Nippon India ETF Liquid BeES

| Details as on February 28, 2022 |

|

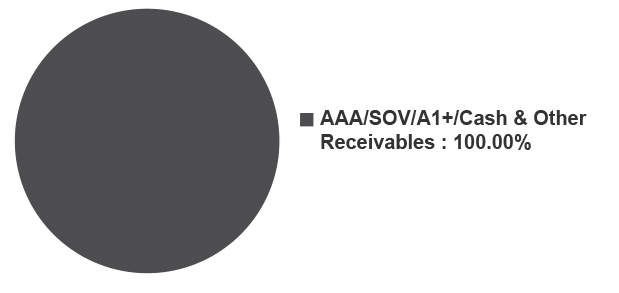

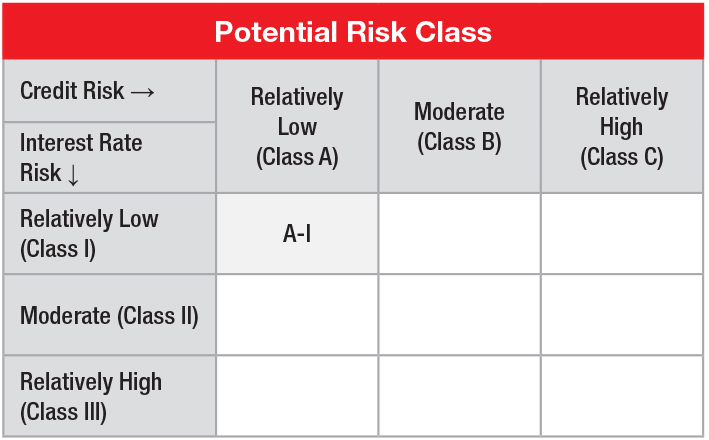

An open ended liquid scheme, listed on the Exchange in the form of an ETF, investing in Tri-Party Repo on G-Sec or T-bills /Repo & Reverse Repo with daily Dividend and compulsory Reinvestment of Income Distribution cum capital withdrawal option. Relatively Low Interest Rate Risk and Relatively Low Credit Risk.

All investments of the scheme would be in Tri-Party Repo, Repos, Reserve Repos and other Money Market Instruments.

July 8, 2003

Siddharth Deb

Nifty 1D Rate Index

| Monthly Average : | ₹ 4,066.26 Cr |

| Month End : | ₹ 4,384.15 Cr |

| NAV as on February 28, 2022 | ₹ 1,000.0000 |

| Creation Unit Size | 2500 Units |

| Average Maturity | 1.99 Days |

| Modified Duration | 0.00 Days |

| Macaulay Duration | 0 Days |

| Entry Load: | Nil |

| Exit Load: | Nil |

| Exchange Listed | NSE, BSE |

| NSE Symbol | LIQUIDBEES |

| ISIN | INF732E01037 |

| Bloomberg Code | LBEES IS Equity |

| Reuters Code | LBES.NS & LBES.BO |

| Total Expense Ratio^ | 0.65 |

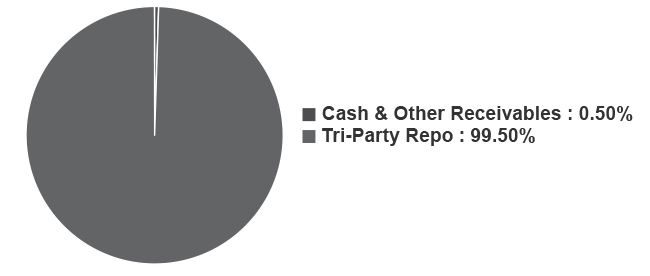

| Company/Issuer | % of Assets |

| Tri-Party Repo | 99.50 |

| Cash and Other Receivables | 0.50 |

| Grand Total | 100.00 |

This product is suitable for investors who are seeking*:

• Current Income with high degree of liquidity

• Investment in Tri-Party Repo on G-Sec or T-bills/Repo & Reverse Repo

predominantly & Money Market Instruments.

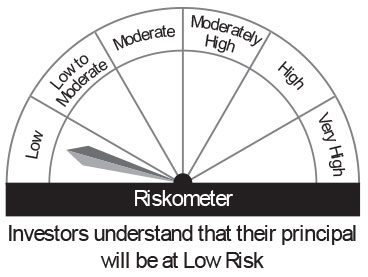

Fund Riskometer

Nippon India ETF Liquid BeES

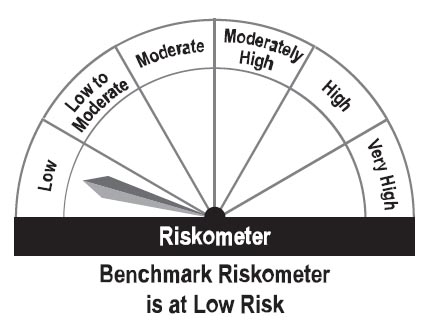

Benchmark Riskometer

Nifty 1D Rate Index

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

For scheme performance please click here. For Fund manager wise scheme performance click here.