Will Global Markets Recover soon? Key learnings for investors from the 2008 recession.

India and the world are not unfamiliar to a global market downturn. It has happened before, and the 2008 recession is a relatable example. While the reasons back then were different from what we are facing now, the result is not completely out of context.

Since the time the IMF (International Monetary Fund) forecasted a global recession as a consequence of the COVID-19 pandemic, questions have been raised. The world wants to know when this global financial downturn will end.

But, to understand global-market recovery, one needs to understand and evaluate certain factors.

What is the current situation?

The IMF's World Economic Outlook Update dated June 2020, projected a sharp contraction of 4.5% for the Indian economy in 2020. The reason for which being the unprecedented coronavirus pandemic that has nearly stalled all economic activities.

With this current situation, there are talks about the country being in a period of recession.

What happens in a recession?

During a recession, economic growth is negatively impacted. This leads to a decline in the GDP, a fall in average incomes and a rise in unemployment.

Is India facing an economic recession?

Addressing the elephant in the room, India has never faced such a sustained long-term downturn in economic activity. The country might be looking at an economic depression for the very first time.(Opinion published in the National Herald India, dated 21st June 2020)

However, the 2008 crisis was also the first of its kind for the nation and India sailed through without barely skipping a beat. The country fared better compared to many other nations in the developing world.

Even though India’s recovery from the 2008 recession offers hope, a dire wait for a recovery from the COVID-19 impact is still alive across the country.

When will we recover fromthe currenteconomic situation? Let’s find out.

How long does a recession last?

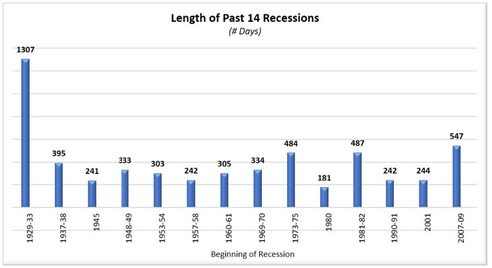

If we look at the past 14 recessions, they have lasted for an average of 1.1 years. The longest being about 3.5 years (the great depression of 1929) and the shortest was six months (the recession of 1980).

Will the Global Markets recover anytime soon?

While answering this question can be a bit tricky, one thing’s for sure - an economic recovery has never happened overnight.

Recessions have generally been followed by periods of expansion. These periods of expansions have varied over the years, ranging from about a year after the 1980 recession to nearly ten years after the 1991 recession. On average, an expansion period lasts around four years. While past events can be referred to for making predictions, they cannot always be considered as an accurate forecast forthe days to come.

The time taken to recover from a global recession will depend on the type of recovery pattern

Types of recovery

Recovery from recessions has a certain pattern to it, depending upon how the global economy bounces back. Usually, it follows one of the following growth curves:

-

V-shaped:This is fast and sharp. In this case, there is a quick decline in the economy, which is followed by an equally sharp recovery.

-

U-shaped:Here, the economy experiences a sharp fall into a recession but the recovery is slower.

-

W-shaped:In this case, it seems like the economy is undergoing a V-shaped recovery when it plunges into another, usually smaller, decrease before fully recovering.

-

L-shaped:This involves a fall in growth, followed by a very slow return to normal.

-

Swoosh–shaped:Here, a steep decline is followed by an initially slow, yet steady return to normal.

Why isthe study of 2008 recession important for investors?

The 2008 financial crisis did not only batter and bruise stock markets, but it also brought the global economy down to its knees. With the COVID-19 pandemic still raging on with no end in sight, India and the entire world could be staring at yet another economic crisis. However, the lessons learnt from the 2007-2008 crisiscould help prepare us to handle the current crisis.

Here are five lessons we’ve learnt the hard way, thanks to the 2008 economic crisis.

Lesson 1: Diversifyingour portfolio

Diversifying portfolios by purchasing stocks across different industries and sectors can help reduce risk.One can go for

mutual funds as an investment option to diversify their portfolio.

Lesson 2: Investing via Systematic Investment Plan (SIP)

One major lesson investors learnt duringthe 2008 economic crisis was how systematic investments were much better at keeping investment losses to a minimum. This is because

aSystematic Investment Plan (SIP) utilizes the principle of rupee cost averaging to reduce the negative impact on investments from stock market crashes.

Lesson 3: Being patient

The economic crisis of 2008 caused a massive sell-off in the stock market. This led to a large number of investors suffering massive losses. When faced with a global economic crisis, one should, therefore, stay patient instead of giving into the pressure of selling their investments. There’s always a likelihood of investments gaining in value in the future.

Lesson 4: Looking past the equity market

An investment portfolio incorporating multiple asset classes is more likely to survive a financial crisis.While equities may offer a good return on investment, there are other avenues as well. One can opt for bonds, debt instruments, other government securities and gold.

Lesson 5: Being prepared

During 2007-2008, many small-time investors made a costly mistake by not having an adequate emergency fund to fall back on. Also, due to the COVID-19 pandemic, the current employment rate in India is being impacted. Emergency funds help investors tide through difficult periods such as the one faced by the globe right now.

There’s no telling when we can see the global markets picking up again. It may also seem impossible to remain financially unscathed by the impact of COVID-19. The best we can do right now is be better prepared for tomorrow,armed with the learnings of the 2007-2008 recession.

References :

https://www.imf.org/en/Publications/WEO/Issues/2020/01/20/weo-update-january2020

https://timesofindia.indiatimes.com/business/india-business/gdp-growth-falls-to-5-8-in-january-march-quarter-slowest-in-five-years/articleshow/69598816.cms

https://www.forbes.com/sites/mikepatton/2020/04/30/what-the-past-90-years-has-taught-us-about-recessions-and-stock-behavior/#10328ed92ddf

https://www.nationalheraldindia.com/opinion/economists-now-say-future-bleaker-than-ever

https://economictimes.indiatimes.com/opinion/et-commentary/2008-crisis-a-wake-up-call-for-india/articleshow/6000712.cms

https://www.ig.com/au/trading-strategies/what-is-an-economic-recovery-and-what-are-the-types-200612#types-of-recession-and-economic-recovery

https://www.imf.org/en/Publications/WEO/Issues/2020/06/24/WEOUpdateJune2020

https://www.thehindu.com/business/Economy/imf-projects-sharp-contraction-of-45-in-indian-economy-in-2020/article31907715.ece

The views contained herein are not to be taken as an advice or recommendation to buy or sell any investment or interest thereto. Diversification does not guarantee investment returns and does not eliminate the risk of loss. They are considered to be reliable at the time of writing, may not necessarily be all-inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance may or may not be sustained in future. The views and strategies described may not be suitable for all investors. Furthermore, whilst it is the intention to achieve the investment objective of the investment product(s), there can be no assurance that those objectives will be met. Investors are advised to consult their Investment advisors for determining their risk appetite and Tax Advisor before taking any investment decision. The data/statistics/ comments are given to explain market trends, it should not be construed as any research report/research recommendation.