Financial Term of the week- Coupon Rate

When a company needs capital to, say, expand its business, it can either sell its own shares to the public and raise money; or it can issue bonds. If you have purchased a bond from a company, that means you are the lender, and the company has borrowed the money from you. Now, what’s in it for you? When you purchase a bond from a company, it comes with a commitment of a fixed interest rate that will be paid to you annually/semi-annually or at maturity. This is your earning in this transaction. This interest is called the coupon rate and is expressed as a percentage of the face value of the bond.

When a company issues a bond, it specifies certain things clearly, out of which the three important ones are-

- Face value

- Coupon rate

- Maturity

If you buy 100 bonds of a company at Rs 200 per bond, then Rs 200 is the face value, and your principal amount of investment is Rs 20,000. If the company has declared interest of 10% annually, then this becomes the coupon rate. This means that 10% of Rs 20000, i.e. Rs 2000, is the amount you will earn annually. Further, if the maturity of the bond is 5 years, this would mean that you will get Rs 2000 per year for 5 years and at the end of 5 years, you will get your principal amount of Rs 20,000 back.

Please note that apart from various companies, the Government can also issue bonds to the public at large in order to raise capital.

What are zero-coupon bonds?

Now, it is not always necessary that the company issuing the bond will pay an annual interest to the investor. Zero-coupon bonds or discount bonds are the ones that do not provide any annual interest to the bondholder till the maturity. Instead, they get a discount on the face value at the time of buying. Their profit comes from the difference between their buying price and the actual face value of the bond that is returned to them at maturity.

What should debt mutual fund investors know about coupon rates?

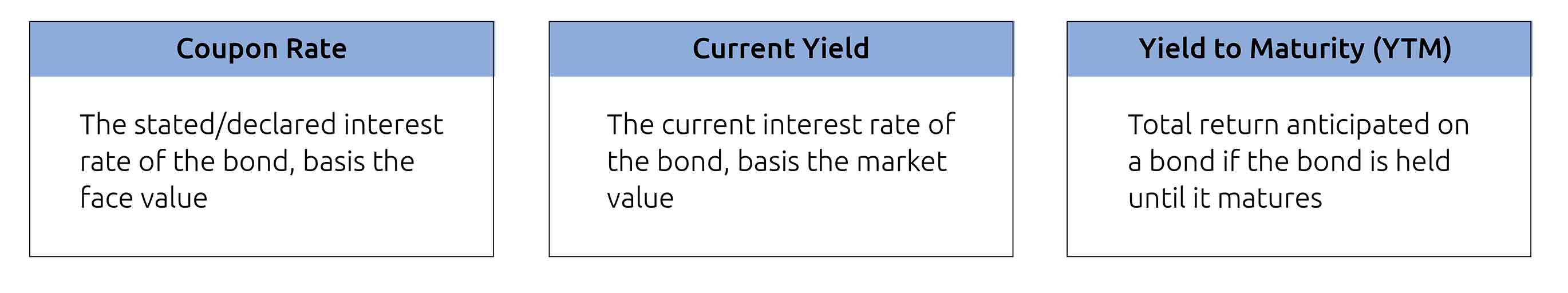

Debt mutual funds invest in bonds from various companies and actively manage the portfolio of these bonds. What you, as a debt fund investor, must know is the difference between the coupon rate and yield of the fund. Yields can be measured in multiple ways, out of which 3 most common measures are-

If there are no changes in the market price of the bonds, interest rates or other external factors that affect a bond’s price, the coupon rate and the current yield will be the same as the YTM. Having said that, the face value of the bond in the above example is Rs 200, but the market price of the bond may fluctuate because of rise and fall of the interest rates in the economy, credit risks, demand for the bond, etc.

Hence, the current yield is the return at any given time, basis the prevailing market price of the bond. When a bond is purchased at face value, the current yield is the same as the coupon rate, which in turn is the same as the YTM. But as the market conditions change, the three begin to differ. Let us understand with an example.

If a bond has a face value of Rs 1000 and a coupon rate of 6%, this means that if you buy this and hold it till maturity, you will get Rs 60 per year. Here, 6% is the coupon rate. This is true if you buy the bond at face value. Now, what if you buy it at a discount, i.e. Rs 950? In this case the yield becomes, Rs 60/Rs 950= 6.31%. Now, this 6.31% is the current yield of the bond and depends on the market value of the bond at which it is being traded. Yield to Maturity (YTM) is the interest rate derived on the summation of the annual yields and the yields generated because of discounted buying of bonds. You can read more about it

here.

In conclusion-

If you are a long-term investor in a debt fund who does not wish to trade his/her bonds before maturity, you can only keep your concern limited to the coupon rates because that is what you are going to earn till maturity. But if you are not a long-term investor, then the market yield may affect the returns.