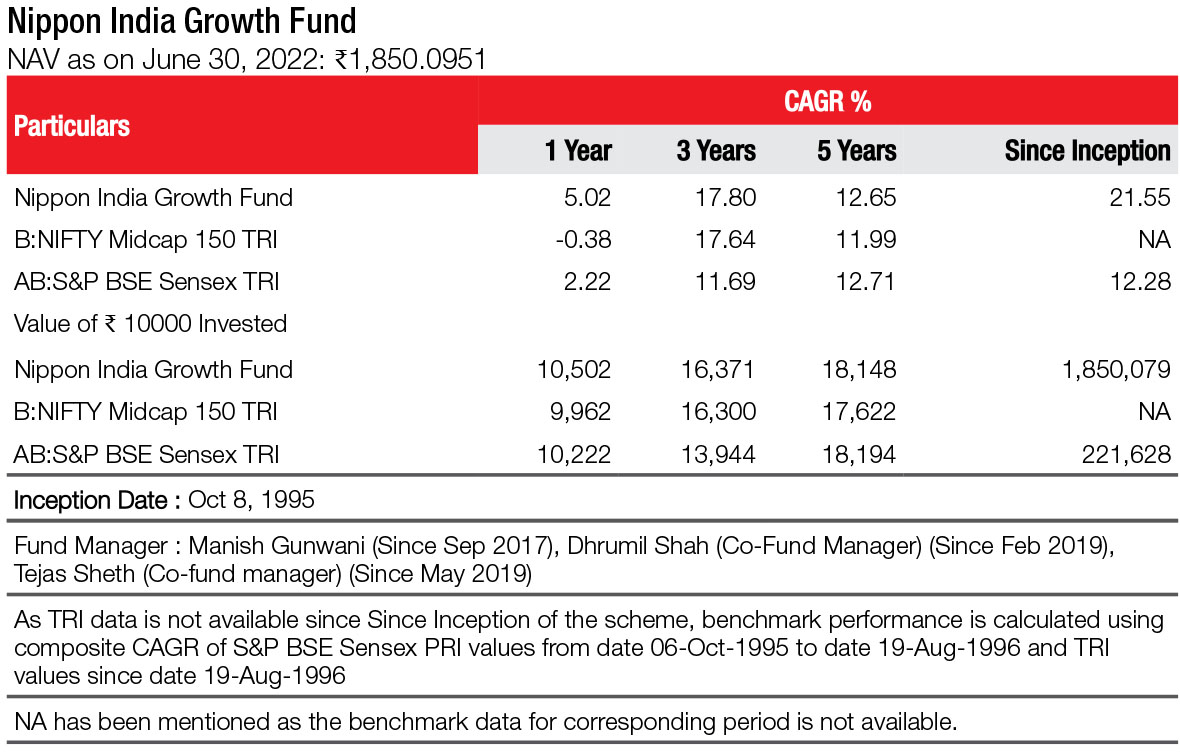

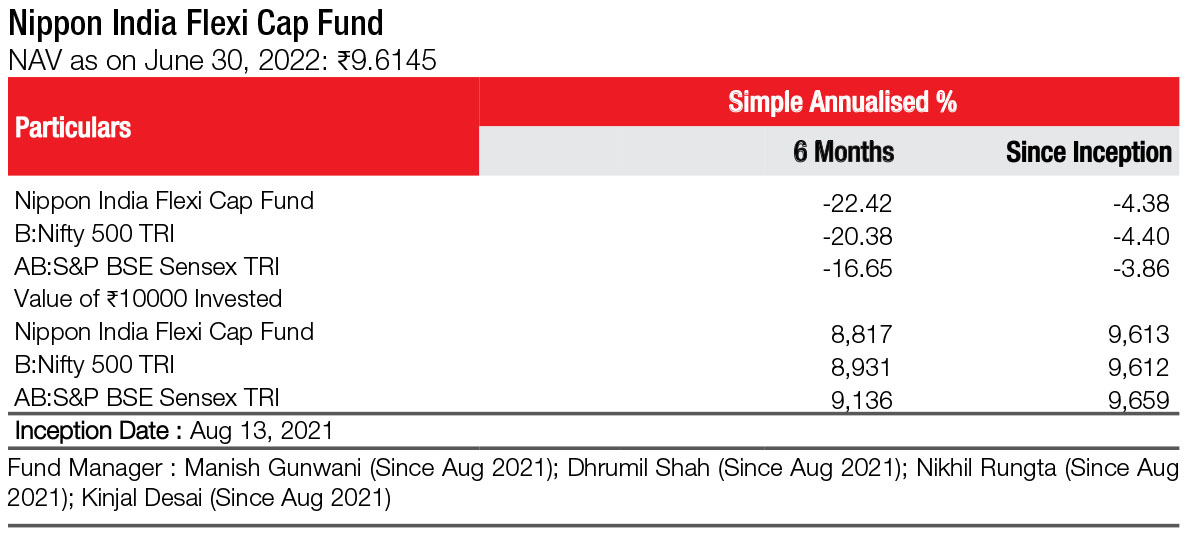

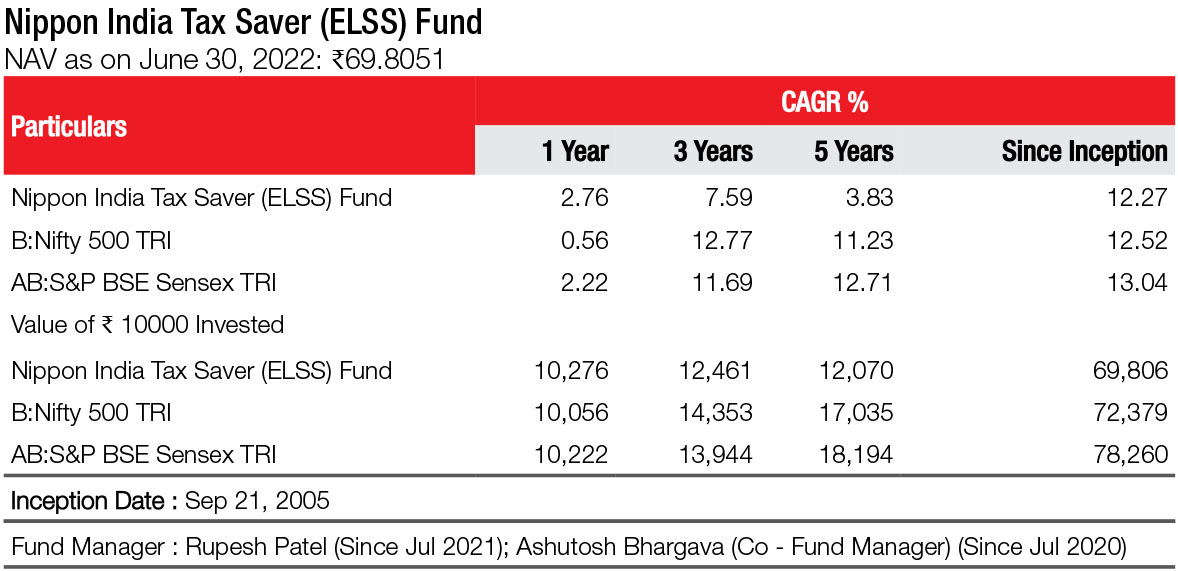

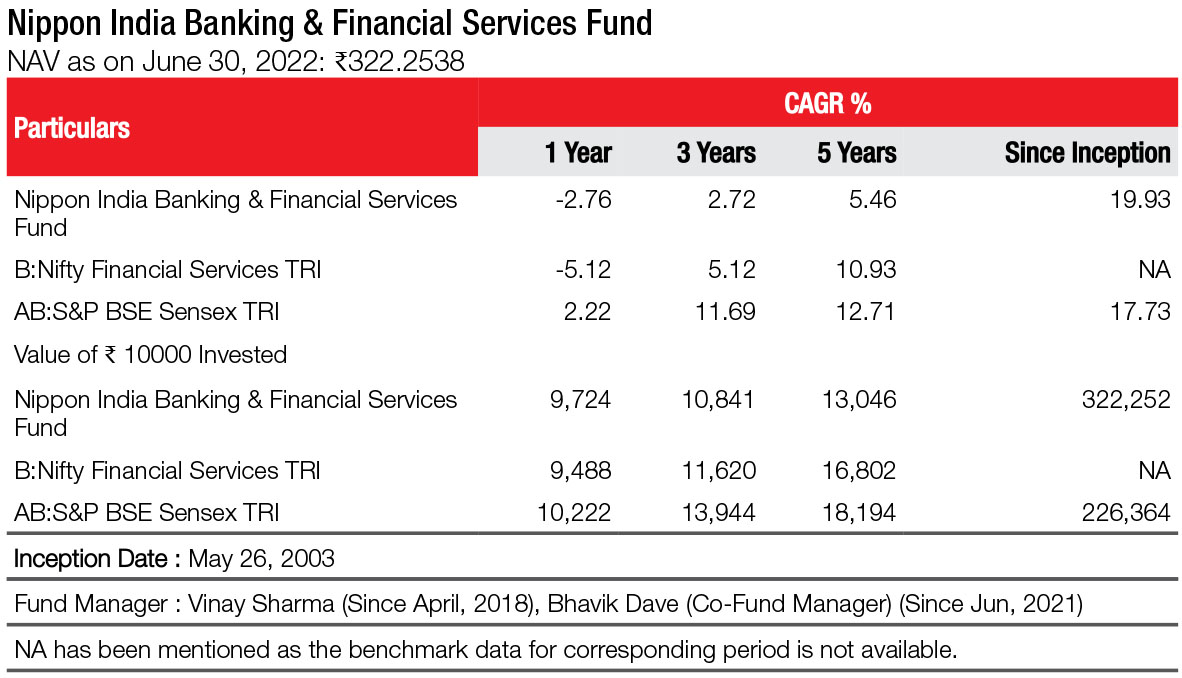

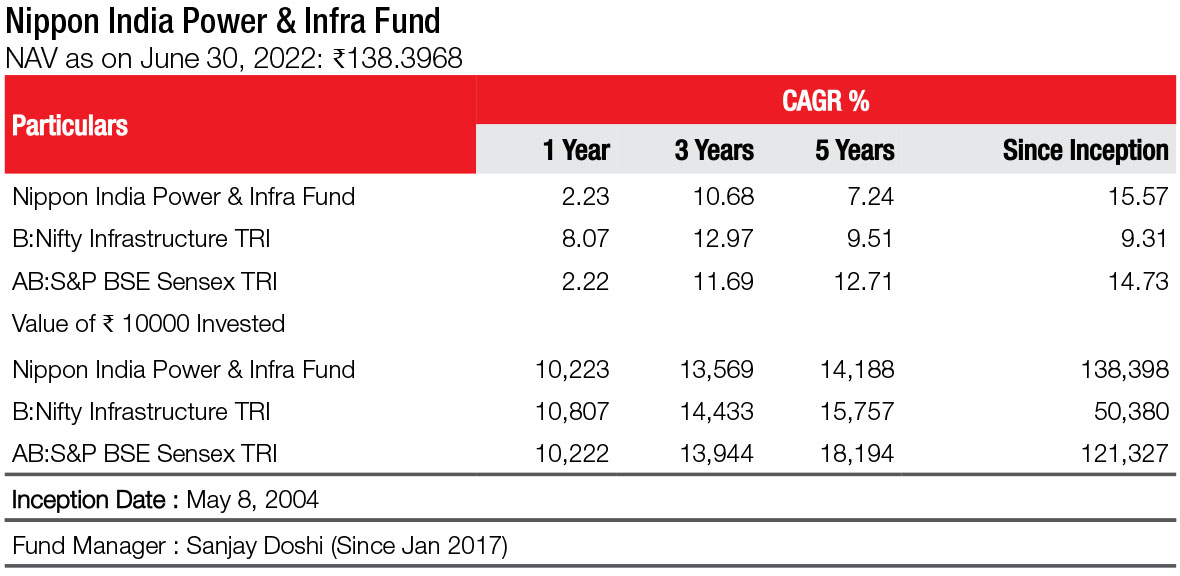

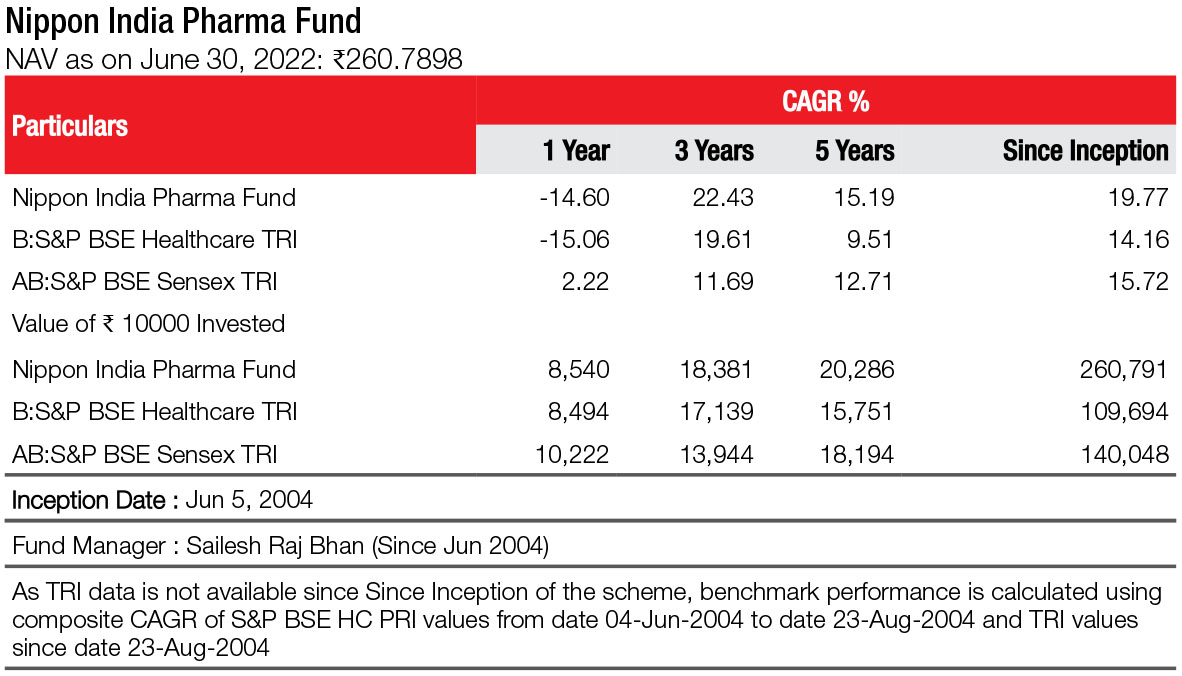

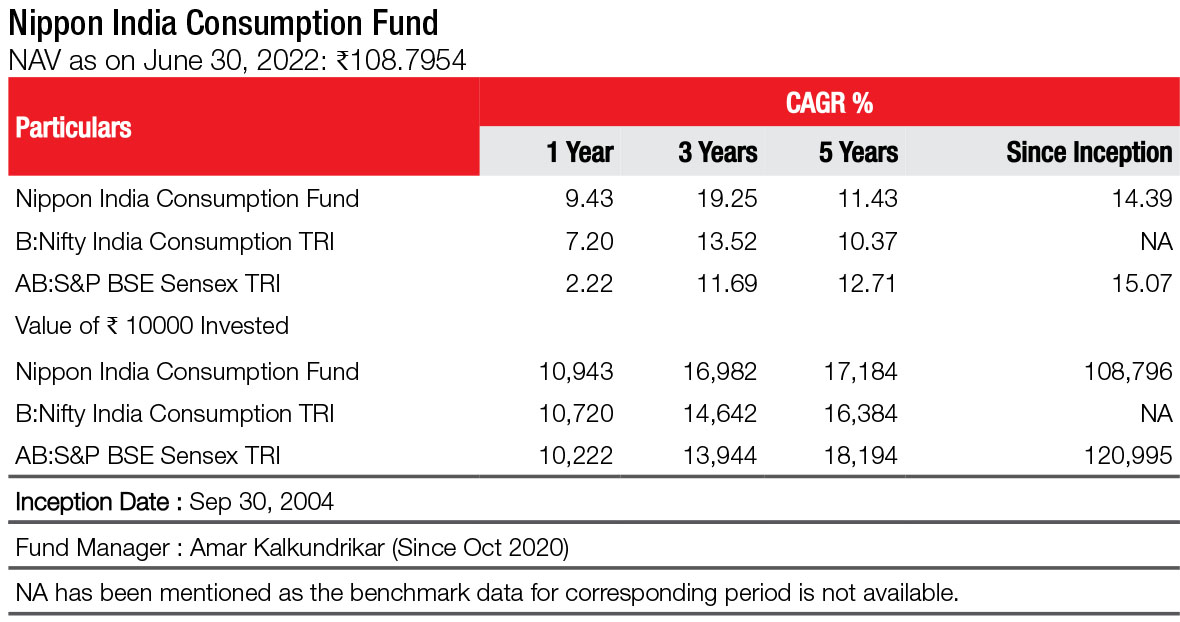

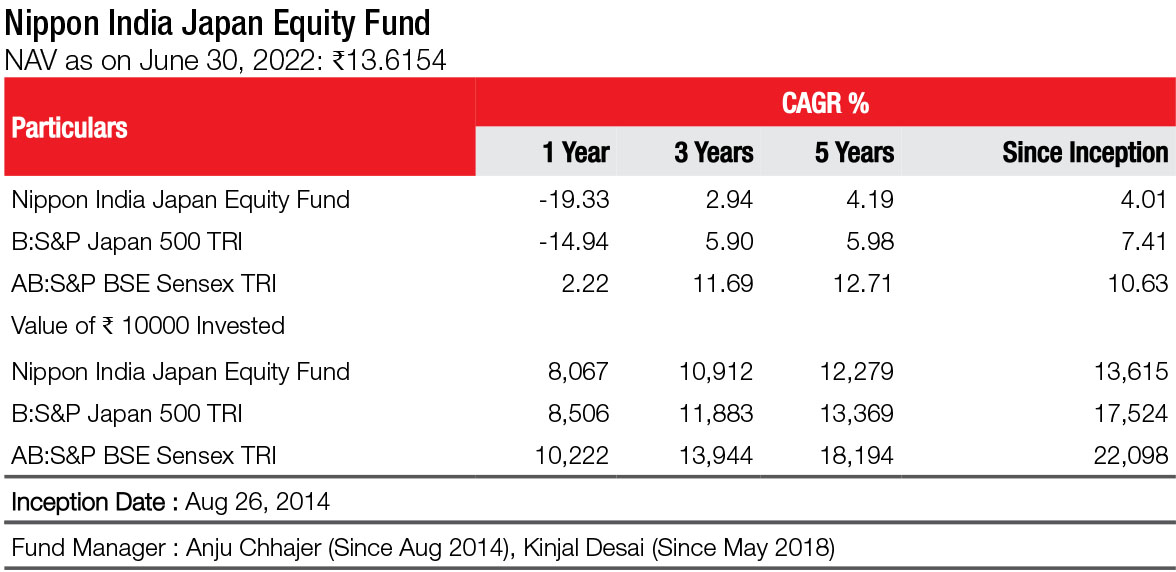

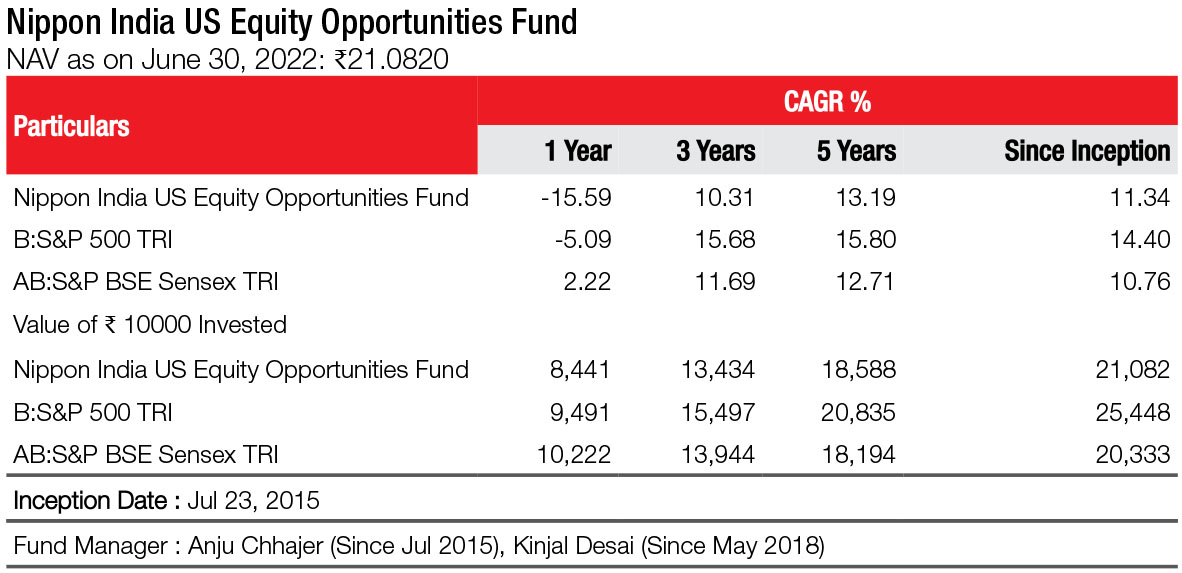

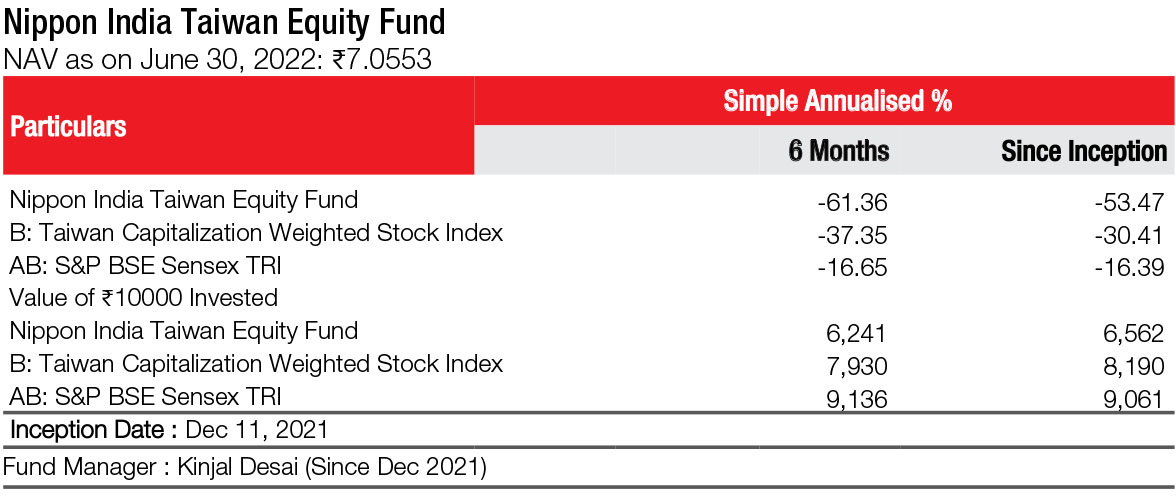

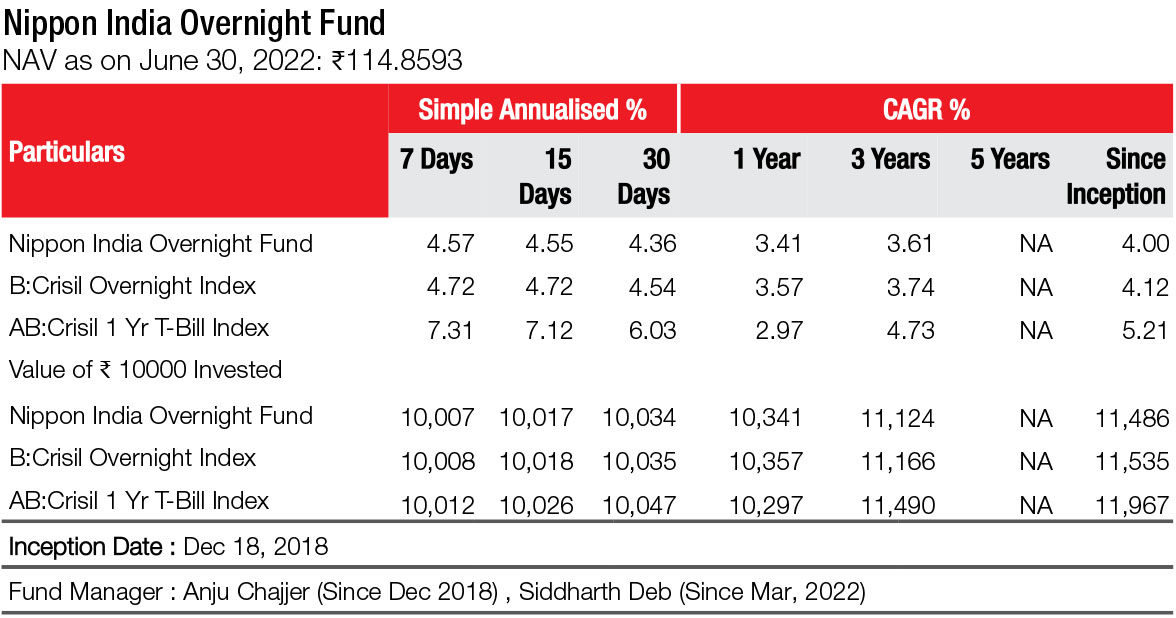

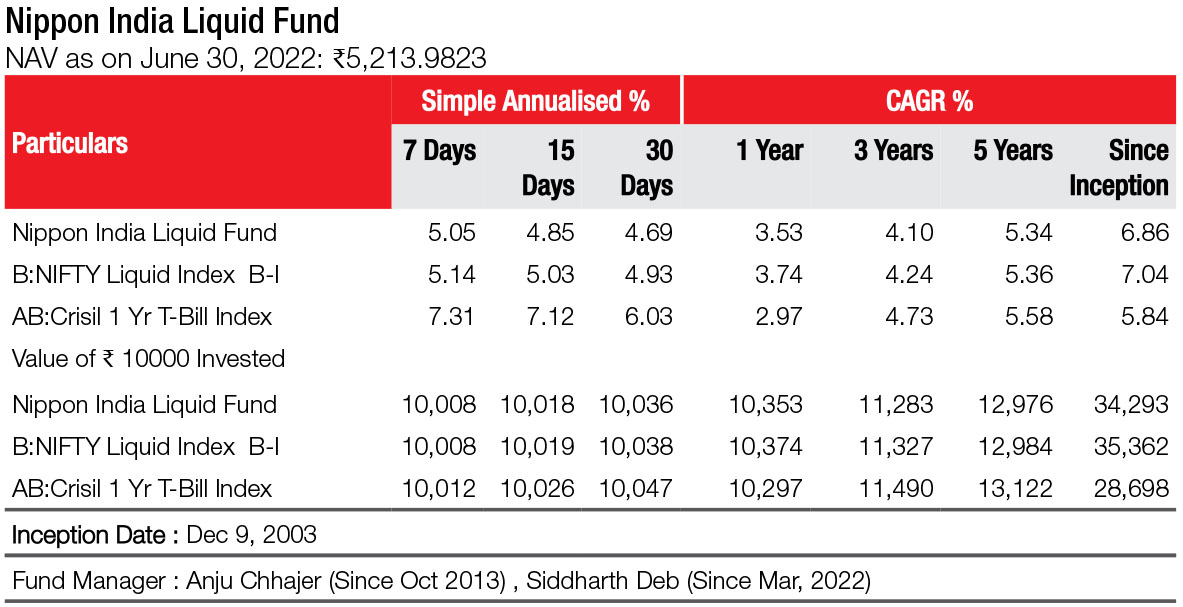

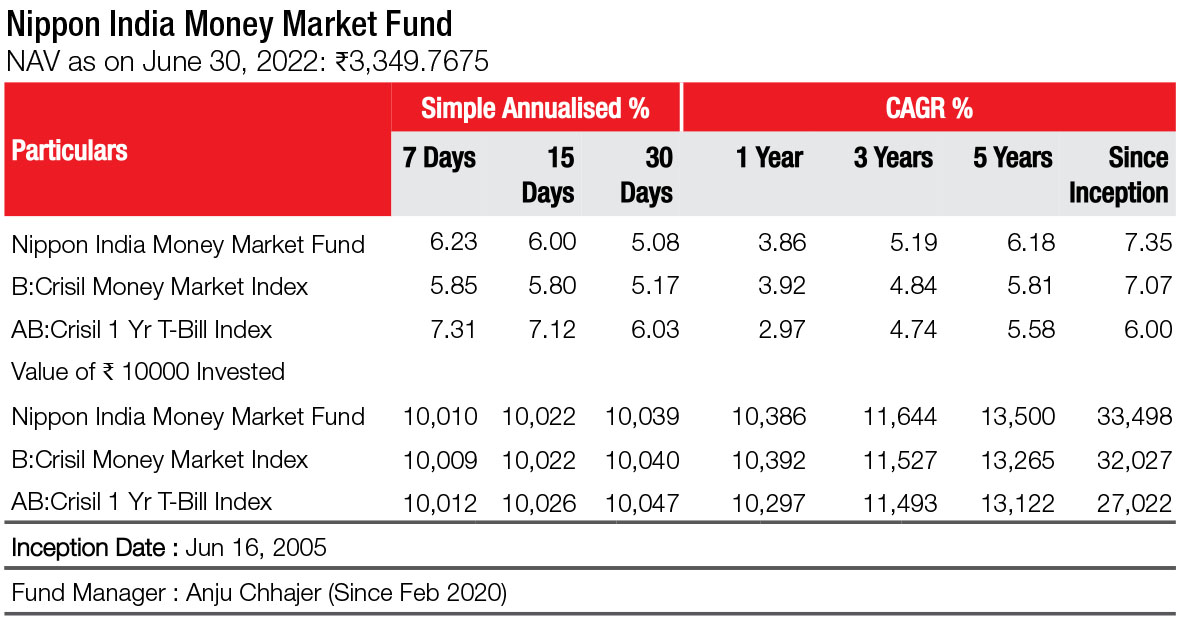

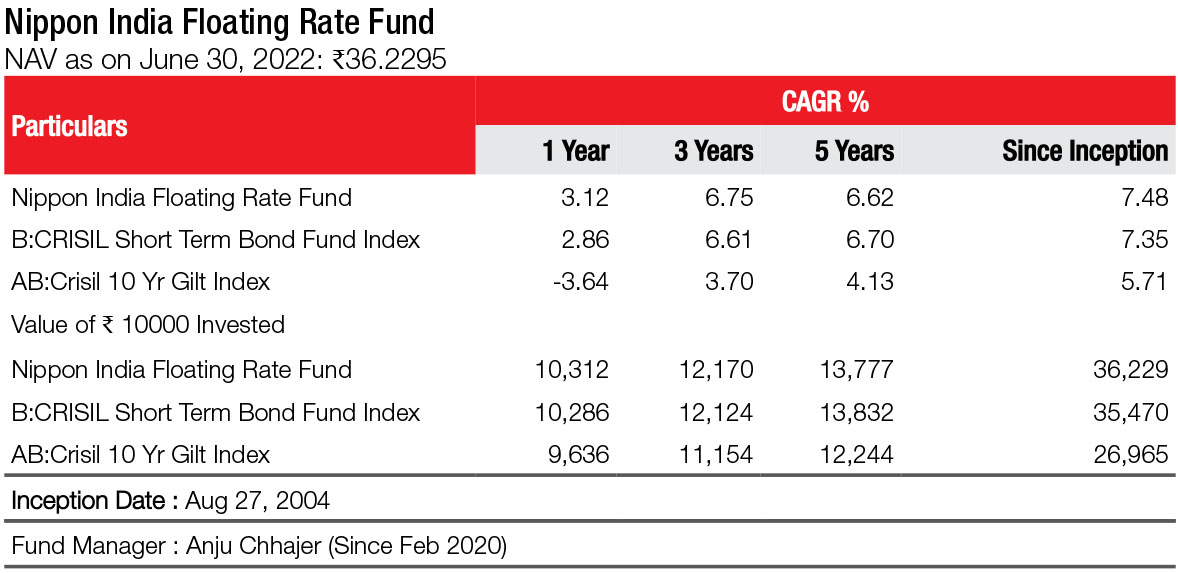

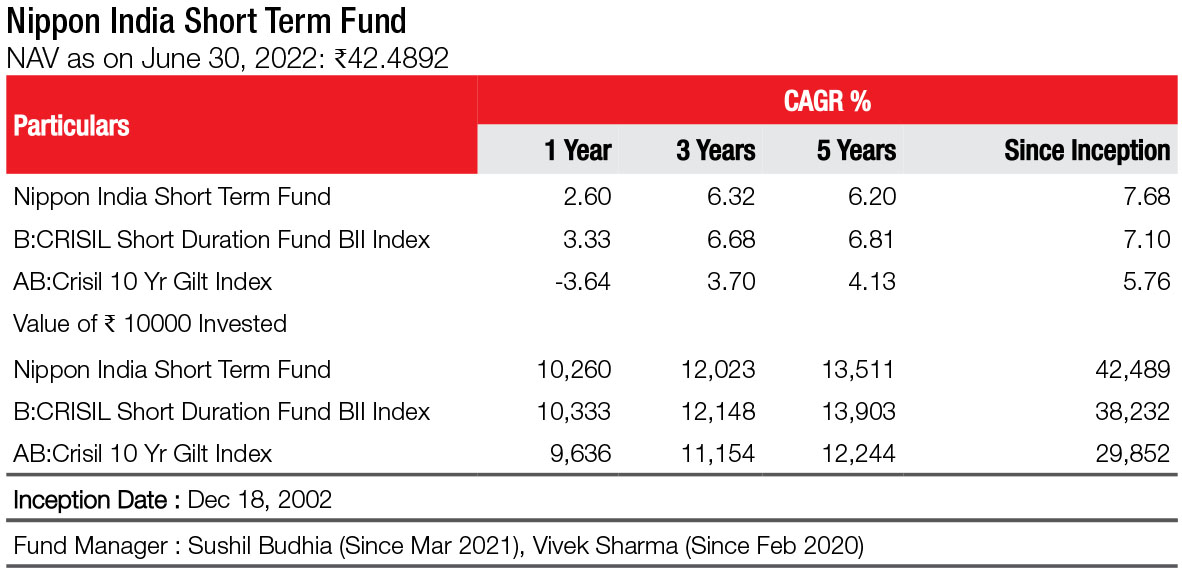

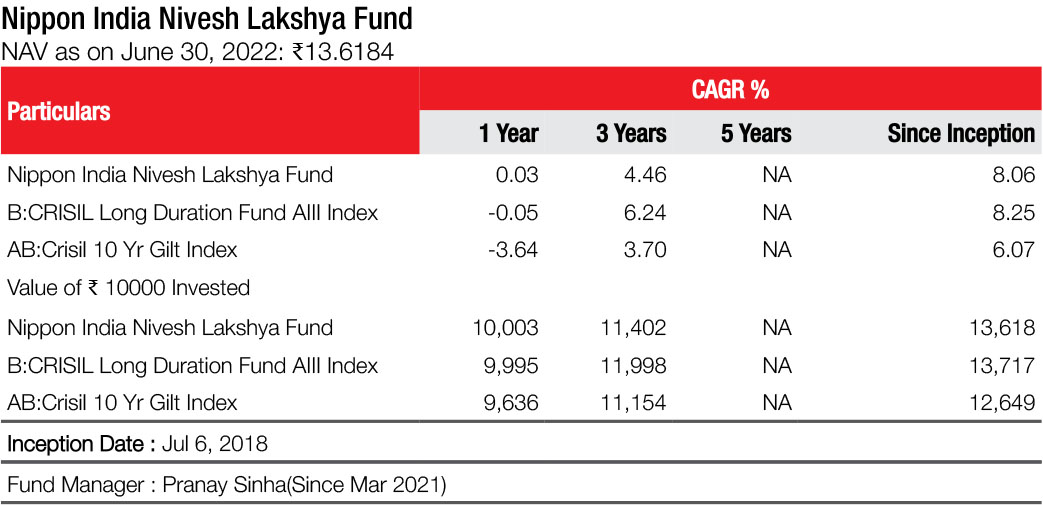

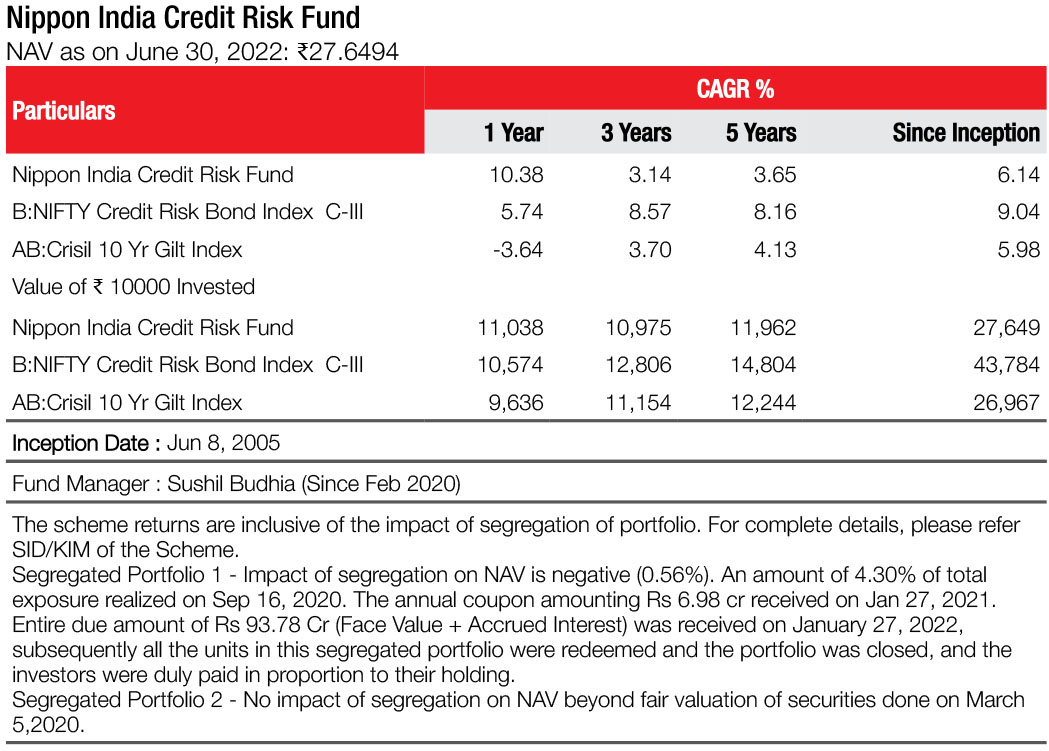

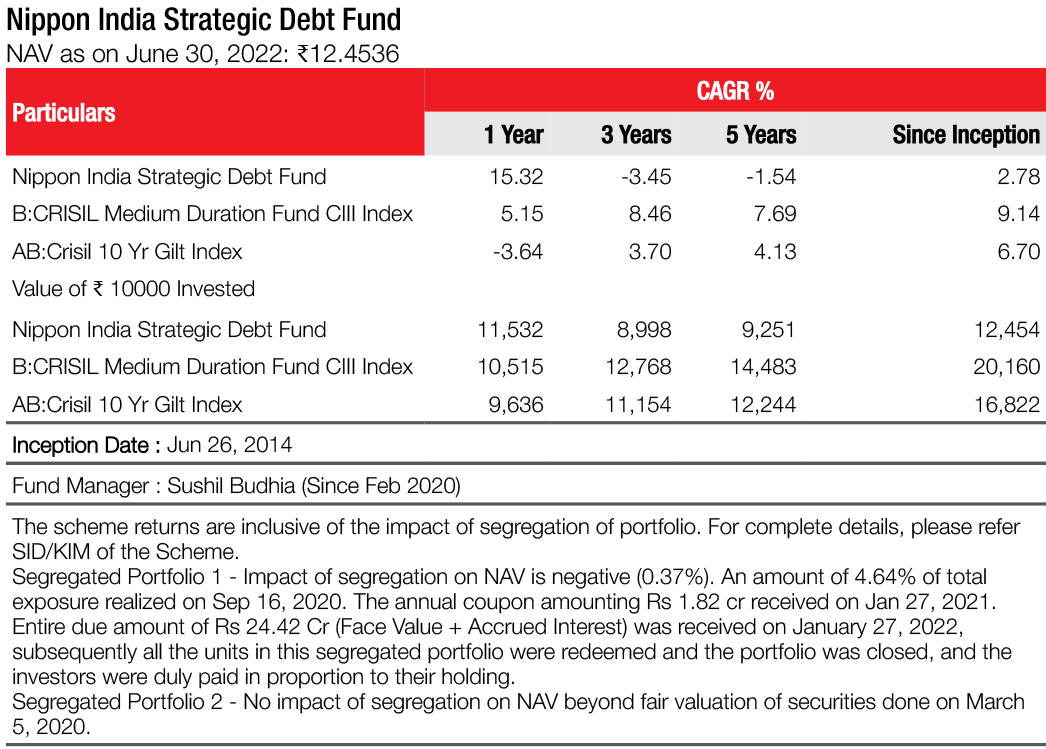

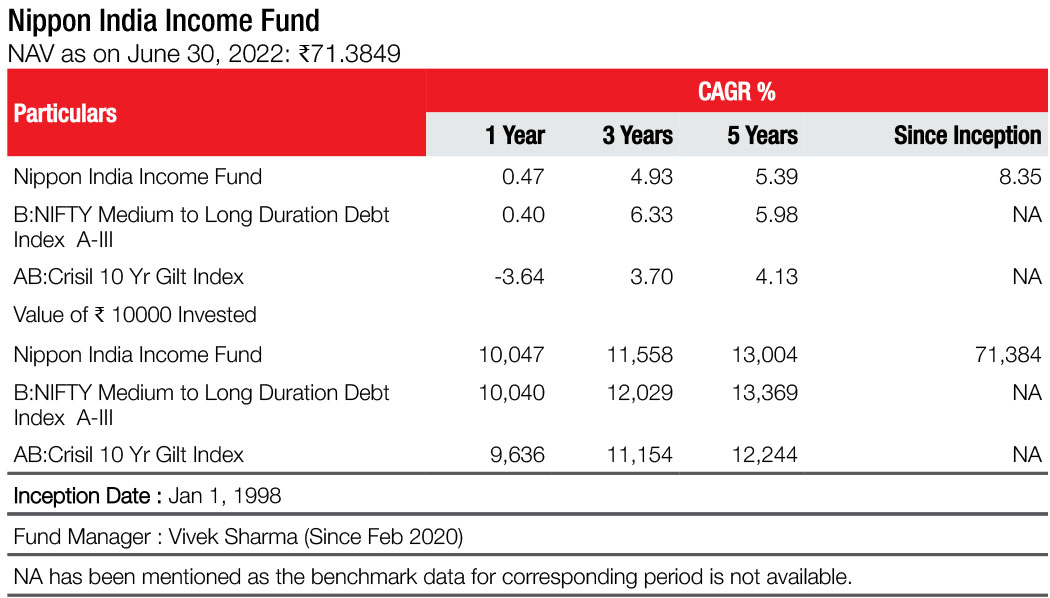

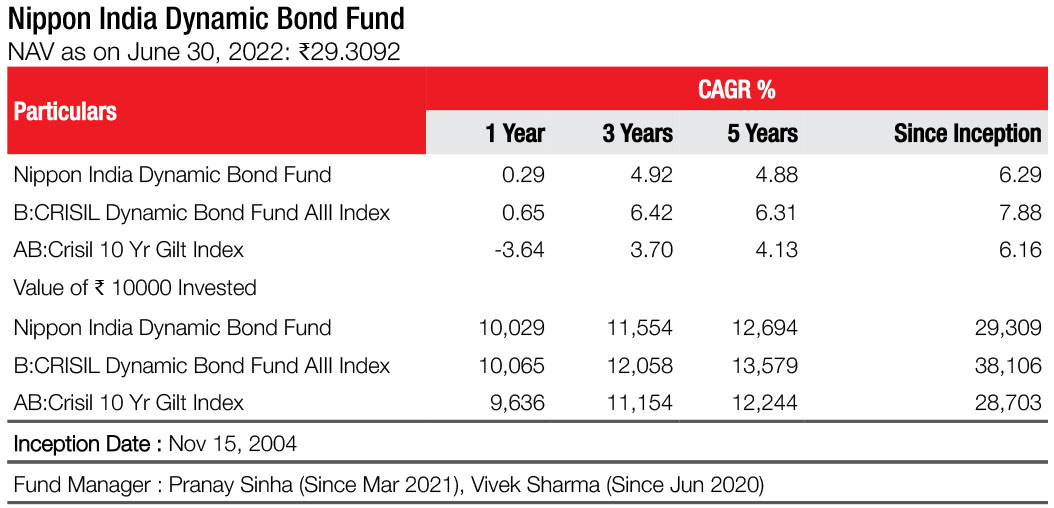

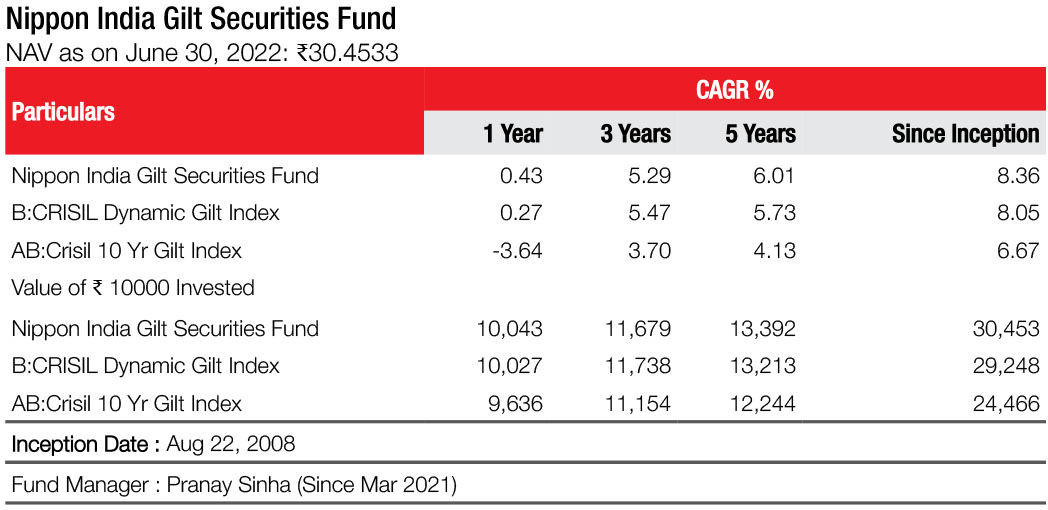

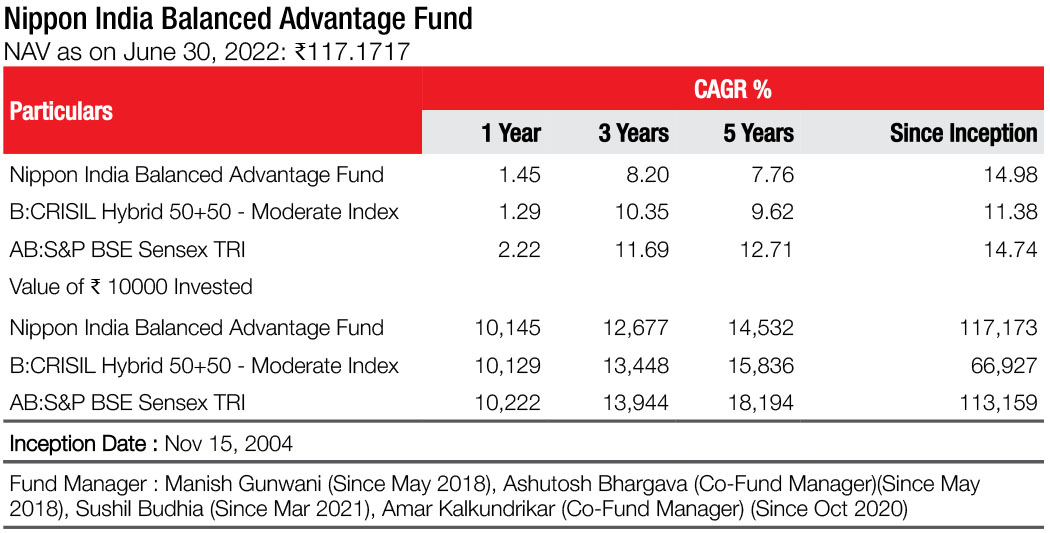

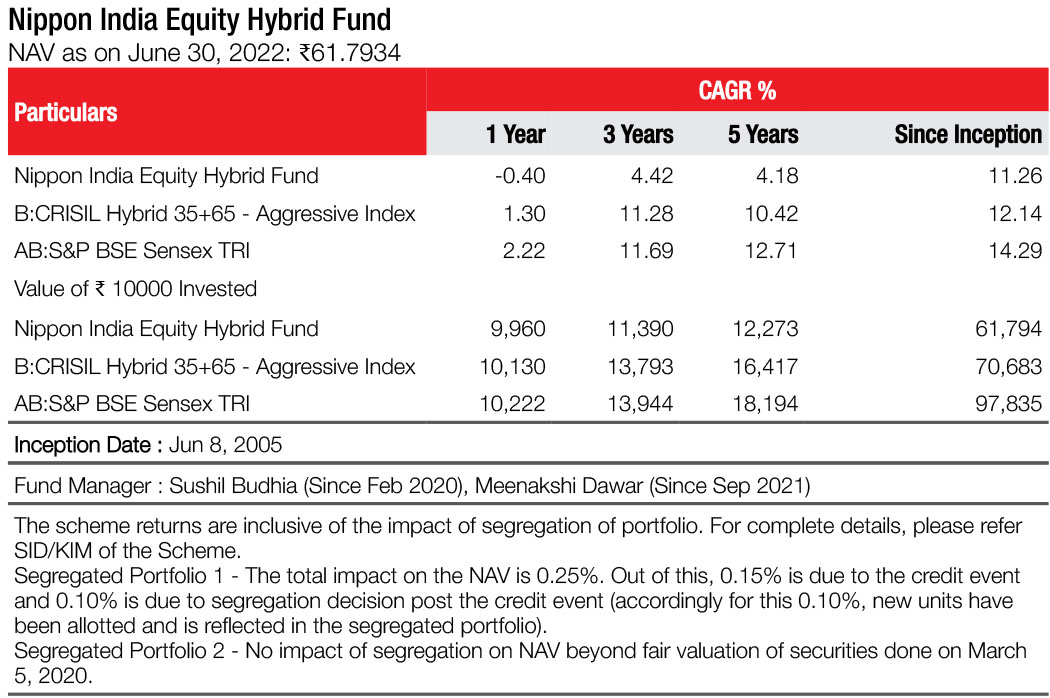

