What is Portfolio Turnover Ratio in Mutual Fund?

The Portfolio Turnover Ratio reflects the percentage of portfolio holdings that were changed/bought/sold/turned over in a year. If a fund has a portfolio turnover ratio of 25%, that would mean that 25% of its securities were sold/bought in the previous year. Thus, a higher portfolio turnover ratio implies that the fund manager is changing the holdings at a higher rate and vice versa.

For example, if your mutual fund scheme buys securities worth Rs 1000 Cr, and sells securities worth Rs 800 Cr in a year; then, provided that its average AUM was Rs 1200 Cr,

Portfolio Turnover Ratio= 800 Cr/1200 Cr %=

66.667%

The above example is for illustration purposes only.

Know more about the portfolio turnover ratio-

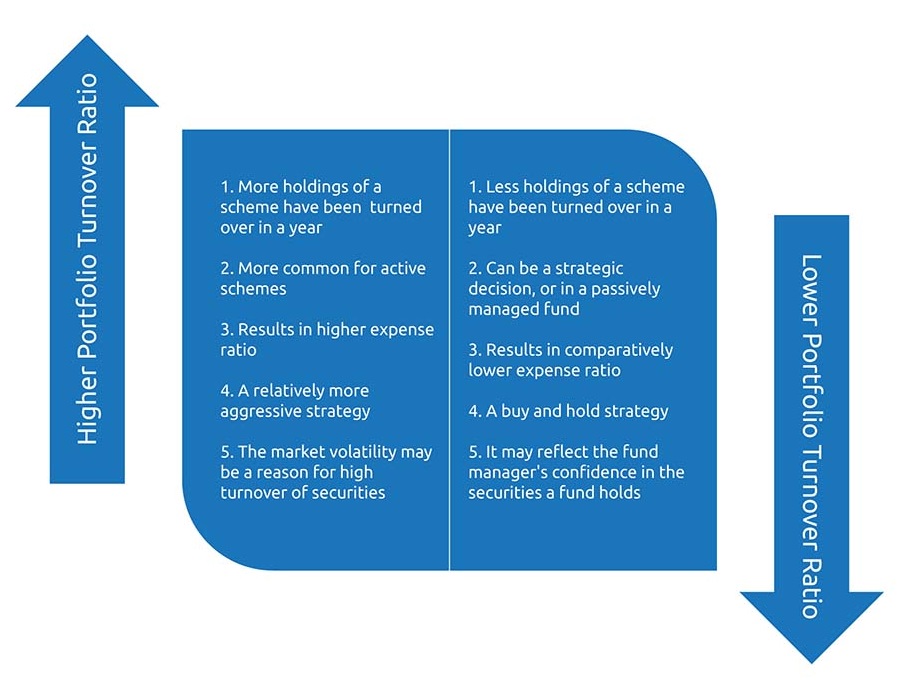

- An actively/aggressively managed mutual fund scheme, in all likelihood, will have a higher portfolio turnover ratio than a passively managed fund.

- A portfolio turnover ratio of 100% does not necessarily mean that all the securities in the fund have been bought/sold; rather, it only represents the % of holdings that have changed in any given year.

- A higher portfolio turnover ratio will imply more trading costs borne by the fund, thereby increasing the expense ratio and affecting the returns.

- The portfolio turnover ratio, ideally, should be used to compare any two funds in the same peer category and along with the other mutual fund analytics tools.

- A lower portfolio turnover ratio often is akin to the buy and hold strategy.

High Vs Low

How does the portfolio turnover ratio affect your investment decision?

It must not be assumed that a scheme with a higher portfolio turnover ratio is to be always avoided. Firstly, you may want to look at the risk-return reward as a result of the high portfolio turnover ratio. If it results in a relatively higher risk-adjusted return, then you may want to invest in that scheme. Secondly, the portfolio turnover ratio needs to be seen and compared in tandem with other tools used to measure a

mutual fund scheme performance, which is the measure of the return-producing ability of a fund per unit of the risk taken.

Consider an example-

Hypothetically, consider that fund A has a portfolio turnover ratio of 120% and a Sharpe ratio of 0.65 when the category Sharpe ratio average stands at 0.78.

A higher portfolio turnover ratio means that the securities are being turned over often, but the return generated per unit of risk by the fund is still lower than the category average. Thus, even after paying a high expense ratio for this scheme, it may not be tapping into the full return potential of the category. Hence, it may be advisable to reconsider your decision of investing in this fund. Having said that, if the scheme’s Sharpe ratio had been 1.05, that would imply that the return produced per unit of risk taken is relatively much higher and thus the higher expense ratio that you are paying may just be worth it.

In conclusion, there can be many factors like macroeconomic conditions, Government regulations, volatility in the market etc. that may result in a fund manager’s decision of higher turning of securities. Therefore, it may not be ideal to be judging a fund on the basis of its portfolio turnover ratio alone; rather, it can be used as one of the tools to shortlist the mutual fund schemes you wish to invest in.