Understanding Standard Deviation in Mutual Fund - Formula & Returns

In life, there is a certain risk in everything you do. For example, if you are ready to go bungee-jumping, it implies that you are a person with a relatively higher risk appetite than the rest. But just because you are willing to take risks, does

not imply that you will not calculate for extreme situations and how often they can occur. To ensure that you are in safe hands, you will want to know if there have been any accidents or how many jumping attempts have been successful. This

is because, even as a high risk-taker, you need to know the extent of the risk you are undertaking. In financial investments, this extent of risk or fluctuation in returns may be a deciding factor in whether you want to invest in a particular

investment vehicle. And this fluctuation in returns is mathematically calculated by Standard Deviation (SD).

SD is a number associated with each mutual fund scheme or any other kind of investment, that tells you how much your returns from that scheme have deviated from the average returns.

Understanding Standard Deviation

The annual returns garnered by a mutual fund scheme is a decisive factor in investment decisions, but these returns do not remain consistent

owing to the market volatility. SD can help you gauge the risk involved; in other words, how much above or below the average can the returns go.

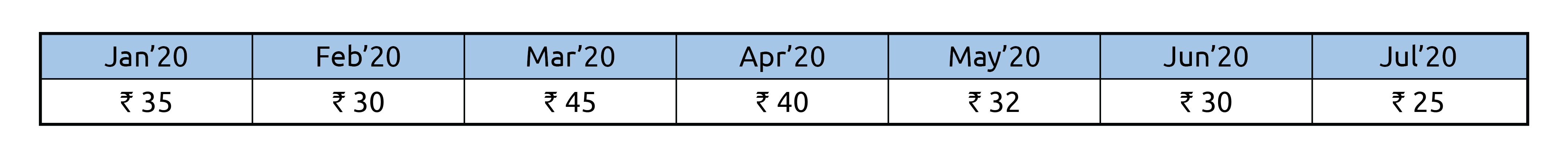

Let us see an example. Assume you track the per kg prices of onions every month for 6 months, here are the records-

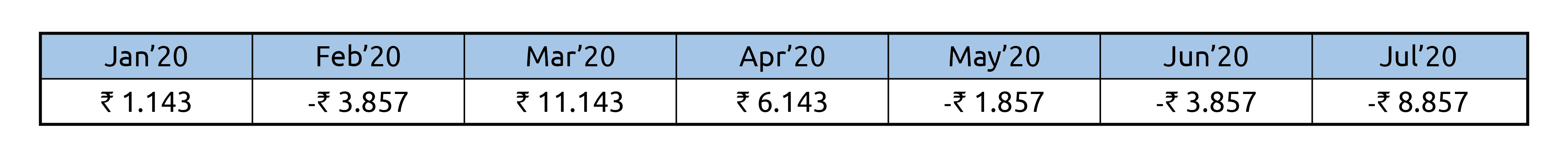

Going by the above table, the average per kg onion price has been Rs 33.8571. Now let us see how much this price fluctuated from the average price on any given month-

The average variation from the average price equals to Rs 6.266. This implies that, most of the times, the price will not fluctuate more than Rs 6.266 either more or less than Rs 33.8571. This value of 6.266 is known as the Standard Deviation

and can be applied on returns as well.

As an investor, you may know that an equity scheme may have more risks when compared to a debt scheme. But how much fluctuation are you comfortable with? If the average annual returns of the equity scheme are, say, 15% and the standard deviation

is 12, your returns can go as low as 3% or as high as 27%.

ABOVE ILLUSTRATIONS ARE ONLY FOR UNDERSTANDING, IT IS NOT DIRECTLY OR INDIRECTLY RELATED TO THE PERFORMANCE OF ANY SCHEME OF Nippon India Mutual Fund

Things to keep in mind-

- The low-risk mutual fund schemes, like the debt schemes, tend to have a lower SD as compared to equity schemes.

- A low or high SD does not make any scheme better unless it is used to compare two mutual fund schemes of the same category. For example, you can compare the SD of two large-cap equity schemes to decide between them, but you mustn’t compare

the SD of a debt scheme to a large-cap equity scheme.

- If the category itself is prone to higher fluctuation and hence, a higher SD - it does not mean the scheme is unstable or avoidable. Similarly, a debt scheme with a lower SD does not mean it is a good choice.

- The longer the investment period, the lower will be the SD as a longer time frame tends to reduce the volatility associated with the mutual fund investment.

In conclusion-

The SD of a mutual fund scheme may help you measure the risk of that scheme, but it is not intuitive, which means that it does not hold any importance when looked at standalone. It is a relative measure and must always be considered in relation

to other schemes. You can get in touch with your mutual fund distributor for more details.

THE VIEWS EXPRESSED HEREIN CONSTITUTE ONLY THE OPINIONS AND DO NOT CONSTITUTE ANY GUIDELINES OR RECOMMENDATION ON ANY COURSE OF ACTION TO BE FOLLOWED BY THE READER. THIS INFORMATION IS MEANT FOR GENERAL READING PURPOSES ONLY AND IS NOT MEANT TO

SERVE AS A PROFESSIONAL GUIDE FOR THE READERS.