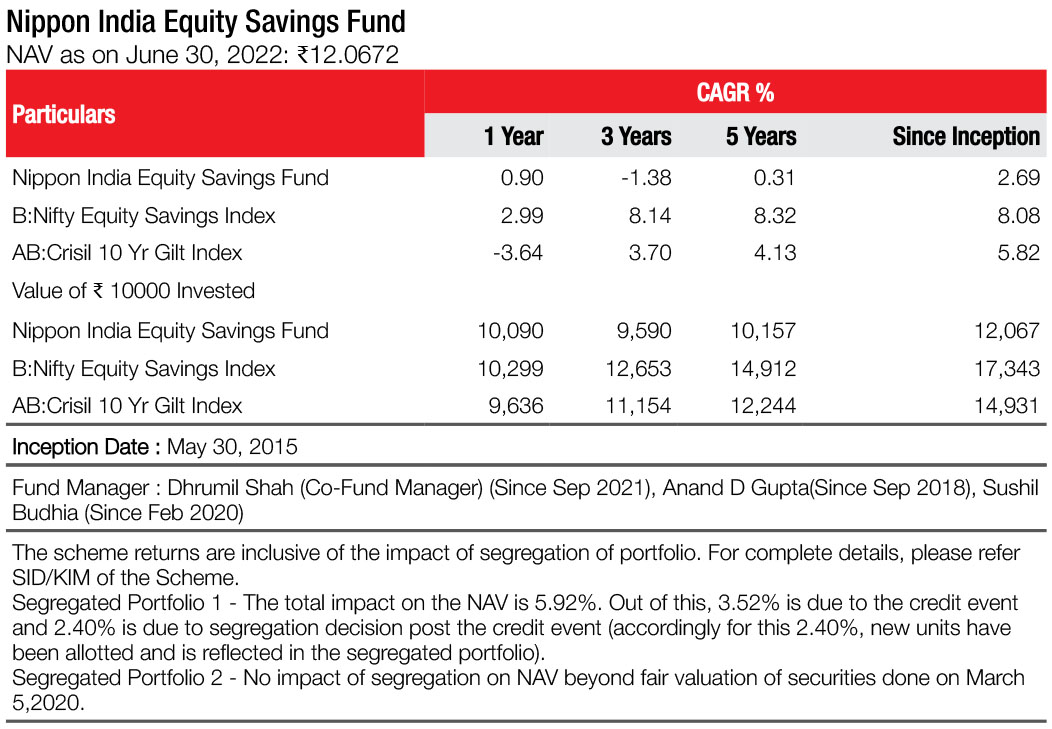

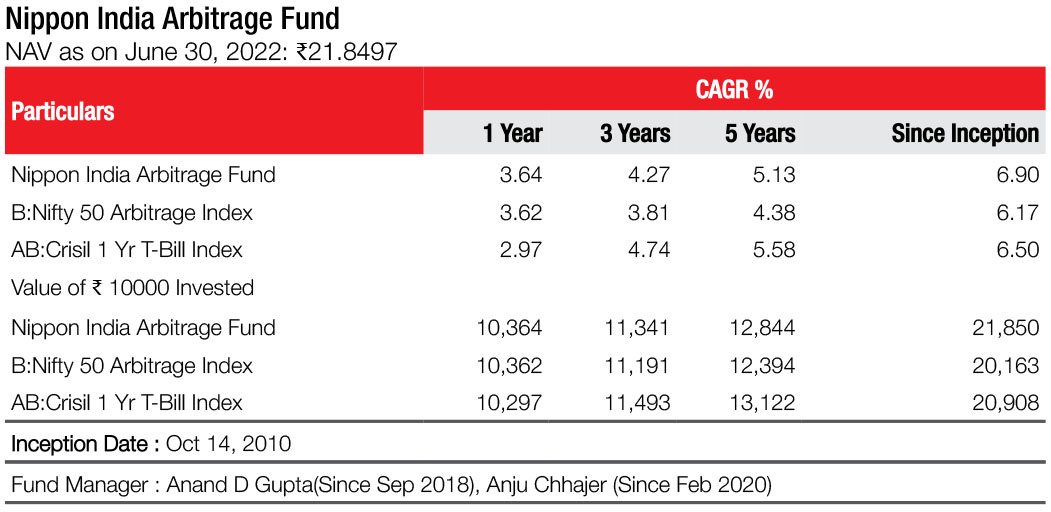

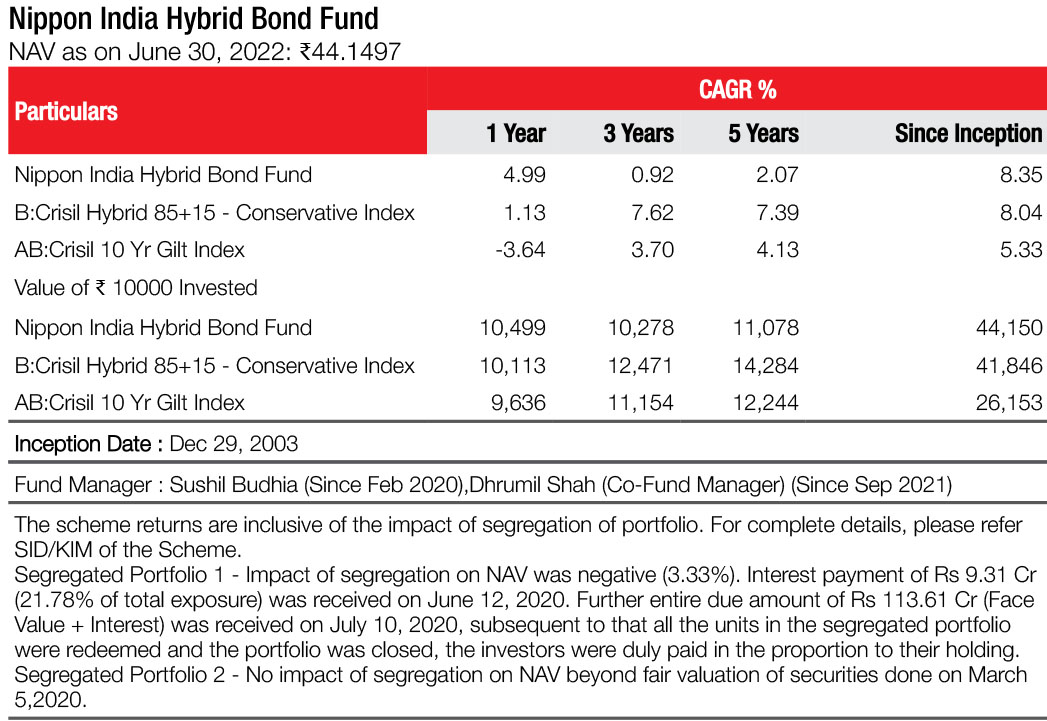

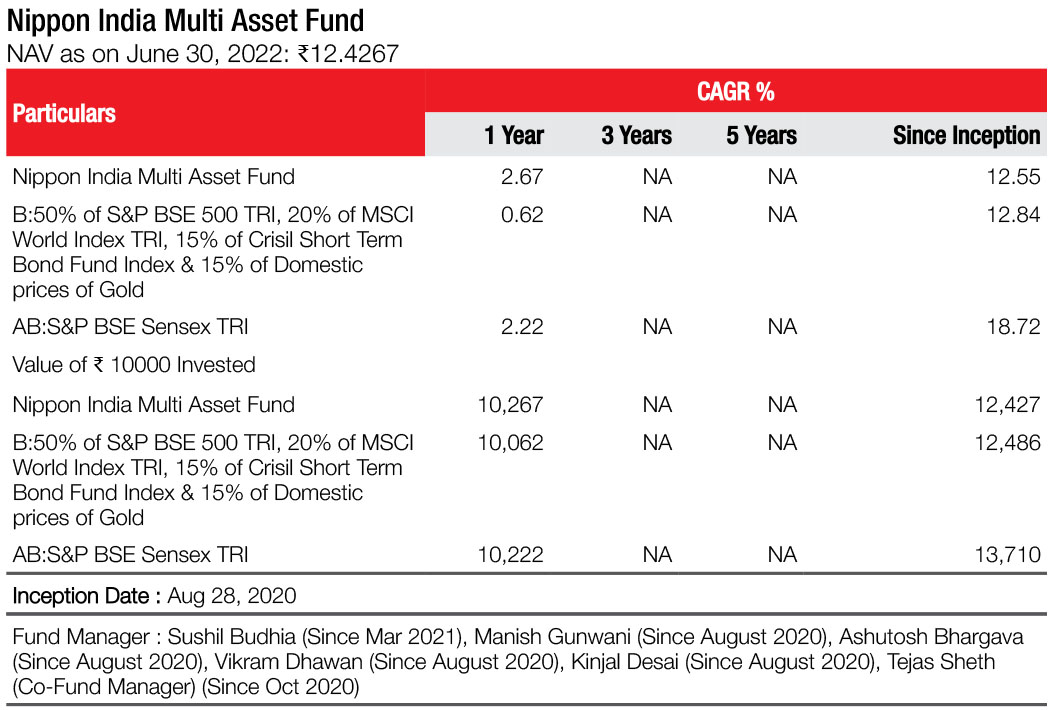

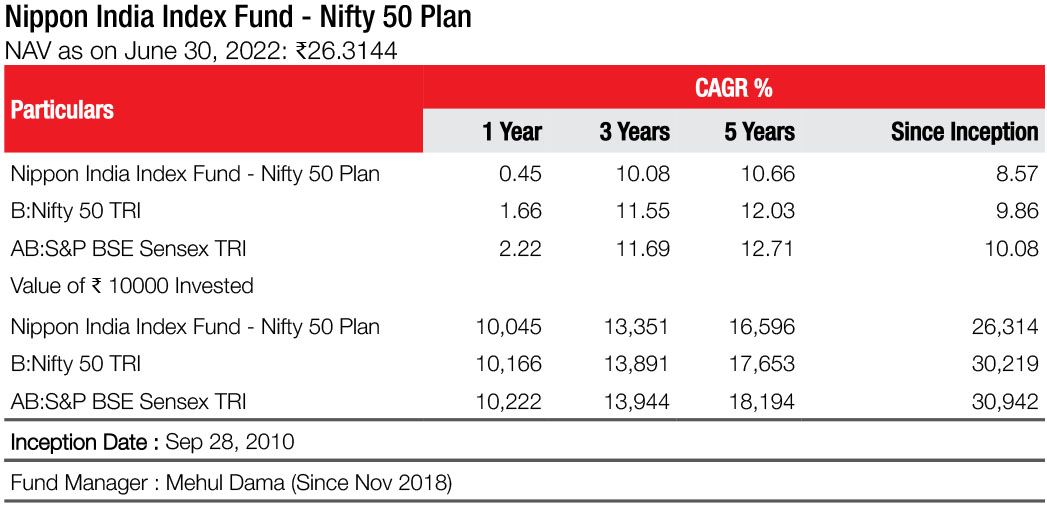

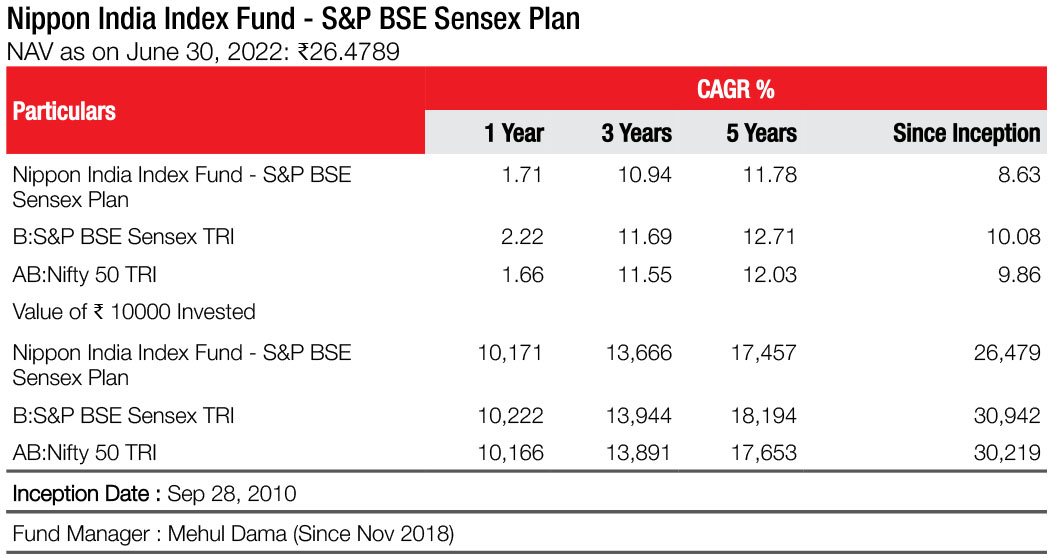

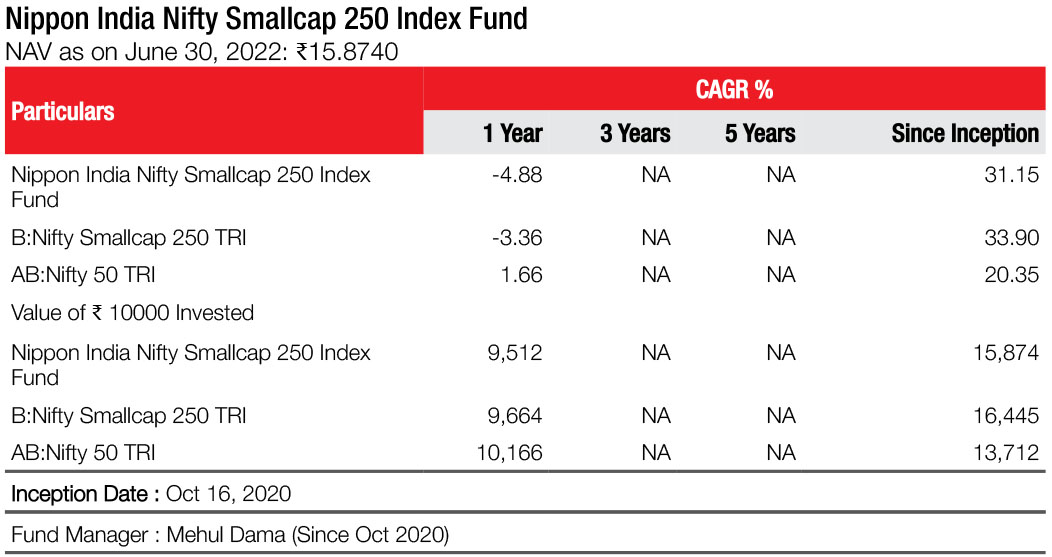

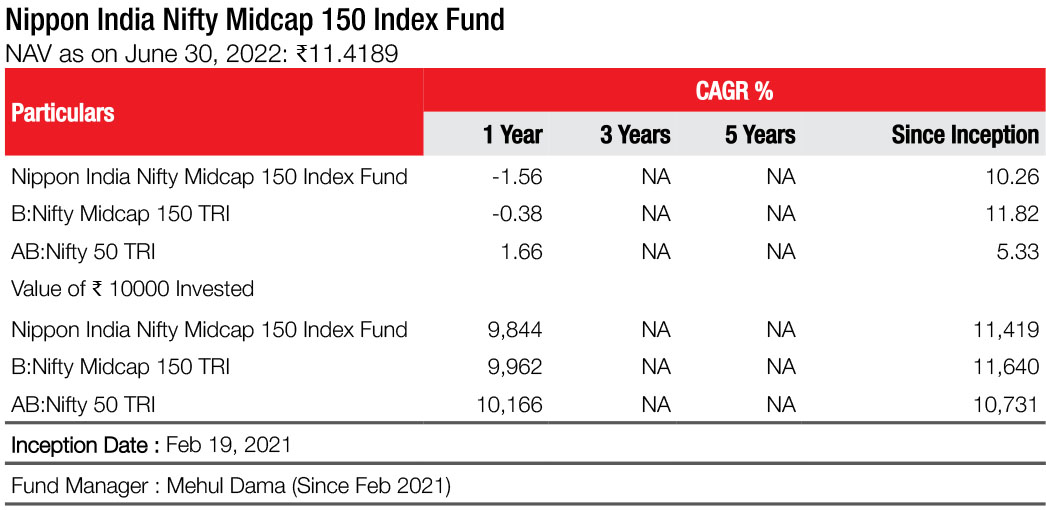

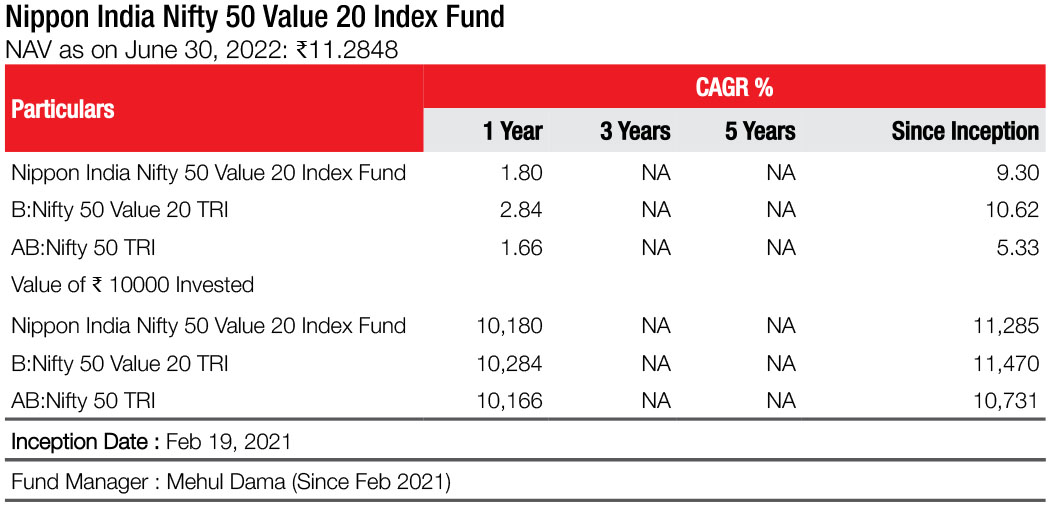

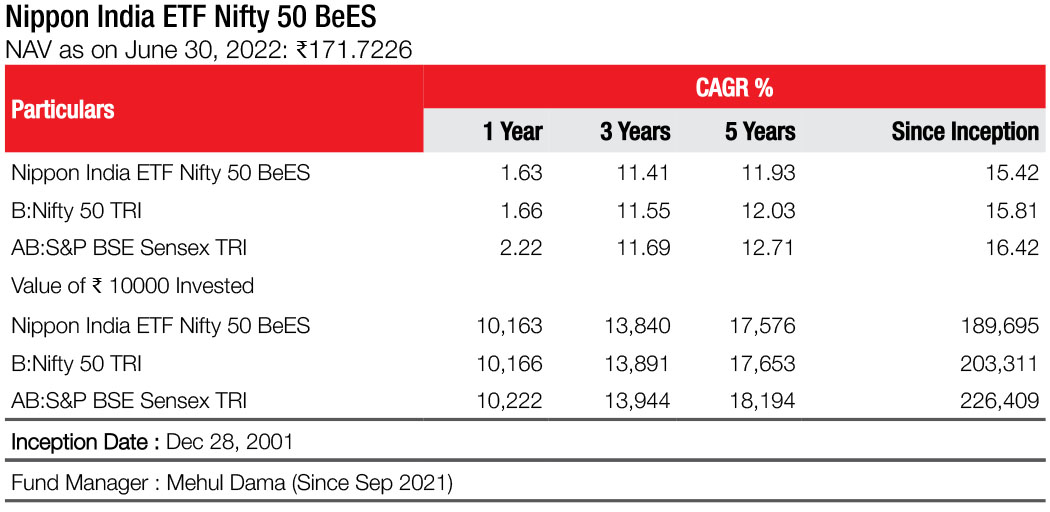

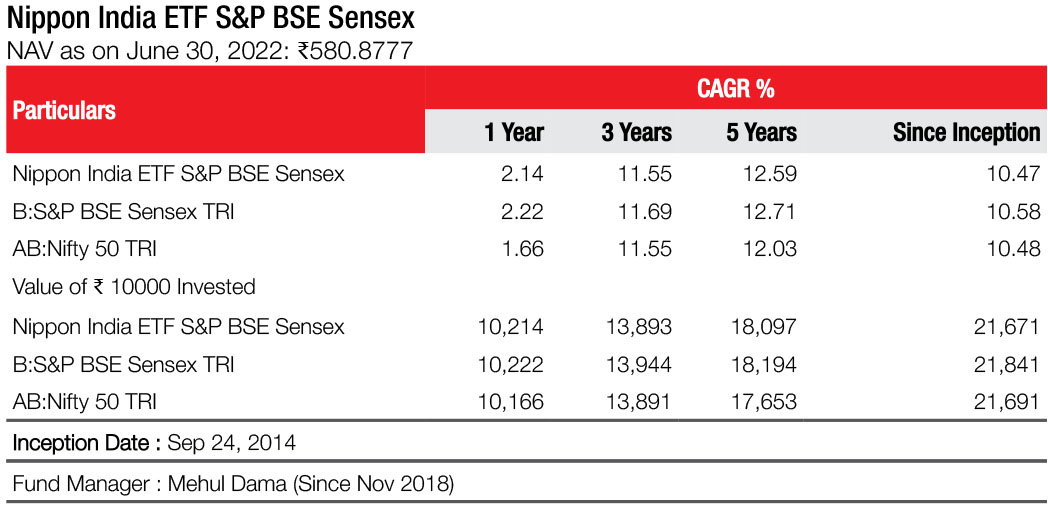

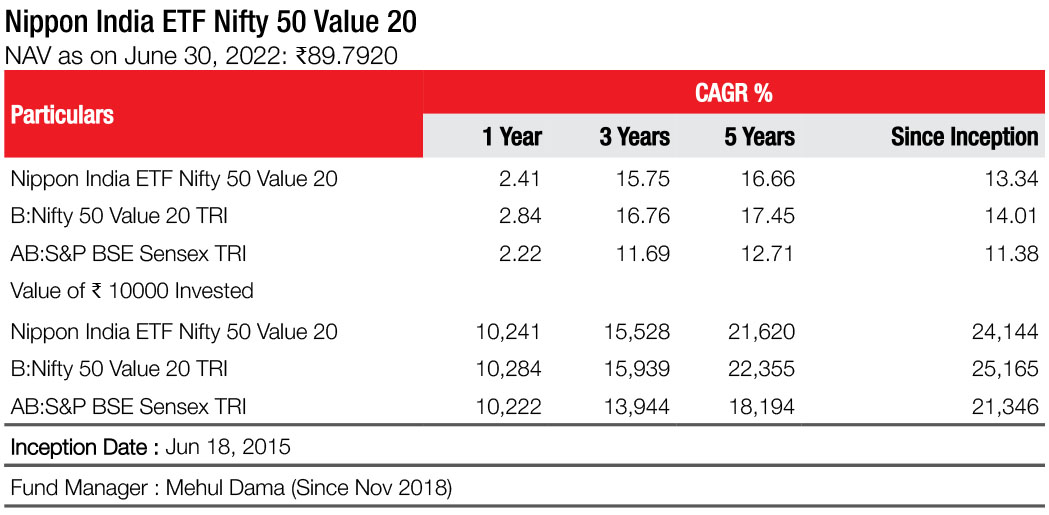

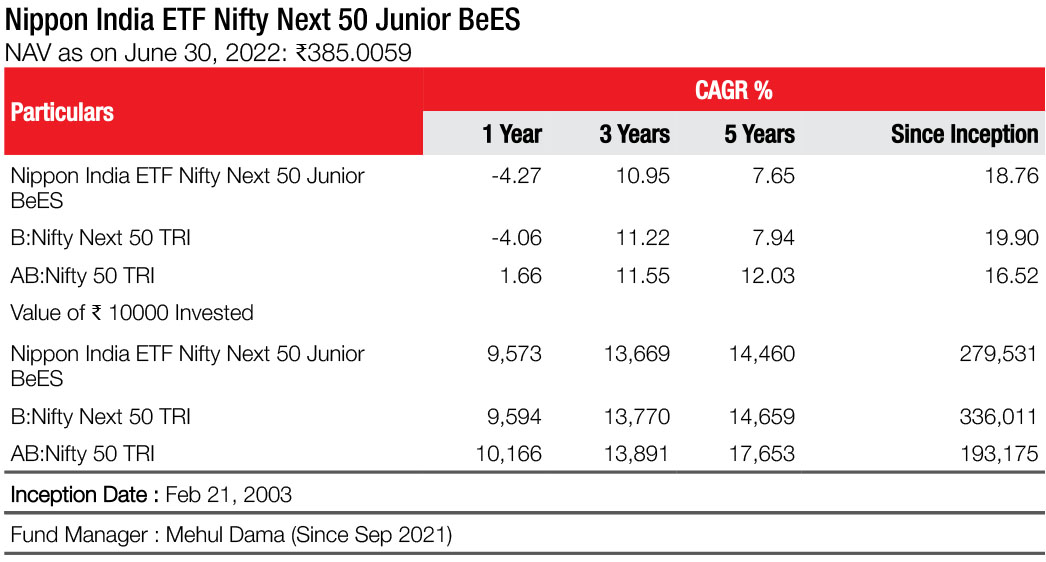

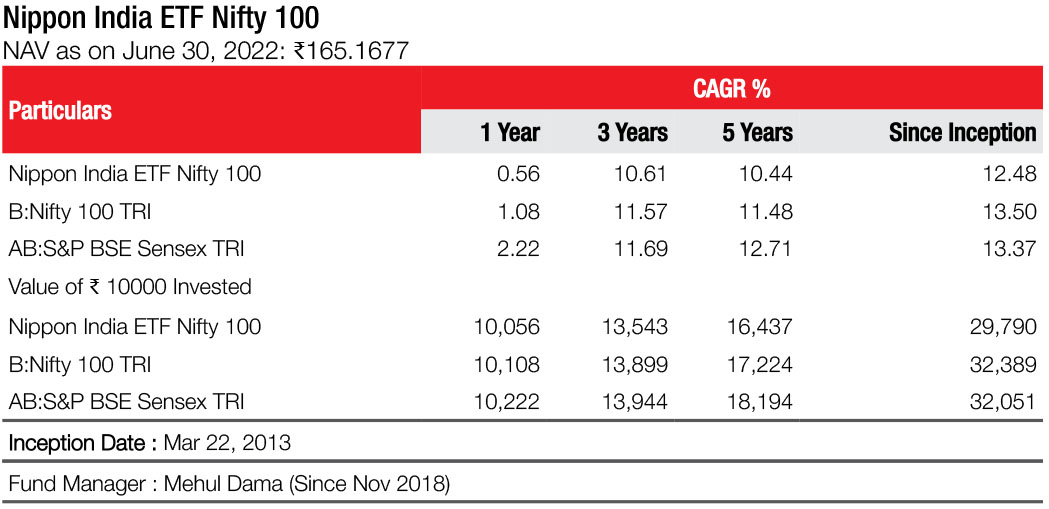

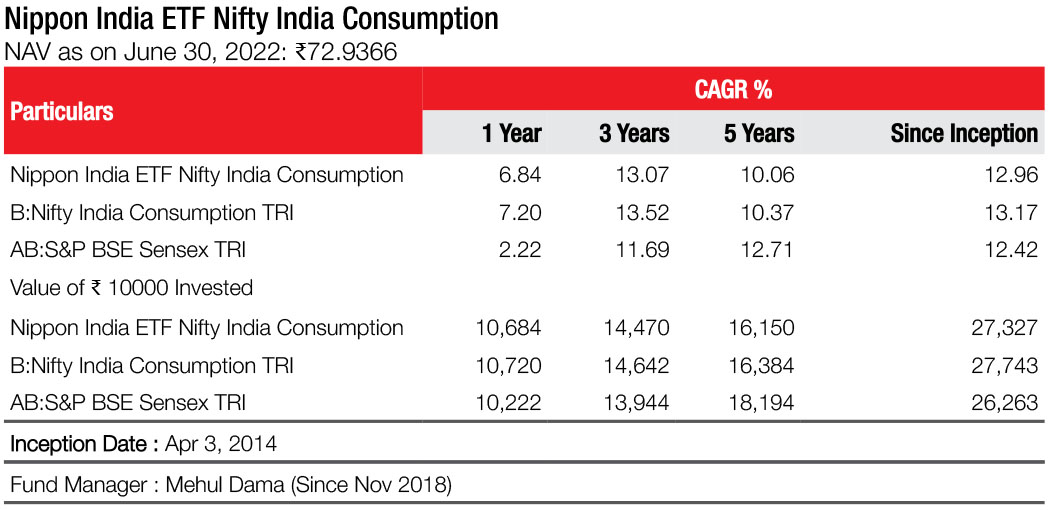

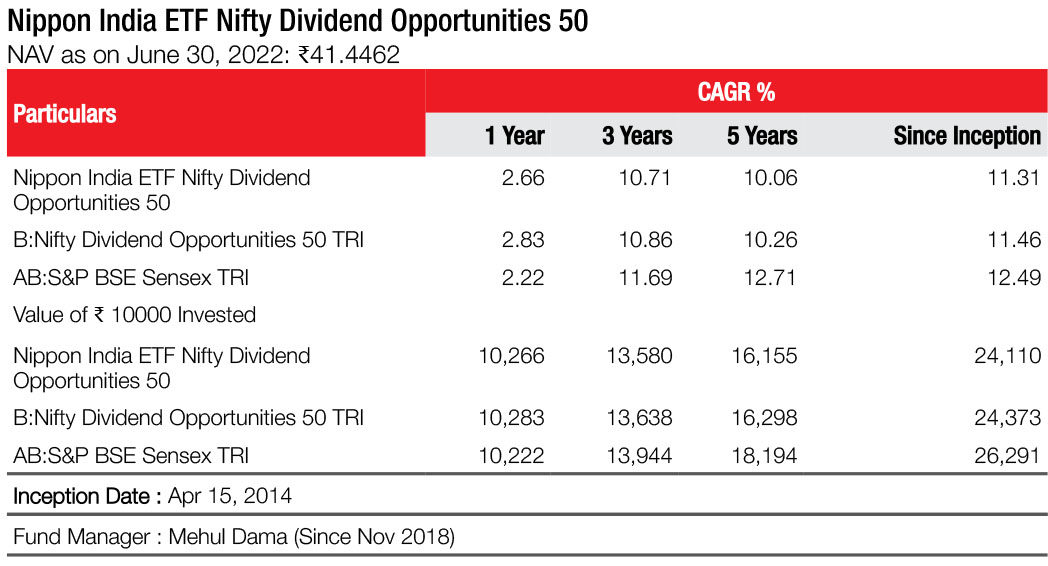

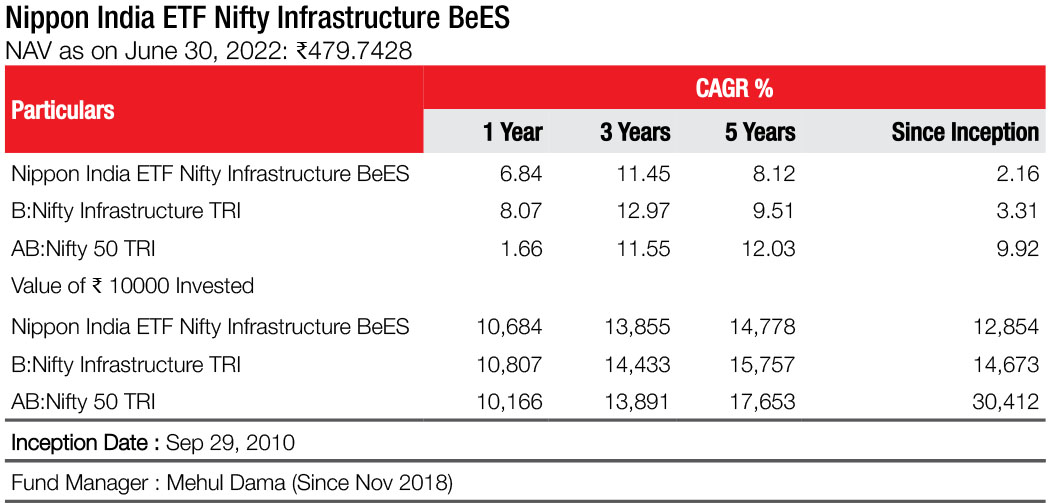

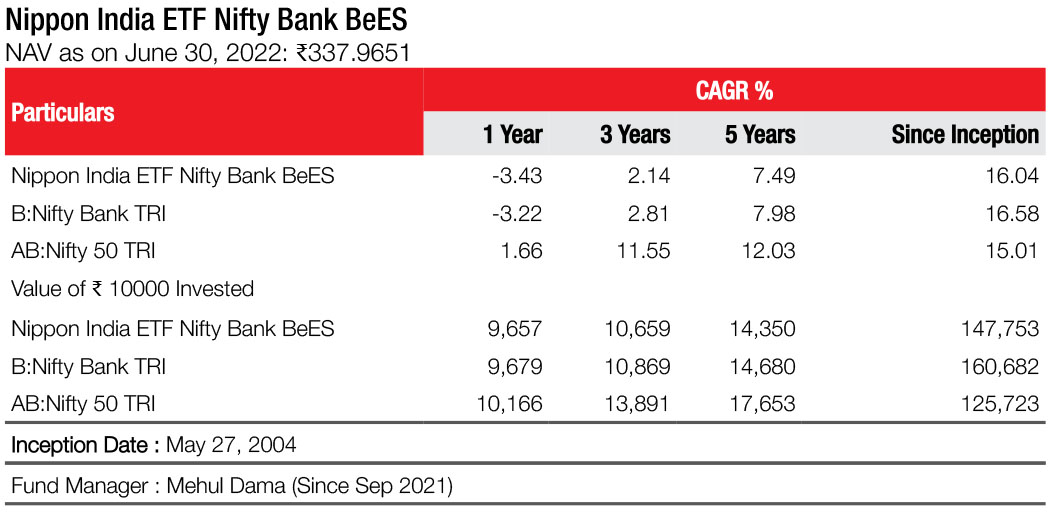

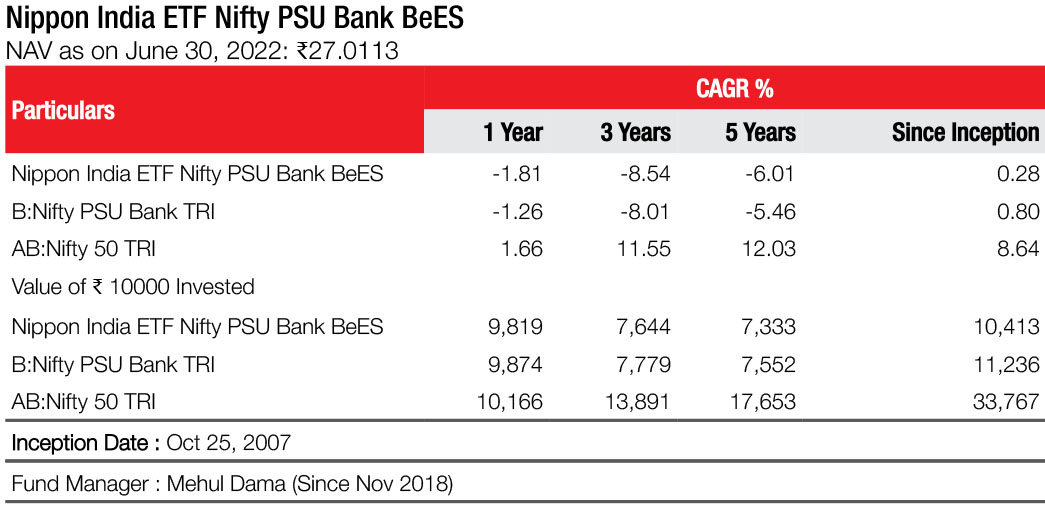

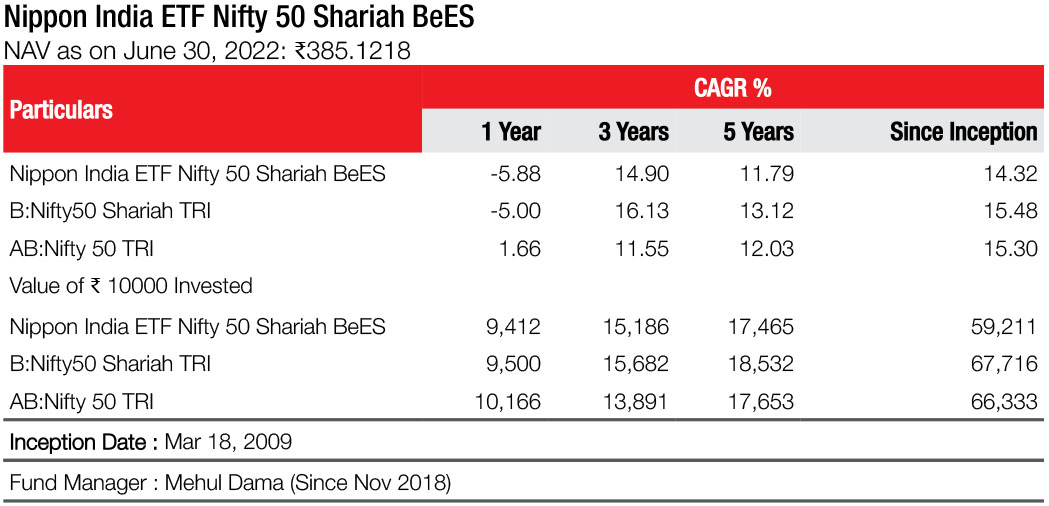

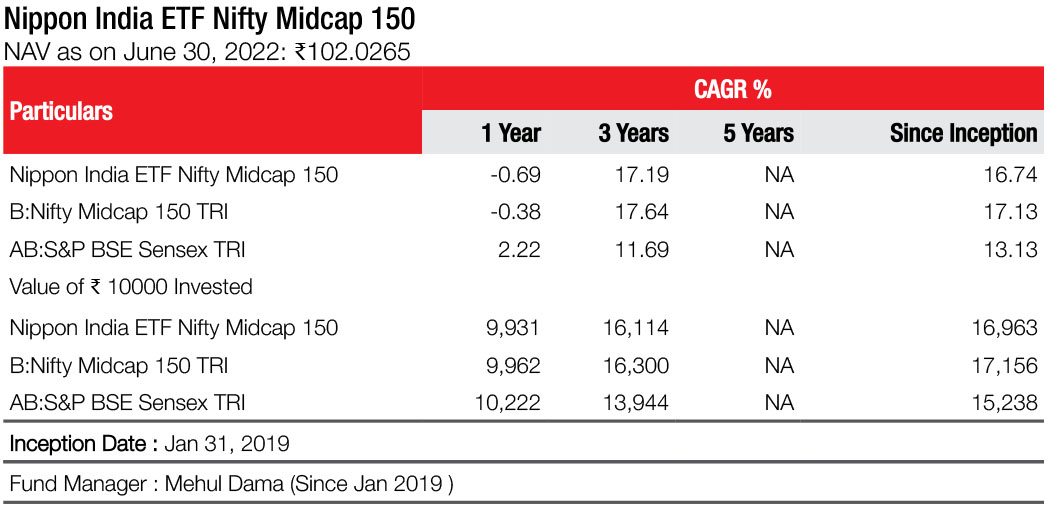

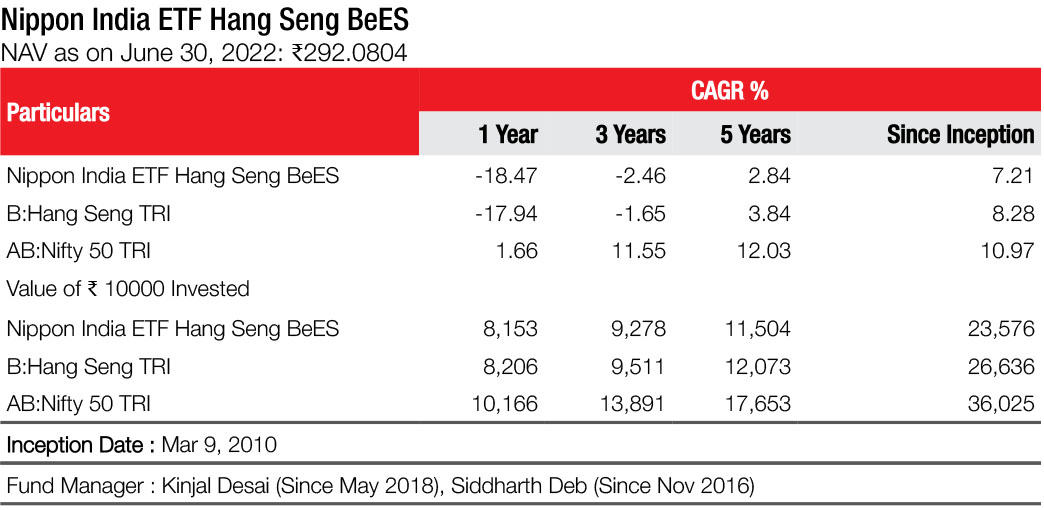

