How is Exit Load Calculated in Mutual Fund?

Exit Load is the fee that may be charged for mutual fund redemptions made before the specified time period. The ‘specified’ period is defined by the mutual fund scheme in the scheme information document (SID) and must be referred to when investing in a new scheme. For example, suppose in the SID of equity schemes, it is mentioned that the holding period after which the exit load is not charged is 12 months; in such a case, any redemption before 12 months shall be subject to an exit load.

The exit load can either be a flat fee defined as a percentage of the current value of the investment or can be graded with the % fee decreasing with time.

Why Exit Load?

There are two main reasons for AMCs to be charging exit loads-

- Exit Load helps discourage investors from redeeming early before the defined period. It also helps protect the financial interest of investors who remain invested for a longer duration

- In a situation when a lot of investors redeem prematurely from a scheme, it may affect the returns of the long-term investors in the scheme. This happens because the Asset Under Management (AUM), i.e. the total value of securities held under the scheme decreases with redemption. The money being redeemed could have been invested by the fund manager for better growth prospects. Thus, the returns may decrease. To counter this, exit loads help in keeping the investors invested in the scheme.

How is the Exit Load calculated?

There are two modes to invest in mutual funds in India-lumpsum and

SIP. While the former implies that the investor invests a chunk of money all at once in a mutual fund scheme, the latter, i.e. Systematic Investment Plan, implies that the investor is investing a fixed amount of money at pre-decided intervals of time like monthly, weekly, quarterly etc.

The calculation of exit load is different for both, as given below.

For lumpsum investment

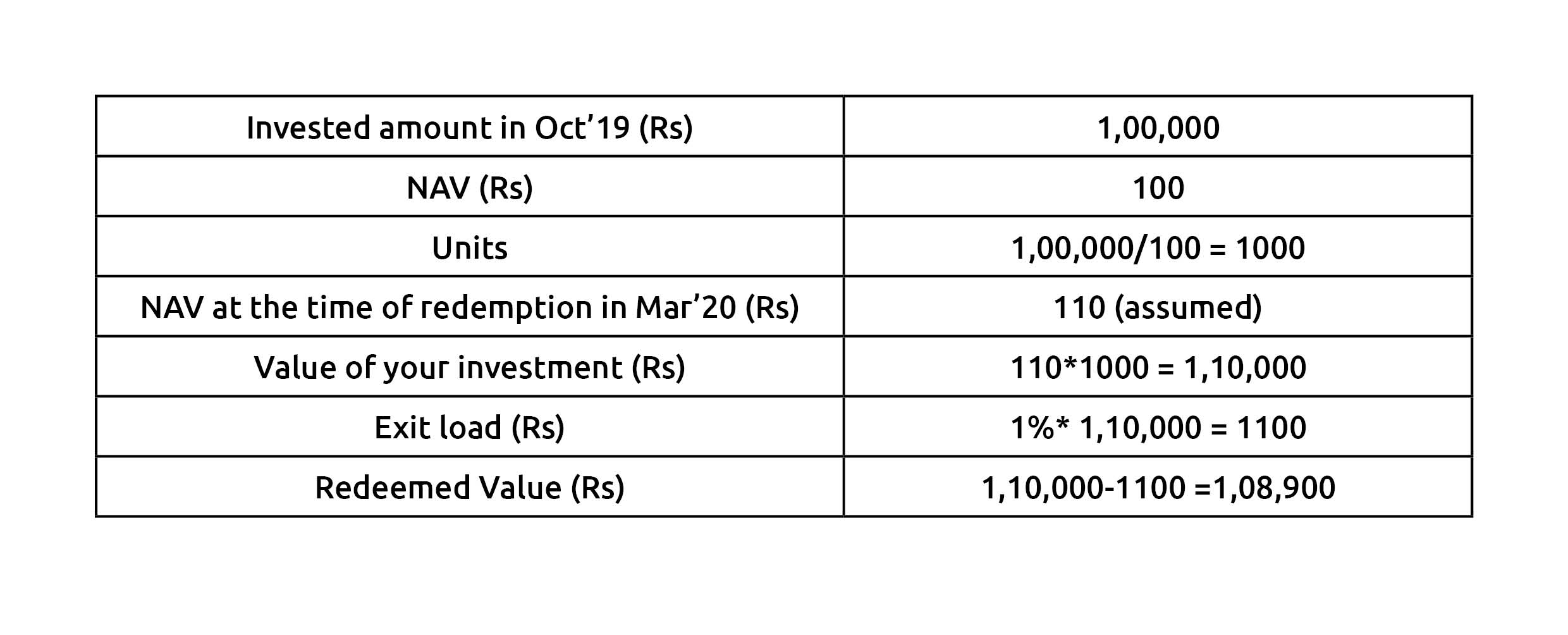

Let us assume that you have invested Rs 1,00,000 in an equity mutual fund scheme in Oct’19, at a NAV of Rs 100. Hypothetically assuming the exit load to be 1% for a mandatory holding period of 12 months, below is how the redemption scenarios would look like-

