Inflation - Meaning, Types, Causes and How To Calculate Inflation

Let us see how the cost of some of the goods has changed over the last decades

|

Item in %

|

M-o-M

|

Y-o-Y

|

|

Onions

|

12.3

|

23.2

|

|

Tomatoes

|

-21.7

|

180.3

|

|

Atta

|

1

|

9.3

|

|

Rice

|

1.8

|

12.5

|

|

Dals

|

1.5

|

13

|

|

Chicken

|

-3.1

|

5.1

|

As you can see, the cost of the same commodity has increased manifold by Year-on-Year In other words, the value of money has decreased. This increase in the cost of the goods and services, resulting in a decline in purchasing power, is called inflation. It is not the increase in the cost of any one item or service but is the overall increase in the purchasing price.

Inflation can happen for a variety of reasons, such as an increase in demand, a decrease in supply, an increase in the cost of manufacturing of goods, increase in disposable income, and many more such reasons.

What does it mean for you ?

As per the basic Inflation definition, it indicates the sustained increase in the price level of goods/services over a period in an economy. It is one of the key indicators of the overall economic stability of a country and is typically expressed as a percentage increase over a specific period.

Inflation results from the increased demand for goods and services beyond their supply, thereby leading to upward pressure on their prices. A moderate inflation rate is considered healthy for an economy as it encourages spending and investment, which further promotes economic growth. However, high inflation scenarios where prices rise rapidly and uncontrollably can erode the purchasing power of the rupee and disrupt financial stability.

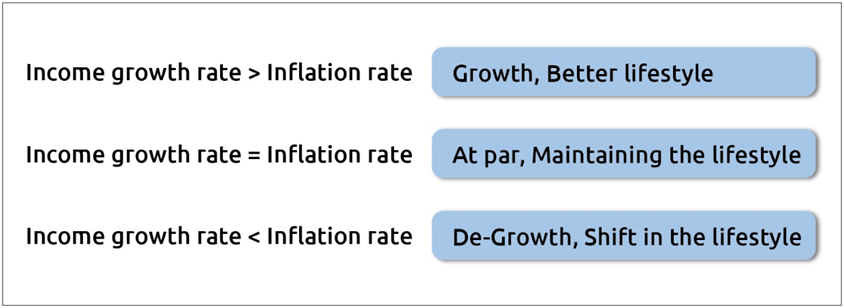

Since inflation is basically an increase in the cost, it implies that what you can buy today, you may not be able to buy a few years down the line, for the same cost. This applies to something as small as a packet of biscuit to bigger things like your house. Therefore, to be able to maintain the same lifestyle, it becomes imperative that your income and capital gains grow at a pace faster than the inflation rate or at least at par with it.

As implied above, if your income cannot keep pace with the inflation, you will have to make changes in your lifestyle to keep the spending constant.

Types of Inflation

In general, there are three types of inflation, as defined below:

1. Demand-pull inflation

Demand-pull inflation is the one when the demand for goods/services exceeds the available supply in an economy. In general, price appreciation arises from the gap between supply and demand after a shortage occurs due to limited supply.

This type of inflation can also be the result of increased consumer spending. When consumers have more disposable income due to rising wages or government stimulus, they tend to buy more goods/services. This surge in demand can lead to price increases as businesses try to capitalise on heightened consumer interest.

2. Cost-push inflation

Cost-push inflation is when the costs associated with producing goods and services increase. It causes the businesses/producers to pass those higher costs on to consumers. From the business perspective, the price increase is generally done to maintain profitability.

For example - as the cost of chicken consistently rises, your preferred restaurant may eventually find it necessary to increase the price of chicken sandwiches on their menu.

3. Built-in inflation

This type of inflation results from the expectation of future inflation and works in the form of a cycle. It starts from the rise in prices of products or services, which leads to higher wages to accommodate the resulting cost of living. The increased wages again increase the production cost, which in turn leads to a further rise in product prices.

Causes of Inflation

1. Increased demand on the consumer side

When consumers have more money to spend, they tend to purchase more goods/services. The changing consumer behaviour and the high demand allow businesses to benefit more by increasing product pricing.

2. Rising production costs

When the costs associated with producing goods/services increase, businesses tend to pass the corresponding rise in expenses onto consumers through elevated prices. Factors contributing to rising production costs may include increased labour costs, raw material prices, or supply chain disruptions.

3. Government policies

Government actions, including changes in taxation, subsidies, or various monetary policies, can influence inflation. For example, if the government reduces interest rates to stimulate economic activity, it can contribute to inflationary pressures. Similarly, an excess supply of money in the market can also lead to inflation and reduced value of the Indian currency.

4. Global factors

Events on the international stage, such as changes in exchange rates, global supply chain disruptions, or fluctuations in commodity prices, can also impact inflation meaning in a domestic economy. These factors can affect the cost of imported goods and raw materials, which in turn influence the overall price levels.

5. Changes in the exchange rate

Dollar value is considered the reference point for exposure to various foreign markets. Any change in the currency exchange rate can impact the inflation rate within a specific geographical region.

Types of Price Indices

1. Consumer Price Index (CPI)

CPI is a widely used measure that tracks the changes in the average prices paid by consumers for a basket of goods and services over time. It provides insights into the inflation experienced by the average household. The CPI includes a diverse range of items such as food, housing, clothing, transportation, healthcare, and entertainment. By monitoring price changes for these goods and services, the CPI helps individuals, businesses, and policymakers understand the impact of inflation on consumers' purchasing power.