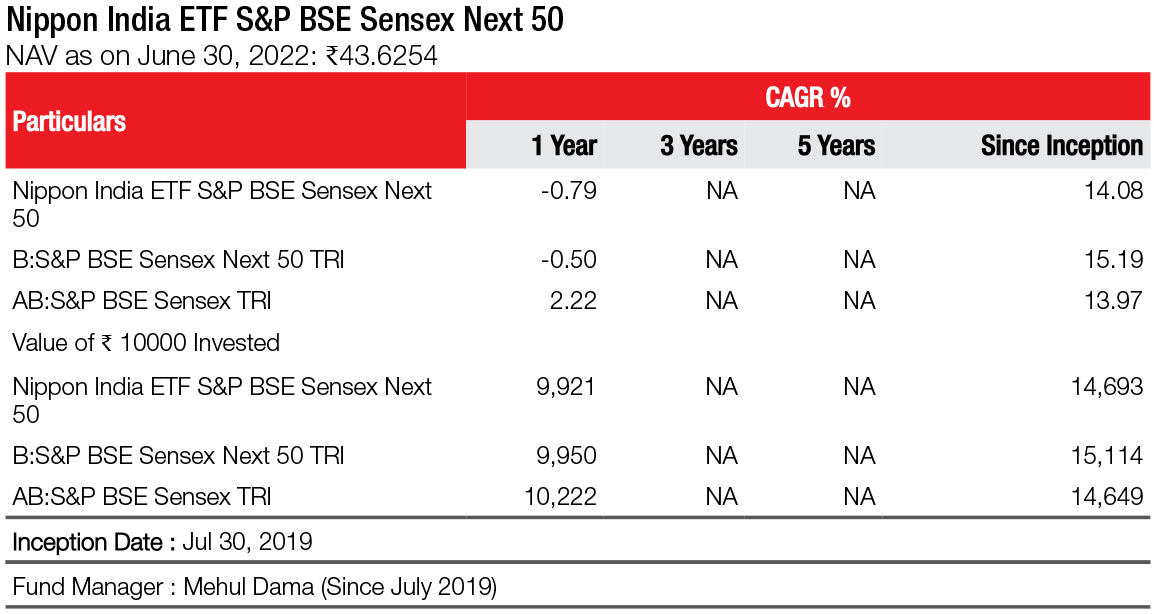

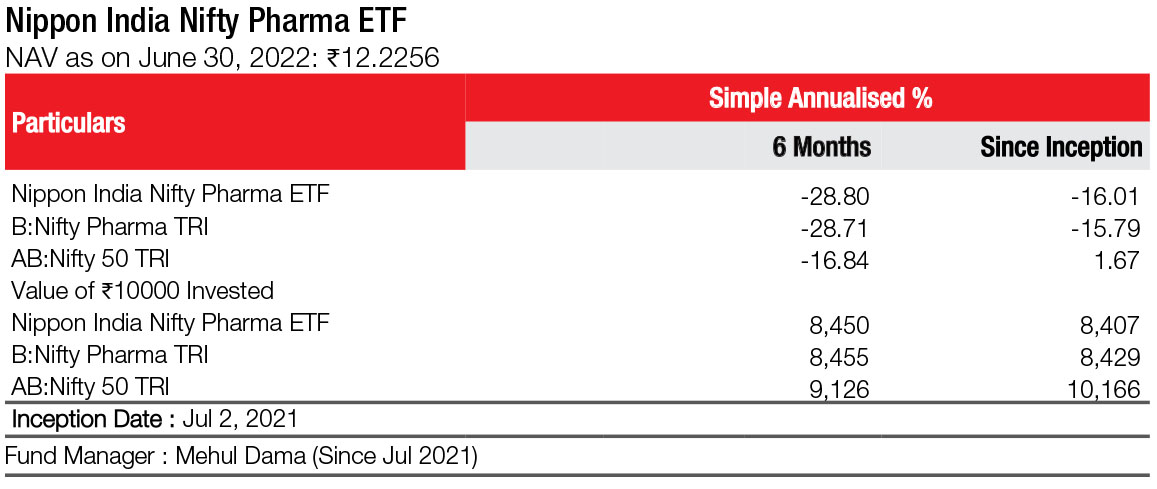

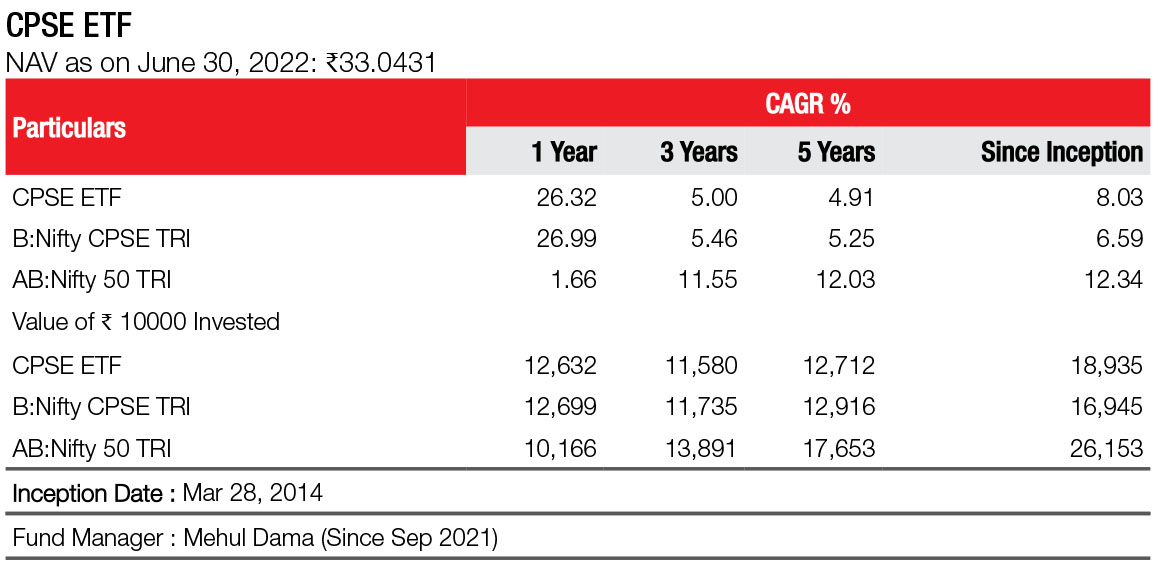

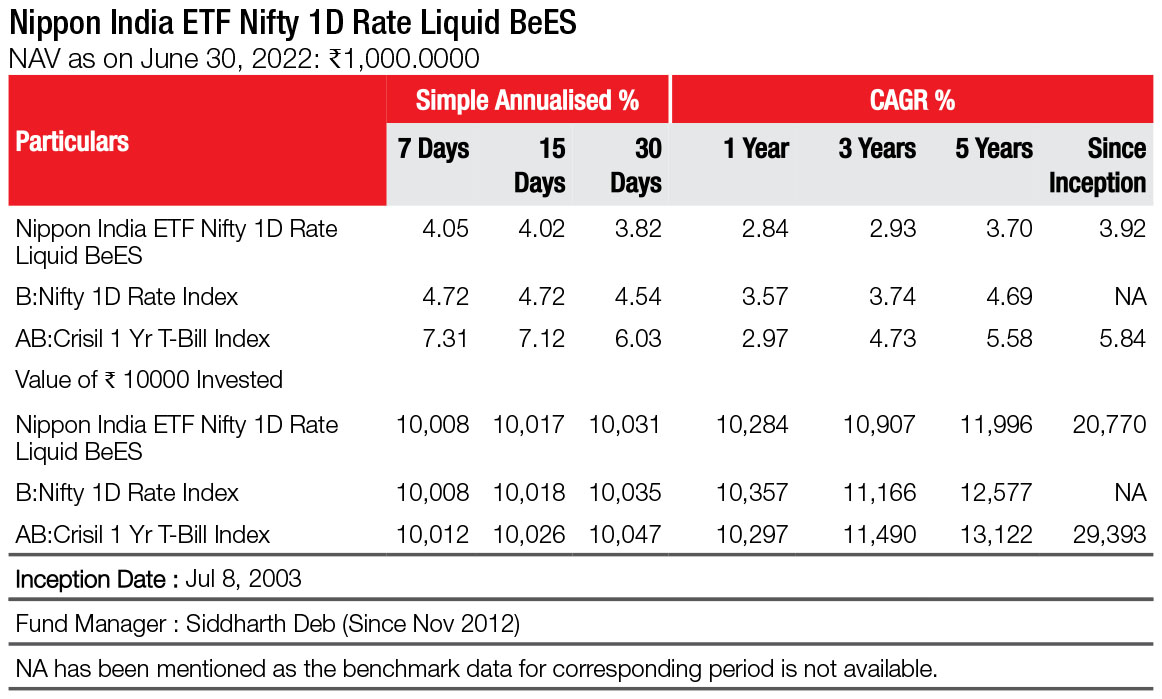

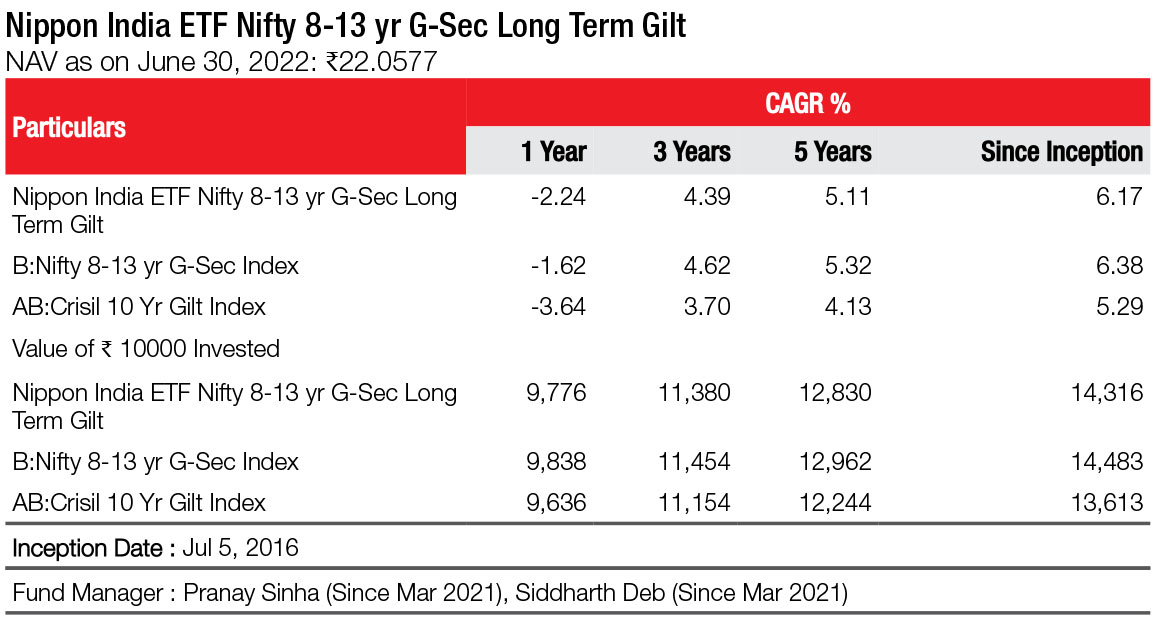

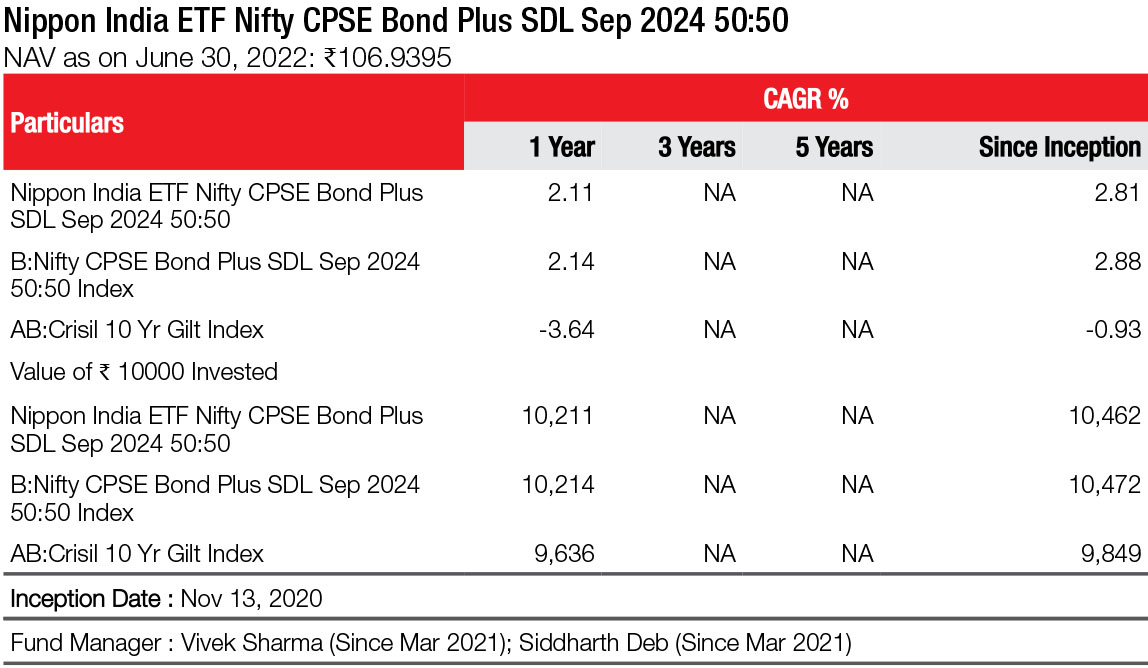

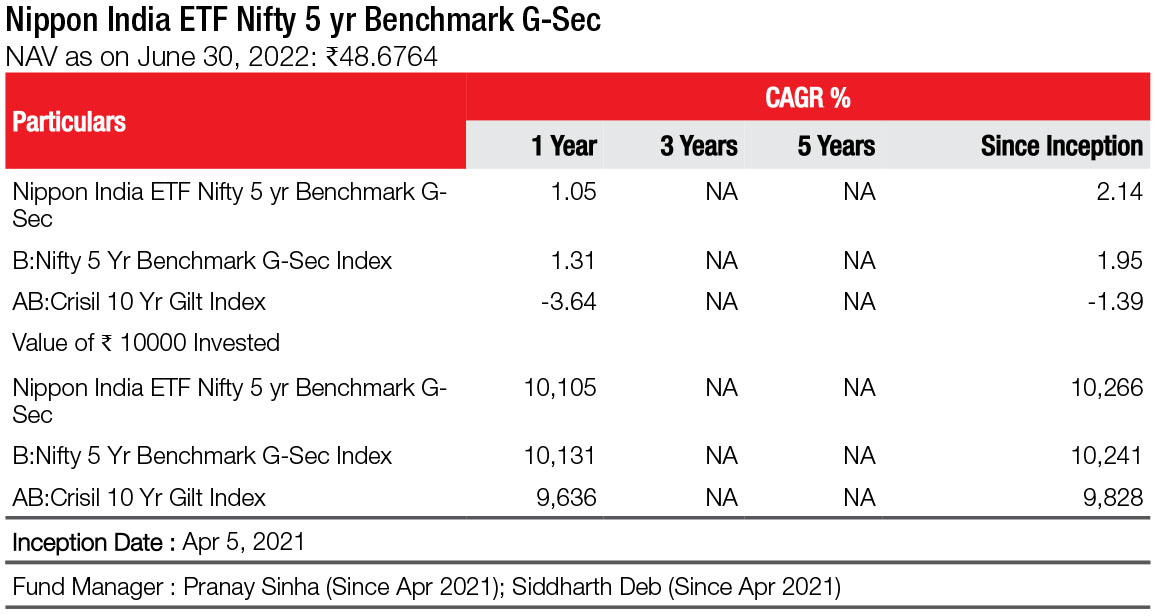

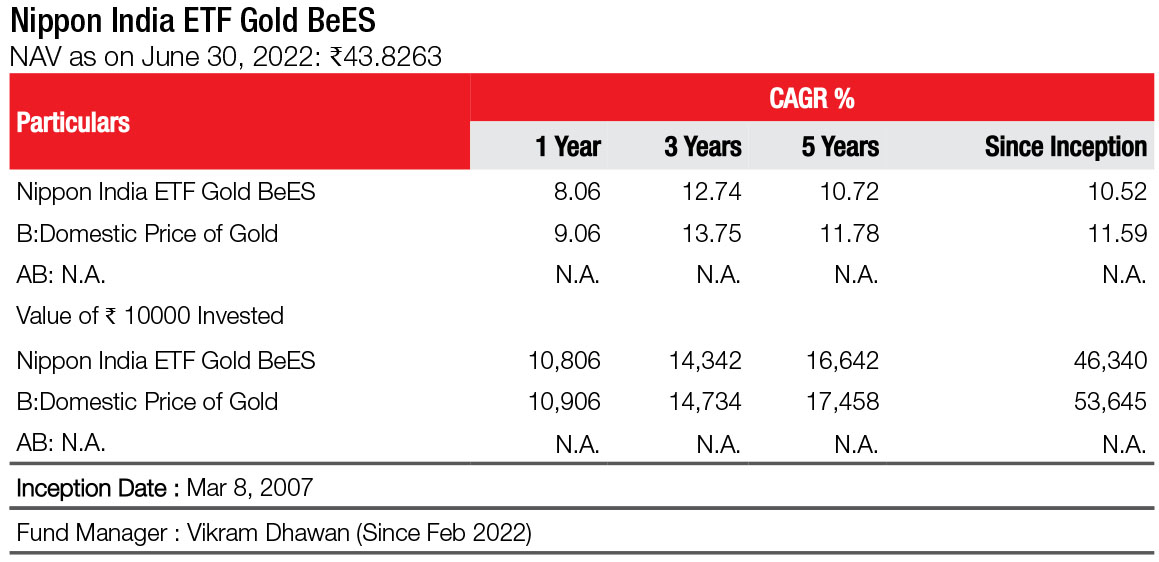

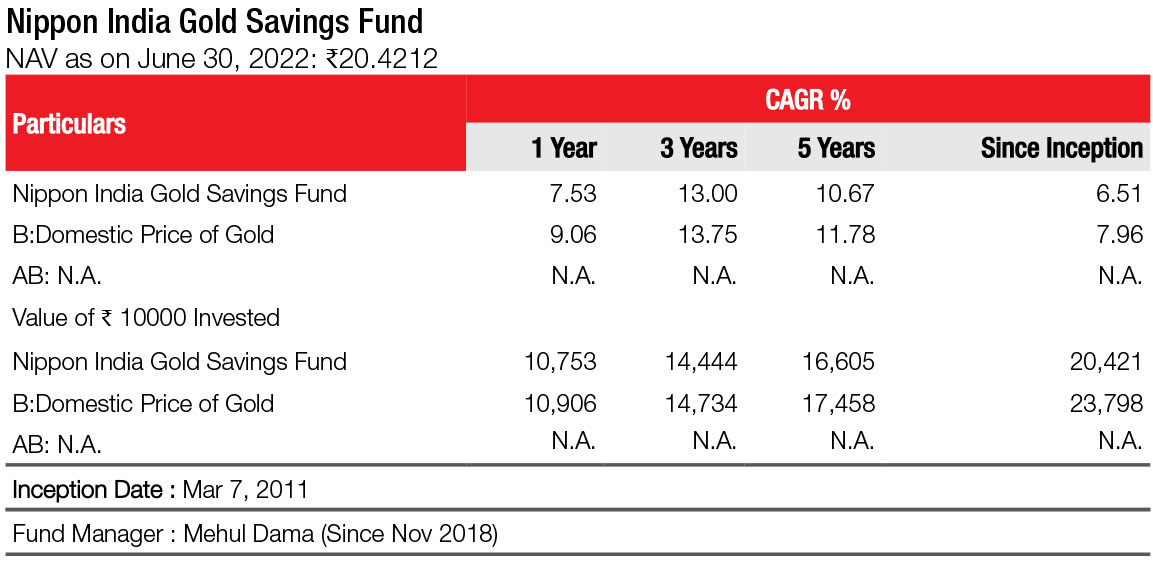

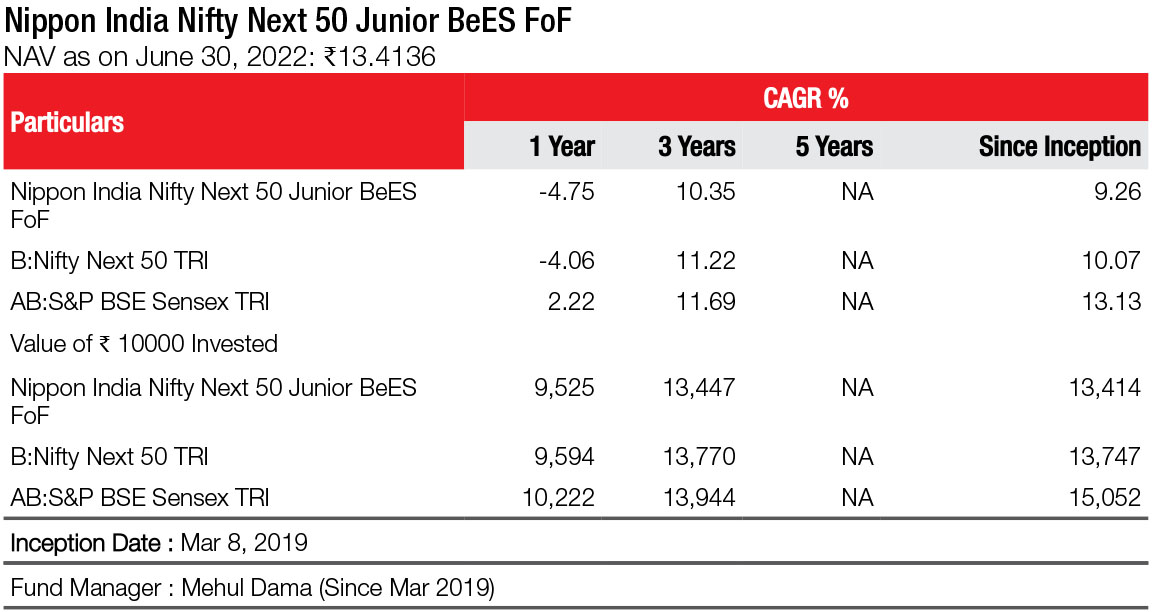

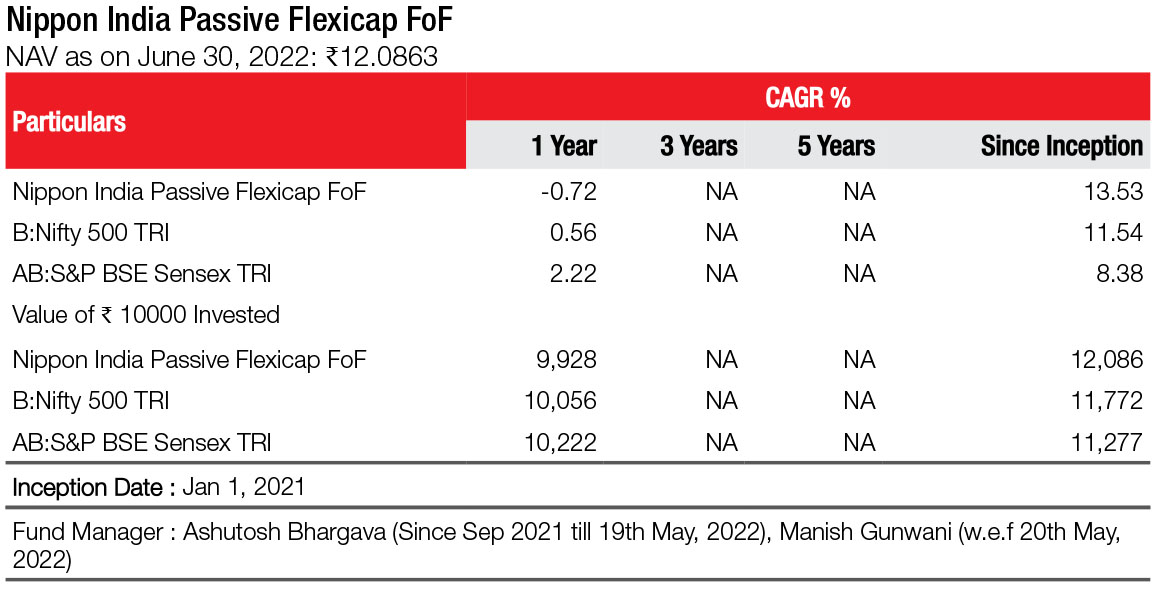

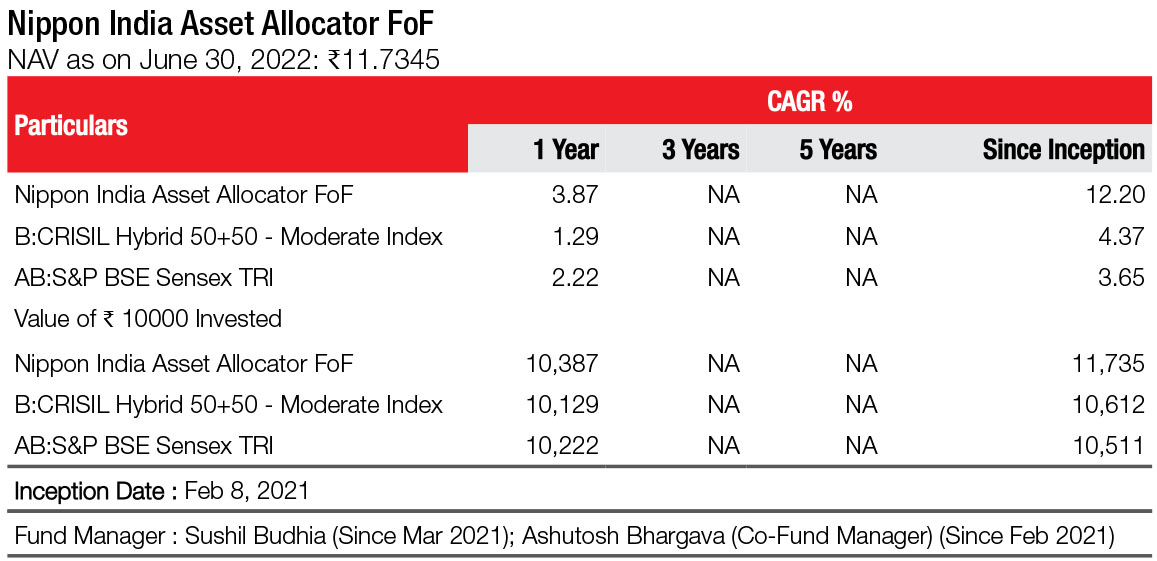

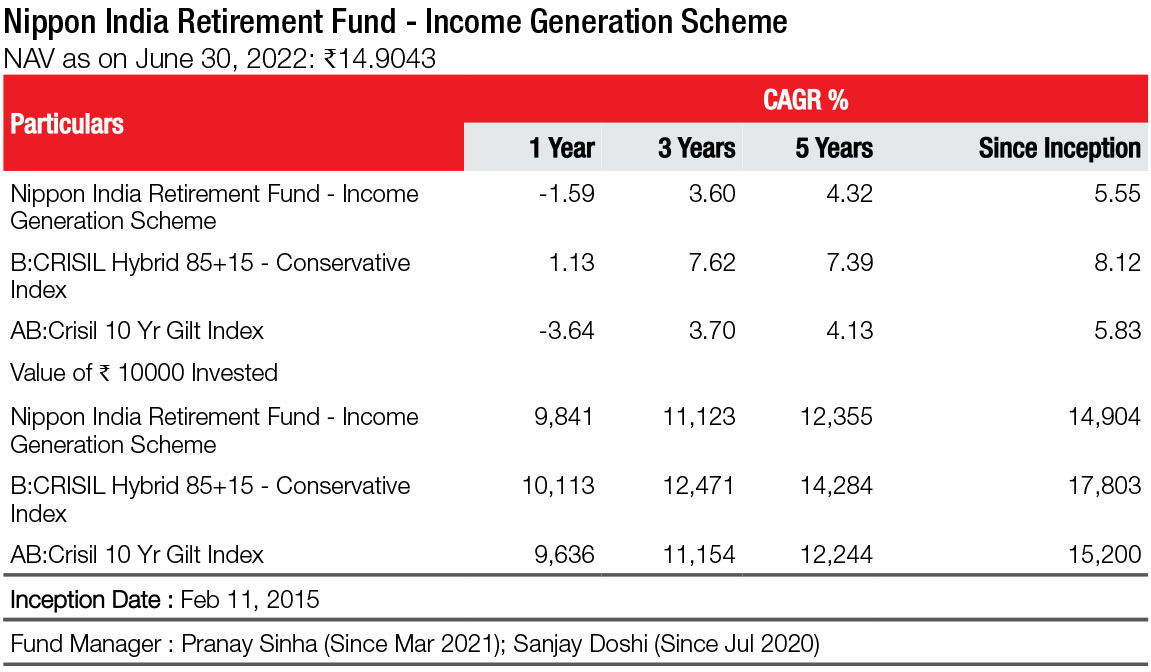

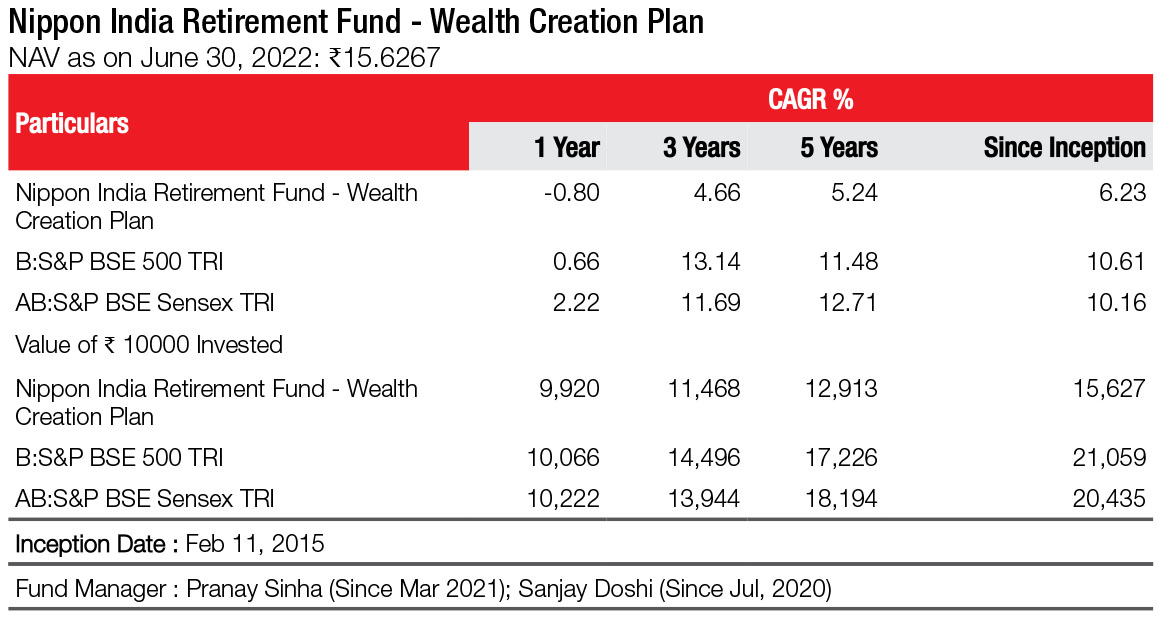

SCHEME PERFORMANCE AS ON June 30, 2022

|

Performance as on June 30, 2022

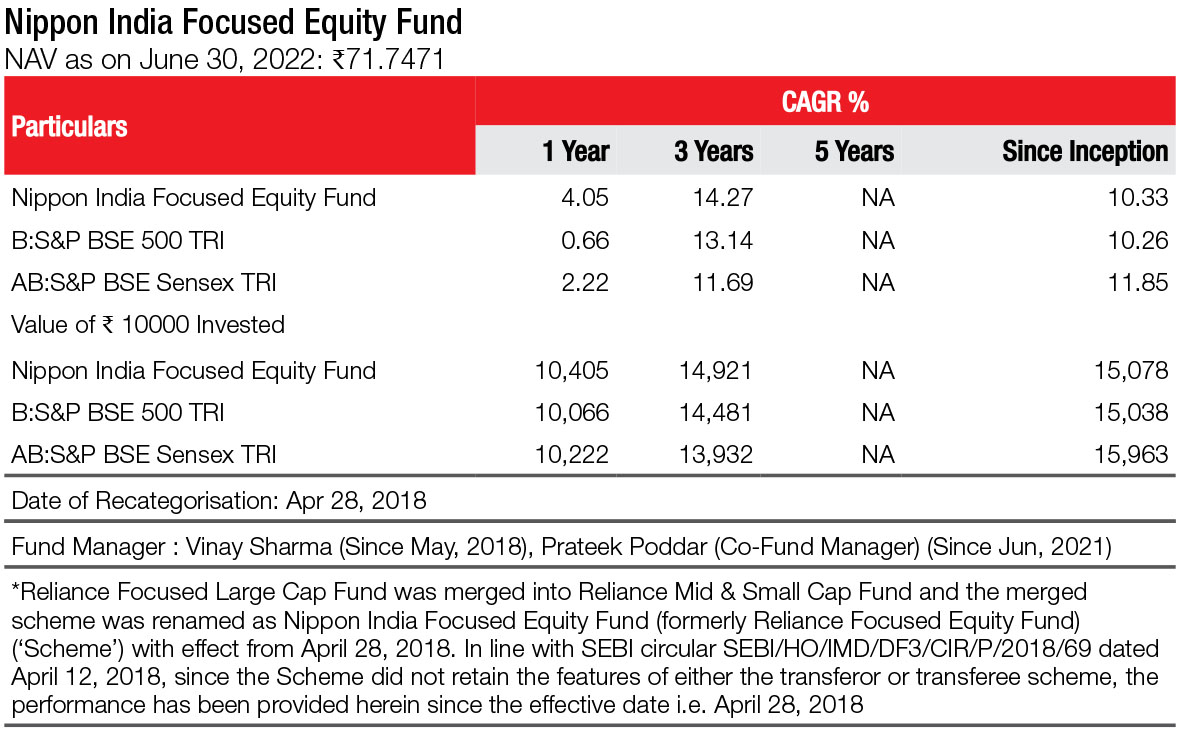

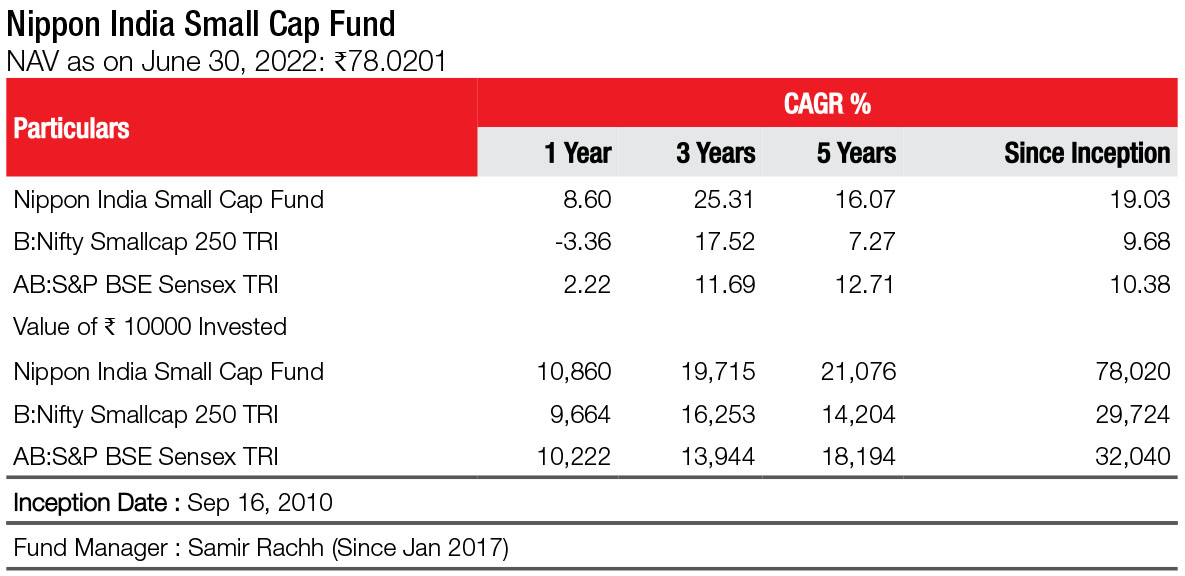

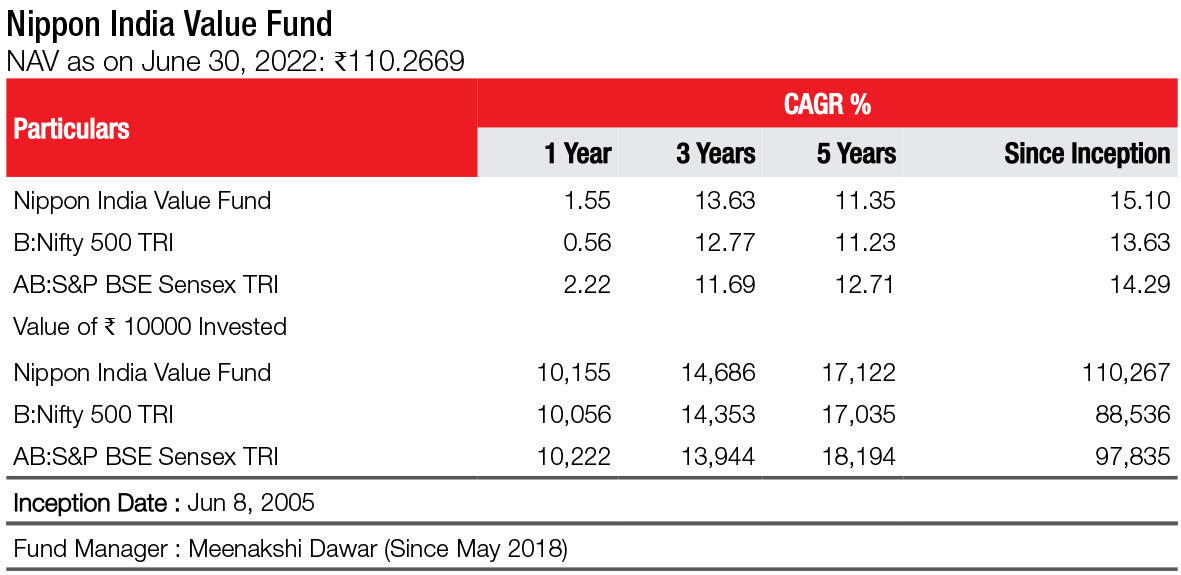

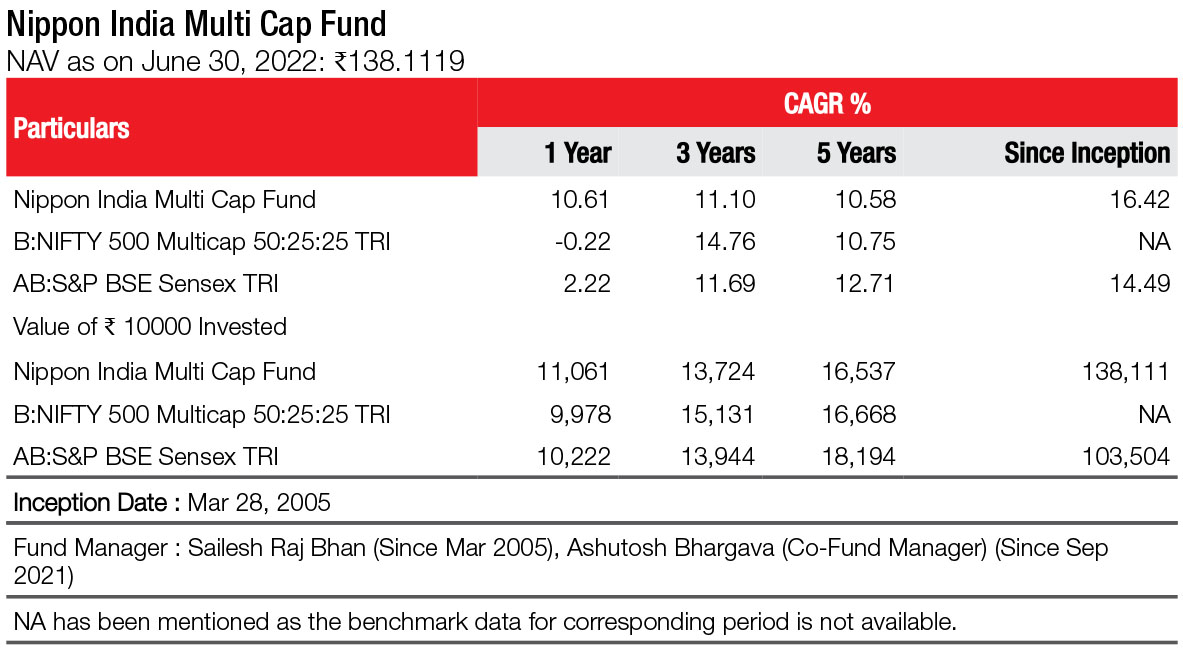

B:Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

The performance of the equity scheme is benchmarked to the Total Return variant of the Index.

Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan), except for Nippon India ETF Nifty 1D Rate Liquid BeES, where the performance provided are of Re-investment of Daily IDCW Plan. For Exchange Traded Funds of Nippon India Mutual Fund, performance is provided at Scheme level using Dividend Reinvestment NAV's, since there are no separate plan/option under such Schemes.

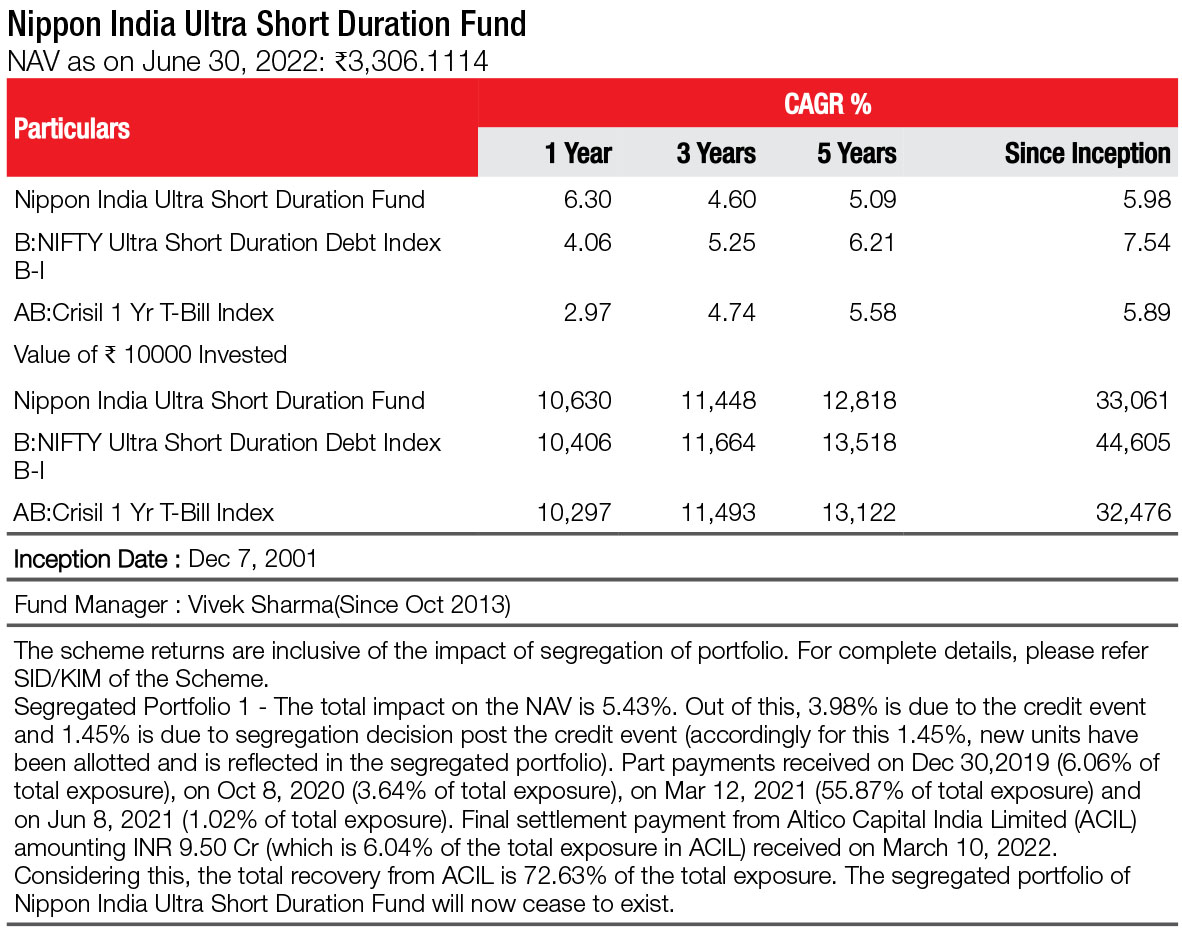

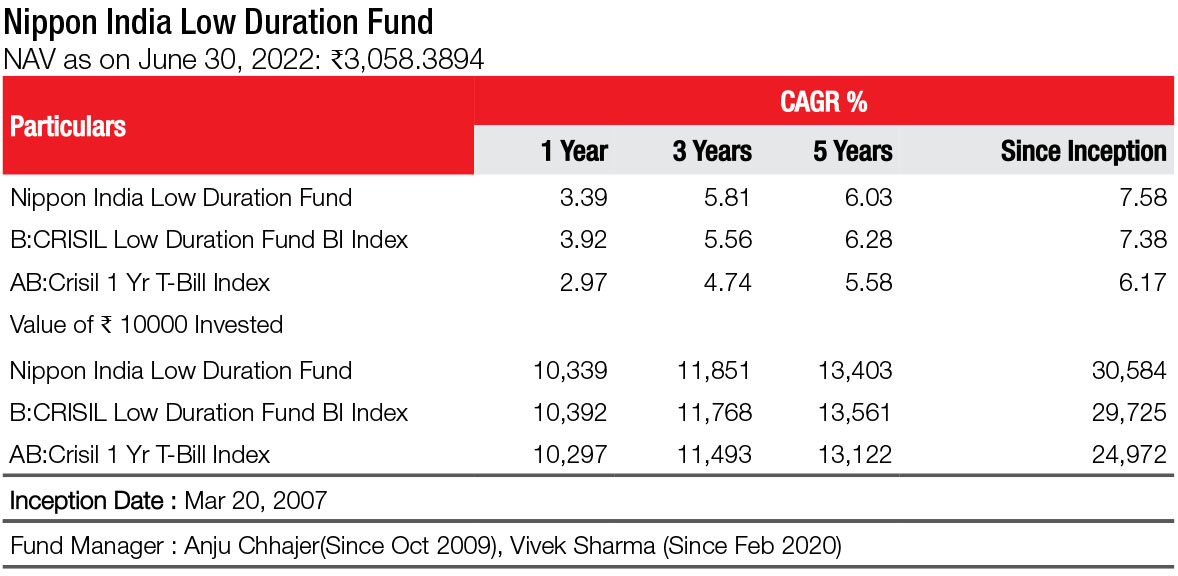

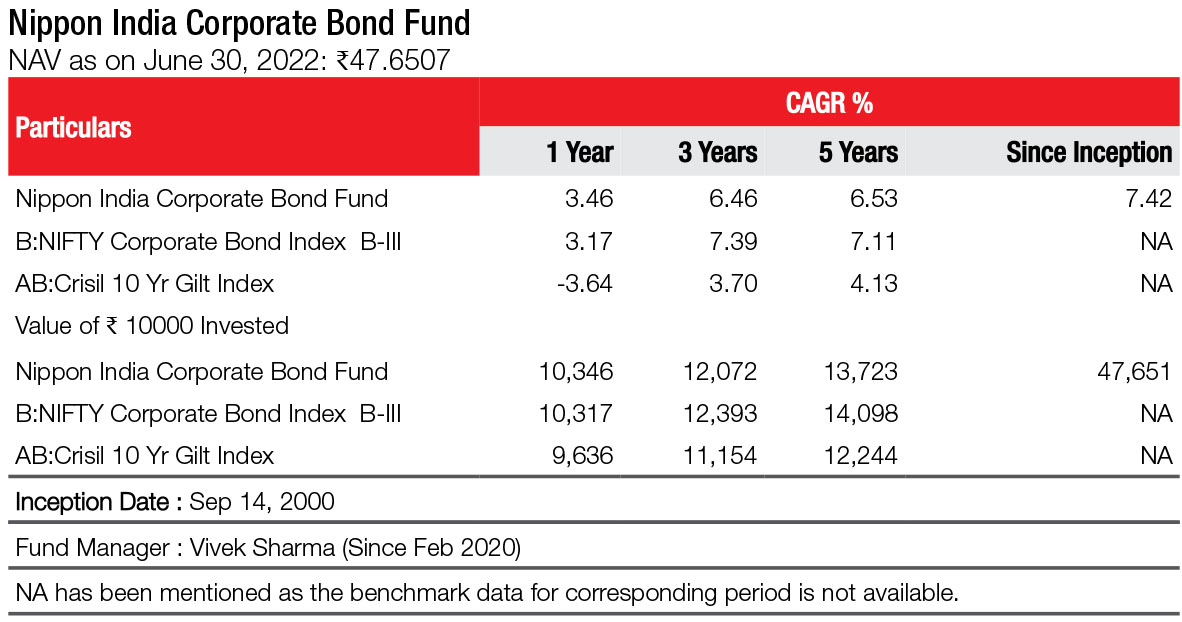

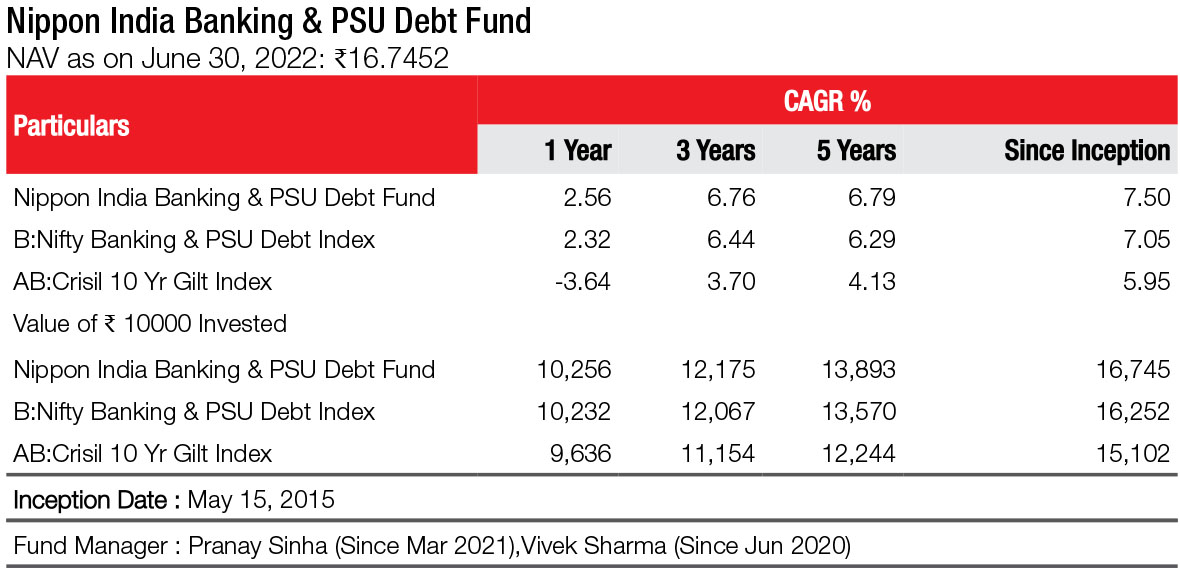

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investments. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement. Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investments. Returns for 1 year and above are compounded annualized (CAGR) and returns less than 1 year are simple annualized basis. 