Financial Term of the week- Interest Rate Risk (IRR)

When you invest in debt mutual fund schemes, you indirectly invest in the debt instruments or bonds that have a fixed maturity period. For example, assume that you have invested Rs 10,000 in a bond with a maturity of 10 years and at an interest

rate of 10% every year or as per the payment terms. This implies that at the end of 10 years, you will get the money back and interest @ 10%. But what if you want to buy or sell a bond before you reach the maturity date? These bonds are traded

in the secondary bond market, and the profit/loss depends on the prevailing interest rates. This is where the interest rate risk comes into the picture.

What is the interest rate risk?

Interest rate risk is the fluctuation in the price of the bond due to the varying interest rate in the bond market. The two are negatively correlated, which implies when the interest rate increases, the bond price decreases and vice versa.

Think of a seesaw with the interest rate on one side and the bond price on the other. When one goes up, the other comes down and the same principles holds when you inverse the two parameters on the seesaw. Also, the length of the seesaw can be

the bond’s maturity period. The longer the length, the more the prices will be impacted by a change in the interest rates, whereas, if the length is shorter, the price will be relatively stable. Hence, the impact of interest rate fluctuation

on price is greater if the maturity period is longer and is lesser for short-term bonds with lower maturity periods.

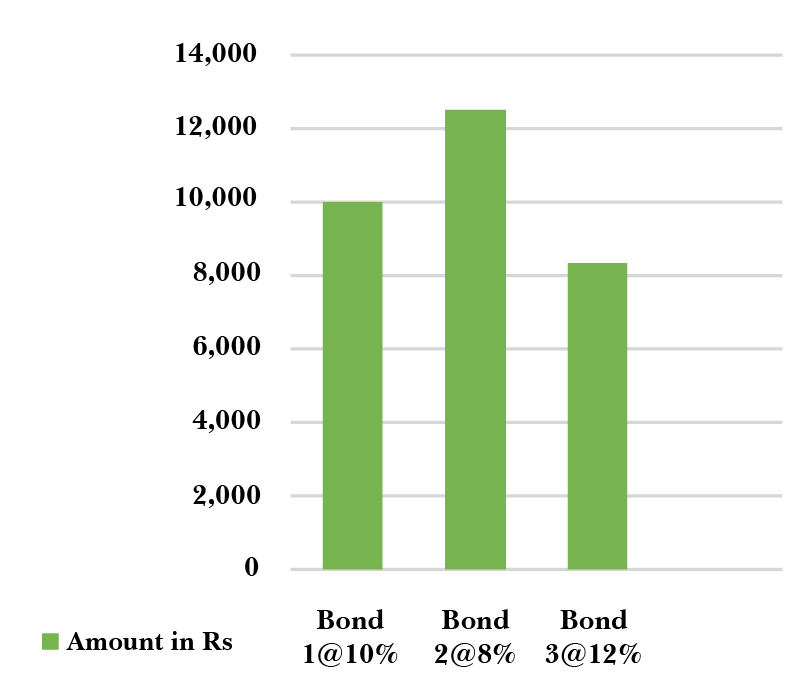

Let us take the abovesaid example further and see how the bond prices fluctuate as the interest rate says-

In the first scenario, let us assume you bought Bond 1 at Rs 10,000 with a maturity of 10 years and at an interest of 10%. You earn Rs 1000 per year.

You don’t have to worry, your investment has been locked-in at 10%, if you do not redeem it before maturity. Now suppose the interest rate for bonds drops to 8% and you want to invest in Bond 2 that has the same maturity of 10 years. To ensure

that, you earn Rs 1000 per year, your total investment will have to be, Rs 1000/8%= Rs 12,500, which is Rs 2500 higher than what you paid for Bond 1. This also implies that if you were to sell your bond at an interest rate of 8%, you would

earn a profit of Rs 2500.

As you can see, when the interest rate decreased from 10% to 8%, the bond value increased and similarly, when it increased from 10% to 12%, the bond value decreased. If you are an investor who likes to trade in the bonds/mutual fund scheme units,

then this interest rate risk that your bond price is being exposed to, may be of concern.

In conclusion-

The relatively safer decision to make may be to check the maturity of bonds that your mutual fund scheme invests in and stay invested till the end of the bond maturity period to ensure that you minimize the fluctuation in the per unit cost of the scheme i.e. Net Asset Value (NAV). This may keep you safe from the interest rate risk cycles. Another way to hedge this risk is to diversify the type of debt mutual fund schemes you are

investing and keep a healthy mix of short-term and long-term securities.