Systematic Transfer Plan: Meaning, Types & Benefits of Systematic Transfer Plan

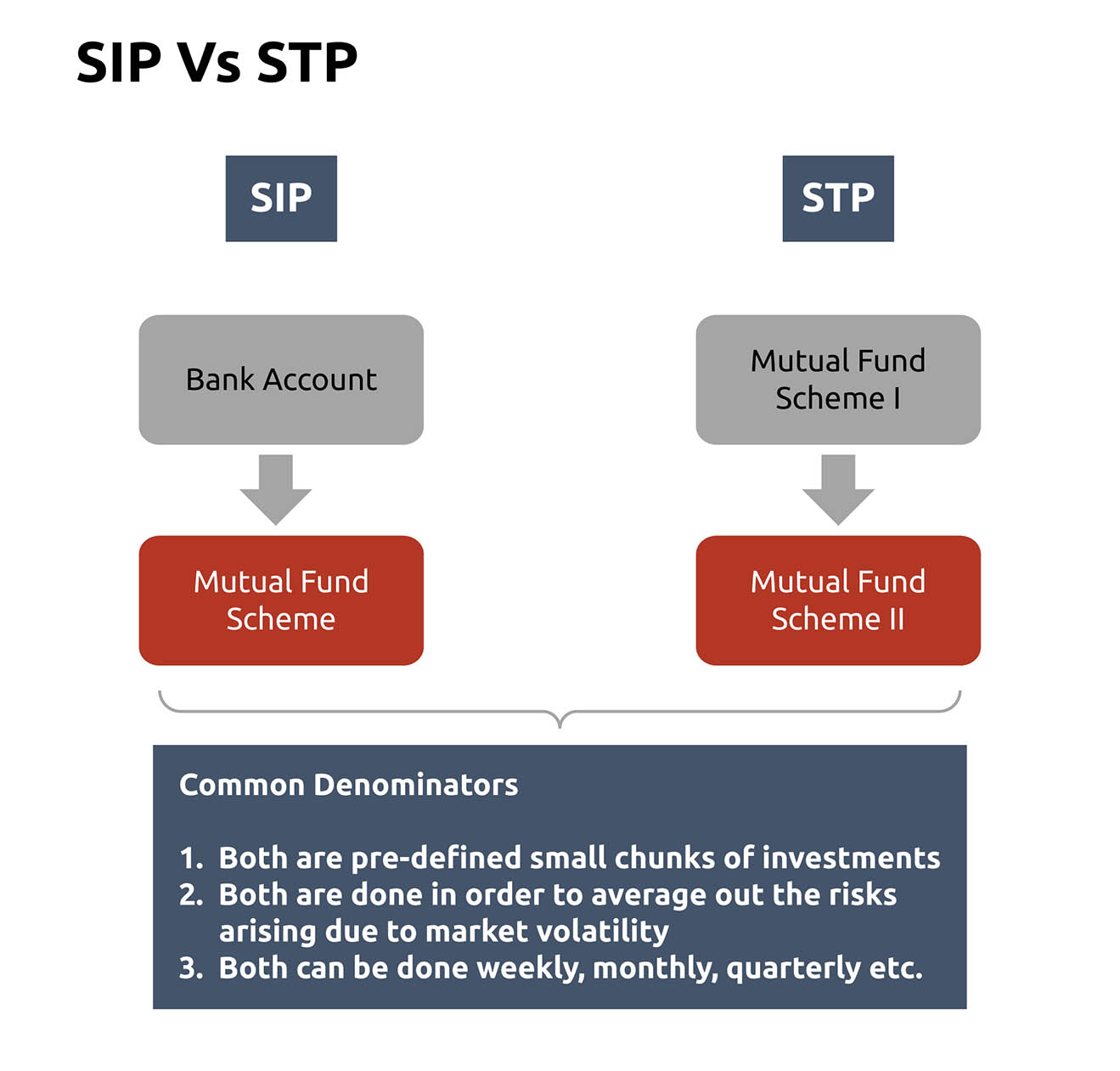

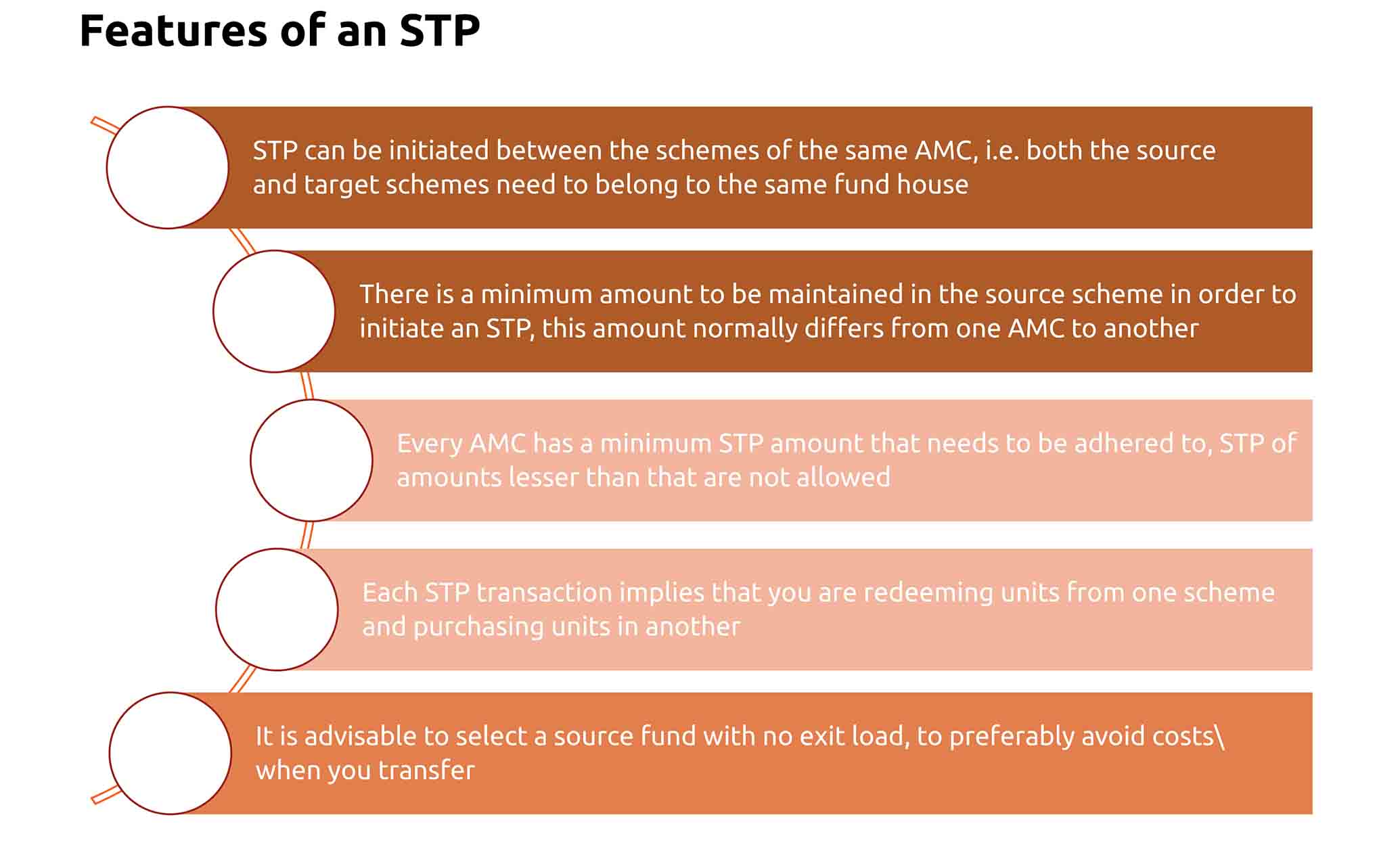

STP is a way of transferring money from one mutual fund scheme to another scheme of the same fund house at pre-defined intervals. It is usually opted for when you have a lump sum amount to invest but do not wish to invest it all at one go in a particular scheme, for averaging out your risks.

For example, assume that Zoya, an employee who is a part of the corporate workforce, has a SIP of Rs 10,000 per month in an equity scheme. It works for Zoya because her income is fixed and regular, and she has decided to allocate a certain % of that income to

mutual fund investment via SIPs. There can be two situations when Zoya might have to rethink this strategy-

1. She gets a performance or festival bonus from her company which is a lump sum amount

2. She quits her job and starts a business of her own, with her income becoming irregular and in lump sum spurts. Therefore, a fixed Rs 10,000

SIP may not be possible every month

Here’s where STP comes into play. Zoya may invest this lump sum amount in a liquid fund and initiate an STP from the liquid fund (source scheme) to the equity fund (target scheme) of her choice. For e.g. if the amount was Rs 2,00,000, Zoya can initiate a monthly STP of Rs 20,000 and invest the money in 10 months or can choose any other amount and frequency.

STP can be done from open-ended schemes (Source scheme) to another open ended scheme (Target scheme), depending on your financial goals

Types of STP:

Fixed STP: As the name suggests, a fixed STP is one in which the amount of STP and the frequency of STP are fixed.

Flexi STP: Under a flexi STP, you can choose different amounts to transfer from source to the target scheme, perhaps depending on the market conditions.

Capital Appreciation: Capital appreciation STP is when you transfer only the appreciated amountearned from the source scheme to the target scheme

How Is STP beneficial for a mutual fund investor?

The approach of spreading your investment over a period of time in equity markets may help an investor average out costs; an STP provides you this benefit. However, whether and when one can opt for an STP depends on his investment objectives. For example, if your investment horizon is 10-15 years, you can still consider making a lumpsum investment because your costs may get averaged out in this horizon.But, if your investment horizon is around 5 years, an STP may make more sensesince the peaks and lows of the market may be felt more in a short-term investment.

Having said that, you may want to contact your financial advisor for any investment-related decisions.