6 months simple annualized returns are provided for the schemes that are in existence for more than 6 months but have not completed 1 year. Dividends (if any) are assumed to be reinvested at the prevailing NAV. In case of Nippon India ETF Nifty 1D Rate Liquid BeES, returns are based on gross dividend per unit declared by the Fund. Bonus (if any) declared has been adjusted. Performance of IDCW option would be net of dividend distribution tax, if any. Face value of schemes is ₹10 per unit, except for the schemes as specified here. Face Value of Nippon India Liquid Fund, Nippon India Money Market Fund, Nippon India Ultra Short Duration Fund, Nippon India Low Duration Fund and Nippon India ETF Nifty 1D Rate Liquid BeES is ₹1000 per unit. Face value of Nippon India ETF Nifty Next 50 Junior BeES is ₹1.25 per unit. Face value of Nippon India Overnight Fund is ₹100 per unit. Face Value of Nippon India ETF Nifty 50 BeES, Nippon India ETF Nifty Bank BeES, Nippon India ETF Nifty PSU Bank BeES, Nippon India ETF Nifty 50 Value 20, Nippon India ETF Hang Seng BeES, Nippon India ETF Gold BeES is ₹1 per unit. In case, the start/end date of the concerned period is non-business day, NAV of the previous date is considered for computation of returns. Performance details of closed ended and interval schemes are not provided since these are not comparable with other schemes.

For disclosure of risk-o-meter of the scheme vis-à-vis risk-o-meter of the benchmark, kindly refer to the respective scheme page in this document.

B:Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

The performance of the equity scheme is benchmarked to the Total Return variant of the Index.

Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan), except for Nippon India ETF Nifty 1D Rate Liquid BeES, where the performance provided are of Re-investment of Daily IDCW Plan. For Exchange Traded Funds of Nippon India Mutual Fund, performance is provided at Scheme level using Dividend Reinvestment NAV's, since there are no separate plan/option under such Schemes.

