Nippon India Nivesh Lakshya Fund

| Details as on August 31, 2022 |

|

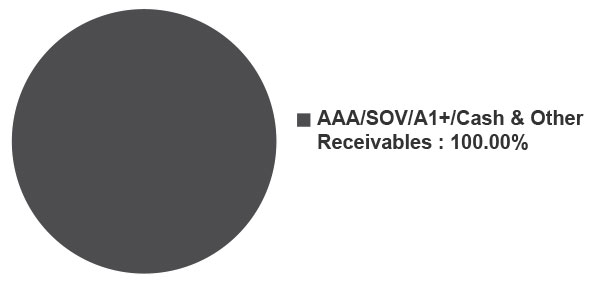

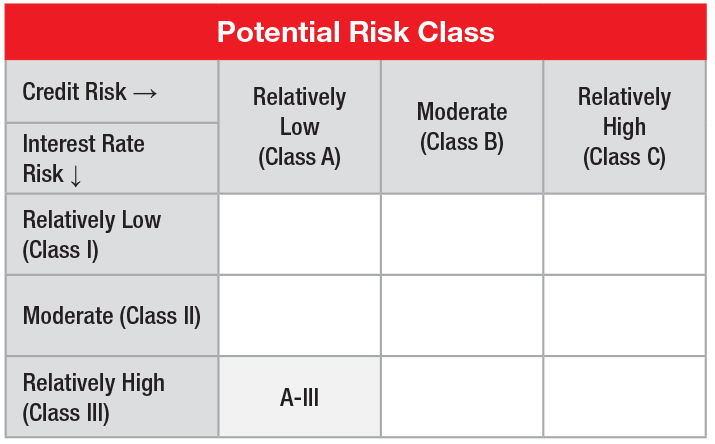

An open ended debt scheme investing in instruments such that the Macaulay duration of the portfolio is greater than 7 years. Relatively High interest rate risk and Relatively Low Credit Risk.

Investments in long term fixed income securities predominantly Government Securities at the current yields. Most of the securities are held till maturity. Rebalancing of the portfolio is done to ensure that similar securities mix is maintained.

July 06, 2018

Pranay Sinha

CRISIL Long Duration Fund AIII Index

| Monthly Average : | ₹ 2,033.81 Cr |

| Month End : | ₹2,094.19 Cr |

| Growth Plan | ₹ 14.1343 |

| IDCW Plan | ₹ 14.1335 |

| Monthly IDCW Plan | ₹ 11.7081 |

| Quarterly IDCW Plan | ₹ 11.7084 |

| Half Yearly IDCW Plan | ₹ 11.8800 |

| Annual IDCW Plan | ₹ 11.6669 |

| Direct - Growth Plan | ₹ 14.3222 |

| Direct - IDCW Plan | ₹ 14.3223 |

| Direct - Monthly IDCW Plan | ₹ 11.7385 |

| Direct - Quarterly IDCW Plan | ₹ 11.7548 |

| Direct - Half Yearly IDCW Plan | ₹ 11.9208 |

| Direct - Annual IDCW Plan | ₹ 11.6885 |

| Entry Load: | Nil |

| Exit Load: | 20% of the units allotted can be redeemed every year

without any exit load, on or before completion of 36 months from the

date of allotment of units. Any redemption in excess of such limit in the first 36 months from the date of allotment shall be subject to the following exit load. Redemption of units would be done on First in First out Basis (FIFO): • 1% if redeemed or switched out on or before completion of 36 months from the date of allotment of units. • Nil, if redeemed or switched out after completion of 36 months from the date of allotment of units. |

| Average Maturity | 22.67 Years |

| Modified Duration | 10.51 Years |

| Annualized portfolio YTM* | 7.53% |

| Standard portfolio YTM | 7.40% |

| Macaulay Duration | 10.90 Years |

*Yields are annualized for all the securities

| Regular/Other than Direct | 0.53% |

| Direct | 0.22% |

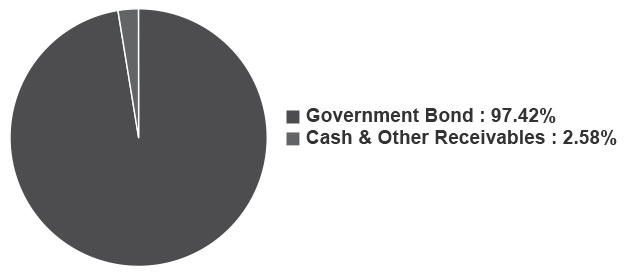

| Company/Issuer | Rating | % of Assets |

| Government Bond | 97.42 | |

| Government of India | SOV | 97.42 |

| Cash and Other Receivables | 2.58 | |

| Grand Total | 100.00 |

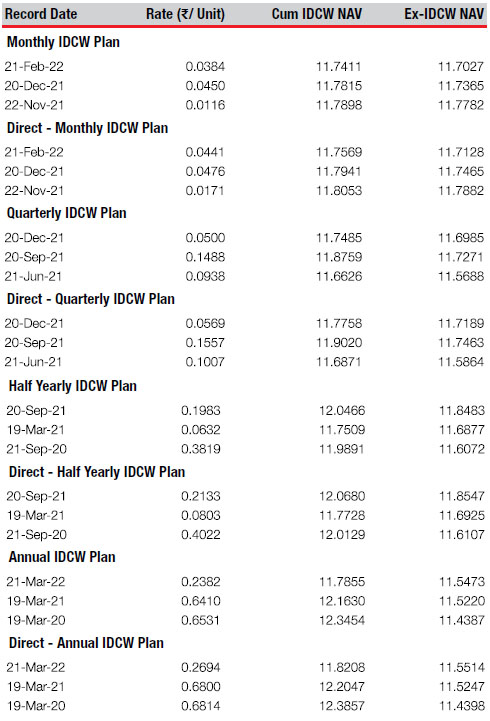

Past performance may or may not be sustained in future. Pursuant to IDCW payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value-₹ 10.

This product is suitable for investors who are seeking*:

• Income over long term.

• Investment in Debt & Money Market Instruments with portfolio Macaulay duration

of greater than 7 years.

Fund Riskometer

Nippon India Nivesh Lakshya

Fund

Benchmark Riskometer

CRISIL Long Duration Fund AIII

Index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

For scheme performance please click here. For Fund manager wise scheme performance click here.