2. Producer Price Index (PPI)

It is a type of price index that measures the change in prices (on average) that domestic producers receive for their output. Producer and consumer prices usually move together because when prices go up or down for producers, they tend to do the same for consumers, and the other way around.

3. Wholesale Price Index (WPI)

WPI is a price index that tracks changes in the prices of goods within an economy at the wholesale level. It primarily measures price fluctuations for goods traded among businesses before they reach consumers. This index encompasses a broad range of products, including raw materials, industrial inputs, and finished goods. It serves as a useful tool for businesses and policymakers to monitor inflation trends in the early stages of the supply chain.

4. GDP Deflator

GDP Deflator or Implicit Price Deflator measures the price of all domestically produced goods and services in an economy in a specific base year in relation to their real value.

How to Calculate Inflation?

While the inflation meaning is generally understood as a price hike, it is calculated in terms of CPI using the following formula:

Rate of Inflation = {Final CPI - Initial CPI)/Initial CPI}x100

Besides this, you can also use an online inflation calculator to get an estimate of how much money you need to invest amidst changing inflation and interest rates for financial planning.

Advantages of Inflation

Inflation, which is often viewed negatively, has various advantages, provided it stays within reasonable bounds. These include:

1. Stimulated spending and investment

Mild inflation can encourage consumers and businesses to spend and invest rather than hoard money. When people expect prices to rise, they are more inclined to make purchases and invest their funds, which can stimulate economic growth.

2. Debt relief

Inflation can effectively reduce the real value of debt. Borrowers may find it easier to repay loans with money that will be worth less in the future. This can provide a form of relief to both individuals and businesses carrying debt.

3. Higher lending

Financial institutions are more inclined to lend money during periods of moderate inflation. This can enhance access to credit and foster business expansion.

4. Wage adjustments

Inflation can lead to nominal wage increases. When wages keep pace with or exceed the rate of inflation, it can improve the standard of living for workers.

5. Higher inclination toward investments

Investors may turn to assets like stocks, mutual funds, and others to preserve the value of their wealth in the face of inflation. This can drive up the prices of these assets and potentially benefit them in the long run.

Disadvantages of Inflation

Here are some notable drawbacks associated with inflation:

1. Reduced purchasing power

As prices rise, the purchasing power of money diminishes. This means that consumers can buy less with the same amount of money. This can lead to a decline in their standard of living.

2. Financial planning difficulty

Elevated or erratic inflation creates uncertainty in the economy. Consumers may find it challenging to plan for the future, make long-term investments, or buy things they need while worrying that they cannot predict future costs accurately.

3. Savings erosion

Individuals living on fixed incomes, such as retirees or pensioners, may struggle to keep up with the rising cost of living. Additionally, savings held in accounts with interest rates lower than the inflation rate can lose real value over time.

How do you plan your investments with inflation in mind?

Let’s break it down. You invest your money for it to grow and possibly get you capital gains which in turn may help you achieve the goal in time. For example, if you are saving for your child’s higher education, you’d want to accumulate a certain amount by the time he/she is 17, so that the investment can pay for his/her admission. Keep in mind is that if the course in question costs you, say, Rs 10 Lakh today, it may not cost you the same at the time of admission, because of inflation. Hence, you can invest for the inflated cost and not the present cost.

Assuming an inflation rate of 6% per year and the age of your child to be 3 years, you have 14 years till college. Now, a course that costs Rs 10 Lakh today, at the said inflation rate will cost Rs 22.6 Lakh. Let us assume that you choose the systematic investment plan (SIP) , SIP allows you to invest in a small amount regularly in your preferred mutual fund scheme. This SIP mode of investment has a hypothetical

CAGR

of 10%. Now, to achieve Rs 10 Lakh you would have had to save ~Rs 2800 per month for 14 years; but because of the inflation, you’d have to invest ~Rs 6200 per month to achieve the inflation-adjusted target.

Thus, it is essential to plan your investments in such a way that the inflation-adjusted returns can help you achieve your goals accurately. Here, is where portfolio diversification and asset allocation come into play, so that your risks are spread out, and so are your returns.

(Past performance may or may not sustain in the future and the same may not necessarily provide the basis for comparison with other investment)

How Does Inflation Impact Mutual Fund Investments?

Inflation can affect mutual fund investments. First and foremost, it can reduce the overall returns investors receive. When mutual fund returns fail to outpace inflation, investors may experience a decrease in their purchasing power over time. This underscores the importance of seeking investments that can provide returns exceeding the inflation rate. Here’s what can happen to your investments in different mutual fund schemes in relation to inflation:

• Inflation can reduce the purchasing power of returns from your investments and lead to a decline in inflation-adjusted returns.

• Rising inflation can negatively impact bond funds as it diminishes the value of fixed interest payments. This can result in capital losses for the investors.

Besides knowing how inflation impacts your investments, you should also know what to do about it. These include considering:

• Equity fund’s potential

Equity mutual funds may provide some protection against inflation as stocks have the potential to outpace inflation over the long term. You can choose to include equity funds in your portfolio to benefit this way.

• Sectoral variance

Different sectors respond differently to inflation. This is why you can diversify across sectors to hedge against inflation's impact.

Conclusion

Inflation can pose challenges to mutual fund investments. Still, as an investor, you can mitigate its impact through strategic asset allocation and diversification, both of which are crucial ways to preserve and grow wealth in the face of rising prices.