NFO (New Fund Offer): Meaning, Working, Types and How to Invest?

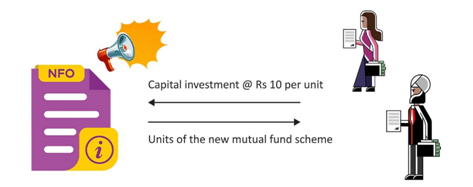

A New Fund Offer (NFO) is like an introduction stage for a brand-new mutual fund scheme being launched by an asset management company (AMC). The AMC gives you an opportunity to buy units of this scheme as the first subscribers of the scheme, in order to build the scheme’s AUM just before it purchases securities in the market as per its investment objective. The units are generally sold at a NAV of Rs 10 during the NFO period.

This is how it works

How do NFOs work?

The window provided to the investors to subscribe to an NFO is limited; hence, the investors can purchase the units in this pre-defined period only. Once the offer period is over, the units of open-ended schemes can be bought like in the case of other mutual fund schemes at Net Asset Value (NAV) i.e. cost per unit of the scheme, prevalent at that point in time. Units of close-ended schemes are available for purchase on the exchange, however, there may be liquidity issues.

Types of schemes that can be offered as NFOs are -

Open-Ended -

These schemes are available for investment and redemption for the investors at any given point in time. After the introductory NFO is withdrawn, the investors are generally free to enter or exit the scheme as per their will and at the applicable NAV and subject to applicable exit load, if any.

Closed-Ended -

These schemes are introduced to collect a pool of money for investments in securities, post which, the schemes are closed for further transactions i.e. the entry and exit from the scheme are restricted till the maturity period is over. However, these closed-ended schemes are listed on the stock exchanges by the fund houses, and if you want to exit the scheme, you can trade these units on the exchange.

Difference between IPO and NFO

Both Initial Public Offering (IPO) and NFO represent methods of raising capital from investors. However, there are distinct differences between these two concepts.

More About IPO

Here are some key characteristics of an IPO:

1. Company status

An IPO is primarily used by private companies that wish to transition into publicly traded entities. It allows them to raise funds for expansion, debt repayment, etc.

2. Regulatory compliance

Companies planning an IPO in India must comply with the Securities and Exchange Board of India (SEBI) regulations. They must provide detailed financial information, business prospects, and other relevant disclosures to potential investors.

3. Stock exchange listing

After the IPO, the company's shares are listed and traded on recognized stock exchanges. Interested investors can then buy or sell the shares at market price.

More About NFO

An NFO, as defined above, allows the AMC to raise capital from investors and create a new fund with a specific investment objective. Here are some key points about NFO meaning:

1. Mutual fund launch

An NFO in mutual funds is specific to the mutual fund industry. This is how AMCs introduce new mutual fund schemes with distinct investment strategies, asset allocations, or target markets.

2. Investor participation

NFOs invite investors to subscribe to the newly launched mutual fund scheme during the initial subscription period. They can invest in the scheme by purchasing units at its NAV during the NFO period.

3. NAV calculation

Unlike IPOs, where share prices are determined through a book-building process, NFOs offer units at the NAV, which represents the net value of the fund's assets divided by the number of units outstanding.

4. Market trading

After the NFO period ends, the close-ended mutual fund scheme is listed for trading. Investors can buy or sell mutual fund units per their NFO investment objectives.

Advantages and Disadvantages of an NFO

Advantages:

1. Fresh investment opportunity

As per the NFO meaning in mutual funds, it offers investors a chance to invest in a newly launched mutual fund scheme from the very beginning. This allows them to participate in the potential growth of the fund from its inception.

2. Unique investment objectives

NFOs are typically launched with specific investment objectives, strategies, or themes. This allows investors to diversify their investment portfolio or target specific sectors or asset classes.

Disadvantages:

1. Lack of track record

Since NFOs are newly launched, they may not have a track record of performance. Investors have limited historical data to evaluate the fund's performance or assess the competence of the fund manager.

2. Limited information

Compared to existing funds, NFOs may have limited information available for analysis. Investors may have to rely on the fund's investment strategy, disclosures, and the reputation of the AMC to make an informed decision.

3. Potential performance risks

Investing in an NFO involves inherent risks associated with new and untested investment strategies. There is a possibility that the fund may not perform as expected or fail to achieve its stated objectives. Therefore, it is important for investors to assess the risks associated with the NFO before investing carefully.

Things to keep in mind when investing in an NFO -

1.While NFO is an attractive opportunity to discover a new asset class or new investing strategies, and on the other, you do not have a proven long-term past record of the scheme to study to understand how it has performed in different market cycles. (Past performance may or may not be sustained in the future)

2.Since the NFO’s amount collection happens before the scheme actually goes live in the market, the fund manager may have some flexibility to hold on to the funds within the regulatory limits if the market is not favourable. Whereas, since the specific securities the fund will be investing in, may not be very clear, you may have to wait to be given details about the scheme’s investment portfolio.

What to consider before buying units in an NFO?

Theme/Investment Strategy:

You may check if the scheme’s theme is in line with your own investment strategy.

NFO exit options:

In case of open-ended scheme one can exit the scheme whenever required. Few schemes having lock-in period may be an exception like Equity Linked Savings Schemes, you can exit from these schemes any time after the lock-in period is over. In case the exit happens before the exit load period, it may attract the respective exit load .

In case of a close-ended scheme, one cannot exit the scheme till the maturity period is over. However, these closed-ended schemes are listed on the stock exchanges by the fund houses, and if you want to exit the scheme, you can trade these units on the exchange.

Minimum investment:

NFOs come with varied minimum investment amounts, which you may want to check before you decide to invest in them.

Investment Horizon:

It’s advisable to check your own investment horizon, before making a commitment to the NFO scheme depending upon the offering.

Risk Appetite:

It is advisable to check the asset classes the NFO is looking to invest in, since, those should be in line with your own risk-taking appetite. For example, if you are a relatively conservative investor with a lower risk appetite, then an NFO that invests in small and mid-cap equity securities may not be suitable for you. The Risk o Meter gives a good idea on the risk the fund will be exposed to.

Why to invest in NFOs?

If an NFO introduces an investment theme/strategy that is new to the Indian mutual fund market or new to your investment portfolio and suits your risk profile, then investing in an NFO can be a fair bet.

Investors are advised to consult their tax/financial advisors before making any investments.

Additional Read:What is Total Expense Ratio ?

FAQs

What Is the Meaning of NFO?

MF NFO or New Fund Offering refers to the launch of a new mutual fund scheme by an AMC where investors have the opportunity to invest in the scheme during the initial subscription period.

How Do I Choose an NFO?

When choosing an NFO, you need to consider factors like investment objective, the fund manager’s expertise, the fund house reputation, and the disclosure/transparency of the NFO.