If you sift through the photos of any wedding album, particularly in India, you will not be surprised to see the bride decked in gold jewellery. Gold is so deeply ingrained in Indian culture that most Indian households deem it fit to invest in it.

But there’s more to gold than weddings and celebrations. Gold is also an important investment vehicle and requires a slightly different mindset. It is also an investment that tends to be misunderstood because of the myths surrounding it. This article seeks to demystify some of those myths so that you can consider gold and gold mutual funds as an integral part of your investing journey.

What are Gold Mutual Funds?

A Gold Mutual Fund is a type of mutual fund that invests in Gold Exchange Traded Funds (ETFs) on behalf of investors. Gold Mutual Fund are also known as Gold Funds of Fund (FoF). They ultimately offer a way of investing in gold digitally.

Top Myths about Gold Funds

Gold and by extension, Gold Funds tend to be shrouded in myths. Here are three such myths debunked:

Myth 1: Gold is only for wealthy people

If you believe that only wealthy people have the means to purchase gold, then think again. You don’t need to be rich to buy gold. On the contrary, this precious metal can be accessible to all investors irrespective of their financial status.

One of the factors that make this possible is the option of buying digital gold, and gold mutual funds can help investors achieve their goals in this regard. If you are overwhelmed by shelling out a big lump sum amount to buy gold, you can purchase this precious metal in smaller quantities over the long term through the Systematic Investment Plan (SIP) route.

Myth 2: Gold is a risky investment

Gold is not necessarily as risky as many think it is. It is a store of value and is generally considered a hedge against inflation and political turmoil. Thus, having gold or gold mutual funds as part of your overall investment portfolio is one way to diversify risk.

Myth 3: One can’t expect returns from gold

The idea of investing in gold and gold mutual funds is to expect more than just returns or appreciation of capital. One needs to view gold and gold mutual funds through a different lens. Gold can be considered money itself; it is, after all, a precious metal and an asset. But more importantly, it acts as a hedge against a volatile economic environment and political risks.

To conclude

Gold mutual funds can be considered if you are interested in diversifying your investment portfolio. How much you invest in gold mutual funds will depend on your overall financial goals and risk appetite. You may consider investing in Nippon India Gold Savings Fund.

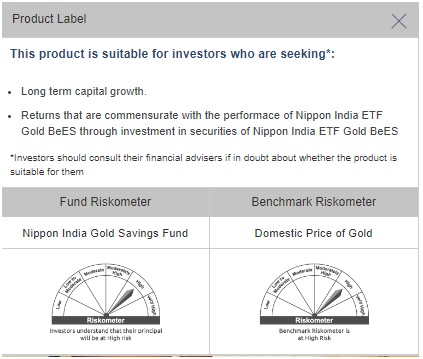

PRODUCT LABEL

The Investors will be bearing the recurring expenses of the scheme, in addition to the expenses of the underlying scheme i.e Nippon India ETF Gold BeES.

Disclaimer:

The information herein is meant only for general reading purposes, and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.