What is PE Ratio? Meaning, Interpretation & Significance of PE Ratio

Let us understand the concept of P/E ratio with a simple example. Hypothetically, assume that you have gone out for grocery shopping, are hunting for mangoes, and you get the below options-

Shop B: Rs 550 per kg, very juicy and fresh

Similar is the case with P/E ratio. Let us understand in detail.

What is P/E ratio?

Applied mostly when investing in direct shares, P/E ratio defines the amount of money an investor is ready to pay to gather 1 Re of the share’s earnings.

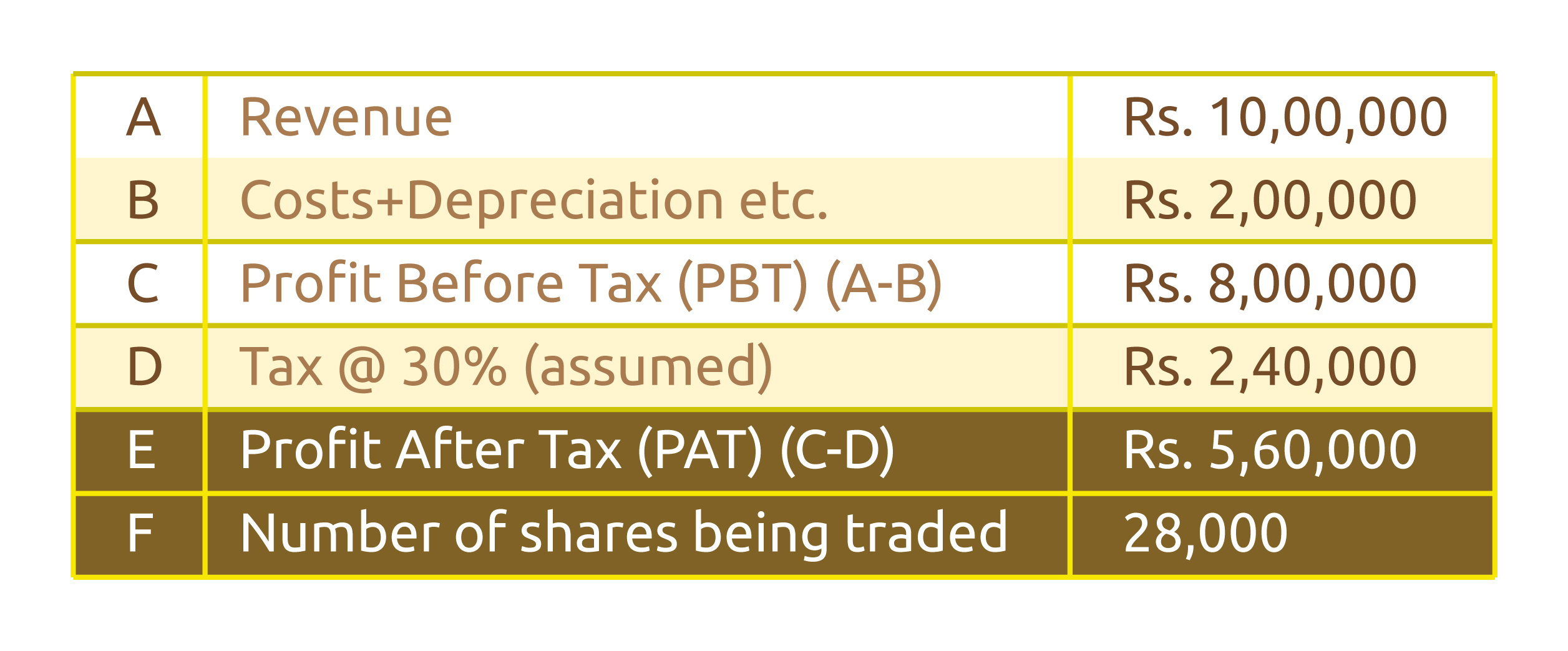

Let us see how EPS is calculated and what is its significance. Consider a company A with the financial numbers-

For the above example,

EPS becomes Rs 5,60,000/28,000= Rs 20. This means that for this organization, each share is earning Rs 20.

Now, let us assume that the market price of this company’s share is Rs 800 per share.

Hence, the P/E ratio becomes

Rs 800/ Rs 20 = 40.

In other words, an investor who has bought this company’s shares is ready to pay 40 times of what each share is earning, OR to earn Re 1 of the company’s earnings, an investor is ready to pay Rs 40.

How do we interpret P/E ratio?

Let’s look at what a P/E ratio of 40 might mean. Is it good, or is it bad? In isolation, a P/E ratio, as in case of our examples of mangoes, does not mean much. It is because just like the value offered along with the mangoes, we don’t know whether the value of 40 is good for us or not. We can determine this only with reference to another P/E ratio, of probably a competitor company B or of the industry itself.

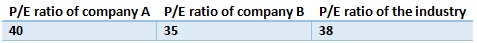

Considering the same example-

Now, the P/E ratio is starting to make sense. We see that the P/E ratio of company A is higher than that of company B and that of the industry, and, that the P/E ratio of company B is lower than that of the industry P/E. Remember, if company A is an apparel-manufacturing company, then company B considered for comparison also needs to be in the same domain; otherwise, the comparison may mean nothing.

Does that mean that company B is cheaper than company A and must be invested in? Maybe, maybe not. You see, if an investor is ready to pay more for company A’s shares and pay less for company B’s shares, it can be for any one or two or all the reasons mentioned below.

Hence, if the P/E ratio was the sole criterion for you to decide which company’s share to buy, then clearly, company B’s share is cheaper than company A. But it is not. There are a variety of factors that are taken under consideration when deciding which company’s shares are to be bought, and P/E ratio is only one of the factors considered. It is advisable to consult your

financial advisor before making such decisions.

What is the significance of the P/E ratio for mutual funds investment?

As said earlier, P/E ratios are more effective when investing in direct equity, but that does not mean a

mutual fund scheme’s P/E is of no significance. An equity scheme is a collection of shares, and hence, the scheme’s P/E is the weighted average of P/E of the shares in the scheme considered in proportion to the allocation of shares in the scheme.

A mutual fund scheme’s higher P/E may imply that the fund manager has a more growth-oriented approach, higher P/E ratio can also indicate overvaluation in some cases. A lower P/E may imply a value-based approach. Lower P/E schemes may be more suitable for longer investing periods and value-conscious investors.

But again, it is advised not to consider the P/E ratio of any scheme in isolation or as a standalone while deciding where to invest. You would not want to go home with a batch of mangoes which looks cheaper at the onset but is largely inedible! The value attached with the P/E ratio, similarly, is largely relative and is advised to be considered likewise.