Financial term of the week: Equity- Linked Savings Scheme (ELSS)

Equity Linked Savings Scheme (ELSS) is a type of mutual fund scheme that invests in equity-related instruments and helps you claim your investment in an ELSS for an income tax deduction. The latter part, i.e. the ELSS tax benefit, is what sets ELSS apart from other equity-oriented mutual fund schemes. ELSS comes with a lock-in period of 3 years from the date of investment, which means that you can redeem your investment in ELSS only after 3 years of investment. Since it is an equity-oriented scheme, it is recommended for a relatively long-term investment with an aim to get relatively better returns.

How to invest in ELSS funds?

There are two ways to invest in ELSS funds-

Systematic Investment Plan (SIP) wherein you invest a pre-defined chunk of money at regular intervals in the scheme or Lump sum investment wherein you invest all the money at one go.

Scenario I- SIP

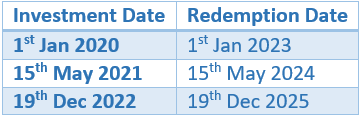

Let us assume that you have started a monthly SIP of Rs 5000 on 1st Jan 2020; then your lock-in period will be as follows-

As can be seen, every instalment of SIP has a different lock-in period and can thus be redeemed accordingly.

Scenario II- Lump sum

If the same investment was made as a lump sum amount on 1st Jan 2020, then the entire capital can be redeemed on 1st Jan 2023.

ELSS Tax Benefit

The investments made under an ELSS scheme are eligible for deduction from your taxable income under the section 80C of The Income Tax Act, 1961 up to Rs 1.5 Lakh. For example, if you start a SIP on 1st Apr 2020 in an ELSS fund of Rs 10,000 per month, then you can claim a deduction of Rs 1,20,000 (12x Rs 10,000) for the entire year under the Section 80C. This translates into ~ Rs 46,800 worth of tax saving in a year. Tax laws are subject to amendments made thereto from time to time. Investors are requested to consult their tax advisor in this regard before investing.

Who can invest in ELSS?

- Investors who aim to achieve comparatively better returns than other traditional tax-saving investments

- Investors who are looking to save tax while investing in a

mutual fund scheme

- First-time mutual fund investors who can seek the dual benefit of tax saving and long-term investments in mutual fund schemes

- Investors with longer investment horizon than 3 years

The above list is only indicative in nature.

Tax implications on ELSS

The returns from ELSS are taxed like any other equity-oriented mutual fund scheme. Since

ELSS comes with a lock-in period of 3 years, only long-term capital gains tax (LTCG) is applicable, i.e. 10% on your gains above Rs 1 Lakh.

For example, if you redeem an investment which has a current value of Rs 2,50,000 after 3 years of lock-in, Then the LTCG levied is 10% on Rs 1,50,000 (gains over Rs 1 Lakh), which is Rs 15,000.

Note: One can save tax upto ₹46,800: Individual and HUF having taxable income of less than ₹50 lakhs can invest upto ₹1.5 lakhs under the ELSS scheme during the FY 2020-21 as per provision of Section 80C of the Income Tax Act 1961 (Includes applicable cess). Tax saving will be proportionately reduced subject to the taxable income and investments. Further, Investment in ELSS schemes is subject to lock in period of 3 years from the date of allotment of units. Long Term capital gain, if any on ELSS scheme investment is subject to applicable tax at the time of redemption. The tax benefits are as per the current income tax laws and rules. Investors are advised to consult their tax advisor before investing in such schemes.