Had the same money been redeemed after 12 months, say in Nov’20, there would have been no exit load, and the current value of your investment would have been redeemed. As you can see, the exit load is charged on the current value of the investment and not on the originally invested value.

For SIP investment

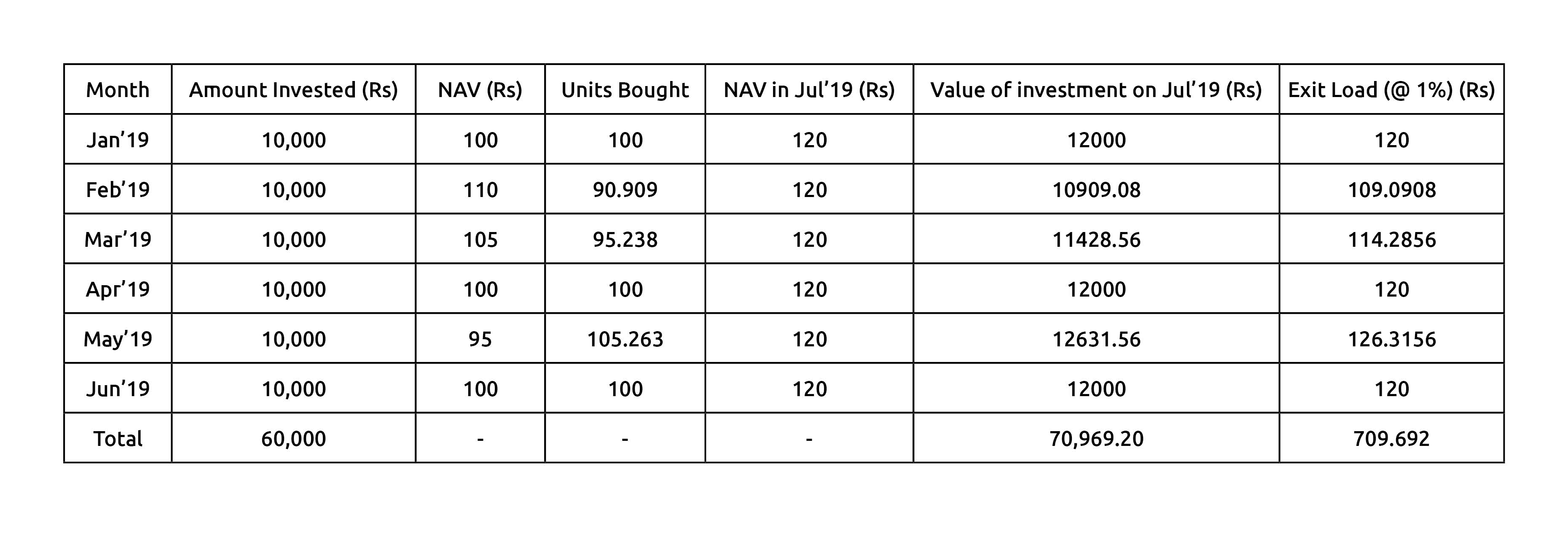

Let us assume that you started a monthly SIP investment of Rs 10,000 in an equity mutual fund scheme (exit load of 1% before 12 months) in Jan’19. Now suppose you wish to stop the SIP and redeem in July’19, the exit load calculation is as below-

Your money, hypothetically, has grown from Rs 60,000 to Rs 70,969.2. But because of withdrawal before the specified period, at the time of redemption, you shall get the amount after deducting the exit load, i.e. Rs 70,259.508.

Now consider the same scenario, with the only change of redemption being made in Jan’20 instead of Jul’19. In this case, the first instalment invested in Jan’19 will see a zero-exit load, because that instalment would have completed 12 months, whereas, for the rest of the instalments, the exit load shall be calculated in a manner similar to the one given above.

In conclusion-

Every investor must go through the scheme information document thoroughly before investing in any

mutual fund scheme and especially go through the exit load in order to align it to his/her own investment objective.