What is Indexation & How does it Work?

When you invest in a mutual fund scheme, the returns that you get at the end of your investment tenure are called capital gains; and the tax that you pay on these gains is called the capital gain tax. Indexation is a tool employed to reduce the burden of this capital gain tax, so that you pay a lesser amount as tax. The tool does this by adjusting your original investment value against inflation.

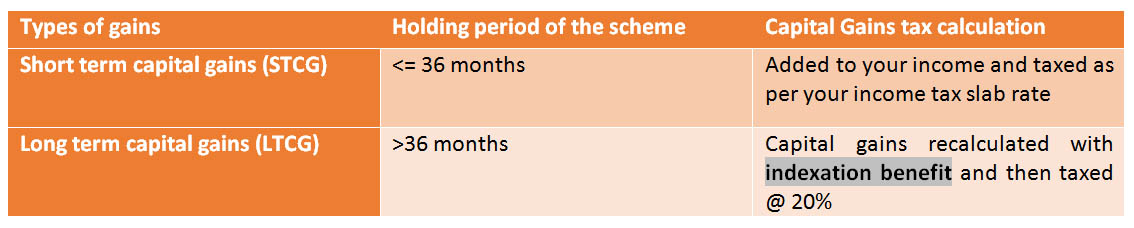

Benefit of indexation is available only for long term capital gain from Other Than Equity Oriented mutual fund schemesin mutual funds to resident investor as follows:

How does indexation work?

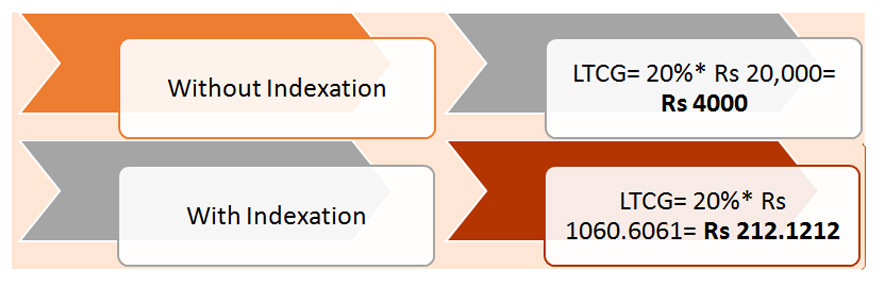

For example, let us assume that you invested Rs 2,00,000 in a Other than Equity Oriented mutual fund scheme in May’16; and at the time of redemption after 3 years in Oct’19, the value of your investment has become Rs 2,20,000. Now, your capital gain= Rs 2,20,000- Rs 2,00,000= Rs 20,000. And this amount will be liable forlong-termcapital gain tax. What indexation does, for the purpose of tax calculation is, that it adjusts your purchasing price of Rs.2,00,000 as per inflation so that your purchase price increases and reduce capital gain for tax purpose.

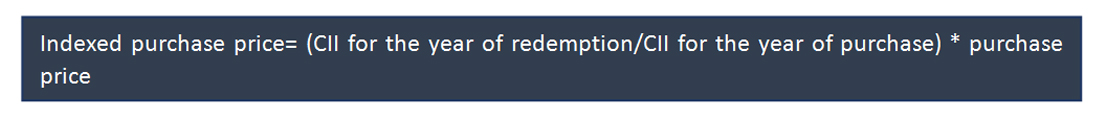

CII is the cost of inflation index notified values for the years 2016-17 and 2019-20 in the above example,

Indexed purchase price= (289/264) * 2,00,000= Rs 2,18,939.3939

Now recalculating capital gains with the indexed purchase price-

Capital gains= Rs 2,20,000- Rs 2,18,939.39.39= Rs 1060.6061

In this illustrative example, indexation has managed to bring down your LTCG by 94.6969%, which is a huge leap saving.

In conclusion-

The tax benefit that indexation can offer to Other Than Equity Oriented Mutual Fund Scheme to a resident investor is fairly considerable, and hence, it may be in your interest to hold on to your

debt scheme investment for a period higher than 36months. Debt schemes also help you in keeping your portfolio diversified while not introducing relatively higher risks in it. While redeeming, you are advised to consider the tax implication of withdrawal by calculating the payable capital gains tax in both short-term and long-term scenarios.