Nippon India ETF Nifty CPSE Bond Plus SDL Sep 2024 50:50 (Formerly Nippon India ETF Nifty CPSE Bond Plus SDL - 2024 Maturity)

| Details as on August 31, 2022 |

|

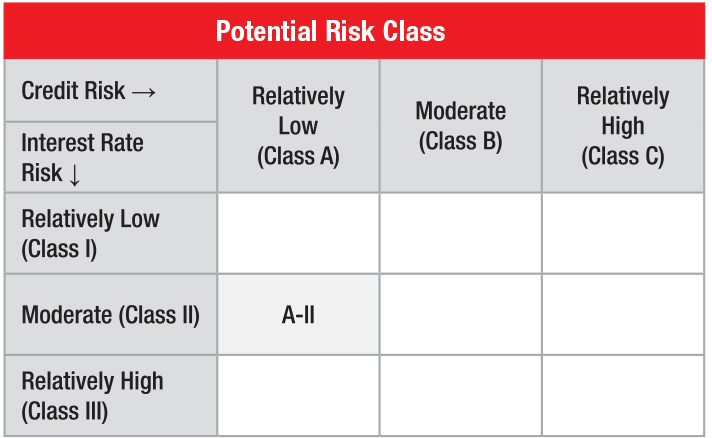

An open-ended Target Maturity Exchange Traded CPSE Bond Plus SDL Fund predominately investing in constituents of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index. Moderate interest rate risk and Relatively Low Credit Risk.

The scheme employs a passive approach designed to track the performance of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index.The Scheme seeks to achieve this goal by investing in securities representing the Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index.The Scheme will invest 95% to 100% in Bonds issued by CPSEs/CPSUs/CPFIs and other Government organizations representing the bonds portion of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index and in State Development Loans (SDLs) representing the SDL portion of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index.The Scheme may also invest in money market instruments.

November 13, 2020

Vivek Sharma

Siddharth Deb

Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index

| Monthly Average : | ₹ 1,894.34 Cr |

| Month End : | ₹ 1,901.48 Cr |

| NAV as on August 30, 2022 | ₹ 108.5382 |

| Tracking Error@ | 0.72% |

| Creation Unit Size | 230,000 Units |

| Pricing (per unit)(approximately) | 1/10th of Index |

| Average Maturity | 1.86 Years |

| Modified Duration | 1.65 Years |

| Annualized Portfolio YTM* | 6.92% |

| *Yields are annualized for all the securities | |

| Standard Portfolio YTM | 6.87% |

| Macaulay Duration | 1.74 Years |

| Entry Load: | Nil |

| Exit Load: | Nil |

| Exchange Listed | NSE |

| Exchange Symbol | SDL24BEES |

| ISIN | INF204KB18W4 |

| Bloomberg Code | NNIFCP24 IN Equity |

| Reuters Code | NA |

| Total Expense Ratio^ | 0.15 |

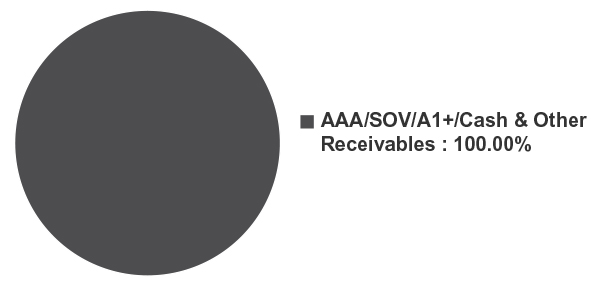

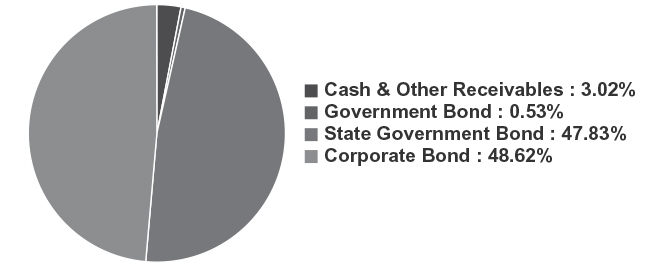

| Holding | Rating | % of Assets |

| Corporate Bond | 48.62 | |

| National Bank For Agriculture and Rural Development | ICRA AAA/CRISIL AAA | 10.67 |

| REC Limited | CRISIL AAA | 10.49 |

| Hindustan Petroleum Corporation Limited | CRISIL AAA | 6.32 |

| NTPC Limited | CRISIL AAA | 6.02 |

| Power Finance Corporation Limited | CRISIL AAA | 5.94 |

| Power Grid Corporation of India Limited | CRISIL AAA | 5.52 |

| Indian Railway Finance Corporation Limited | CRISIL AAA | 2.03 |

| Export Import Bank of India | CRISIL AAA | 0.82 |

| NHPC Limited | CARE AAA | 0.80 |

| Government Bond | 0.53 | |

| 6.84% GOI (MD 19/12/2022) | SOV | 0.53 |

| State Government Bond | 47.83 | |

| State Government Securities | SOV | 47.83 |

| Cash and Other Receivables | 3.02 | |

| Grand Total | 100.00 |

This product is suitable for investors who are seeking*:

• Income over long term

• Investments in CPSE Bonds & State Development Loans (SDL) similar to the

composition of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index, subject to

tracking errors

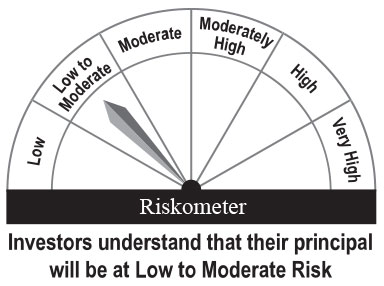

Fund Riskometer

Nippon India ETF Nifty CPSE

Bond Plus SDL Sep 2024 50:50

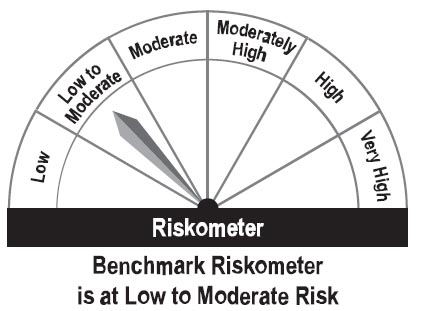

Benchmark Riskometer

Nifty CPSE Bond Plus SDL Sep

2024 50:50 Index

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

Since the fund has not completed one year, the scheme performance has not been provided.