The current trends in the market and businesses may also help determine the strategy to invest money for many individuals. For instance, when people witness infrastructural development, they want to invest more in mutual funds tied to the stocks in the infrastructure theme - power, steel, cement, etc.

A further classification of these funds can lead you to sectoral funds - the ones that invest primarily in the companies falling in a specific sector. This is where you come across

banking mutual funds. If you feel the banking sector in India is doing good and will grow even more, you can invest in them via

banking mutual funds.

But before you do so, let’s get into the details of banking funds.

What are Banking Mutual Funds?

Banking funds, also known as sectoral banking mutual funds, are basically equity funds that concentrate the investment portfolio towards banks. Their asset allocation is mostly toward the equities or equity-related instruments of banks. Investing in banking funds can gain significant exposure to a portfolio of banking securities.

Advantages of Investing in Banking Mutual Funds

1. You can plan to achieve long-term financial goals by investing in banking mutual funds.

2. With banking funds, you get significant exposure to a portfolio covering various securities of Indian banks.

3. Your investments may earn the potential to deliver benchmark-beating returns with a careful selection of these sectoral funds.

Taxation Rules Related to Banking Funds

Banking funds are taxed like any other equity fund you have also invested in. The returns/gains you receive (if any) on redeeming the mutual fund units will be taxed as per the holding period.

● Short-term capital gains realised on redeeming the units within 12 months will be taxed at 15%, irrespective of the tax slab rate.

● Long-term capital gains realised on selling the units after 12 months are taxed at 10% without indexation benefit.

Should You Invest in Banking Funds?

Before investing in banking funds, you should also know that the portfolio could be more genuinely diversified since the asset allocation is concentrated on a particular sector (banking). They carry a higher risk of concentration as compared to various other classes of mutual fund schemes. Therefore, you should consider investing in these funds if you are willing to bear the risk to benefit from their potential of generating benchmarking-beating returns.

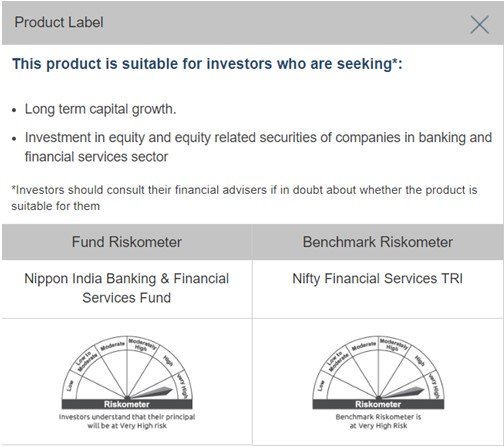

For example, you can begin investing in Nippon India Banking & Financial Services Fund for long-term capital growth. You can check the fund features, performance, and other particulars online to make an informed decision.

Things to Consider Before Investing in Banking Funds

● The concentration of the portfolio of banking funds also implies higher risk, which makes it essential to consider a long-term investment horizon.

● You should also consider both market and volatility risks associated with these funds before investing.

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

PRODUCT LABEL

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.