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investments. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement. Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investments. Returns for 1 year and above are compounded annualized (CAGR) and returns less than 1 year are simple annualized basis. 6 months simple annualized returns are provided for the schemes that are in existence for more than 6 months but have not completed 1 year. Dividends (if any) are assumed to be reinvested at the prevailing NAV. In case of Nippon India ETF Nifty 1D Rate Liquid BeES, returns are based on gross dividend per unit declared by the Fund. Bonus (if any) declared has been adjusted. Performance of IDCW option would be net of dividend distribution tax, if any. Face value of schemes is ₹10 per unit, except for the schemes as specified here. Face Value of Nippon India Liquid Fund, Nippon India Money Market Fund, Nippon India Ultra Short Duration Fund, Nippon India Low Duration Fund and Nippon India ETF Nifty 1D Rate Liquid BeES is ₹1000 per unit. Face value of Nippon India ETF Nifty Next 50 Junior BeES is ₹1.25 per unit. Face value of Nippon India Overnight Fund is ₹100 per unit. Face Value of Nippon India ETF Nifty 50 BeES, Nippon India ETF Nifty Bank BeES, Nippon India ETF Nifty PSU Bank BeES, Nippon India ETF Nifty 50 Value 20, Nippon India ETF Hang Seng BeES, Nippon India ETF Gold BeES is ₹1 per unit. In case, the start/end date of the concerned period is non-business day, NAV of the previous date is considered for computation of returns. Performance details of closed ended and interval schemes are not provided since these are not comparable with other schemes.

For disclosure of risk-o-meter of the scheme vis-à-vis risk-o-meter of the benchmark, kindly refer to the respective scheme page in this document.