একটি শ্রেণীকোঠায় সাধারণত সকল ধরনের শিক্ষার্থী থাকে. কিছু শিক্ষাবিদ ভাল কিন্তু খেলায় দুর্বল; কিছু স্পোর্টসে মজবুত কিন্তু অ্যাকাডেমিক্সে গড়. তারপর এমন কিছু লোক আছে যারা প্রত্যেকের বিশ্বাস সত্ত্বেও শিক্ষক এবং শ্রেণীকে তাদের গড় পারফর্মেন্সের সাথে আশ্চর্য করেন. ক্রেডিট রিস্ক ফান্ড হল সব ধরনের শিক্ষার্থী যাদের মধ্যে লুকানো আশ্চর্যজনক ফ্যাক্টর রয়েছে.

সুতরাং, আসুন প্রথমে ক্রেডিট রিস্ক ফান্ডটি বিস্তারিতভাবে বুঝে নিই.

ক্রেডিট রিস্ক ফান্ড কী?

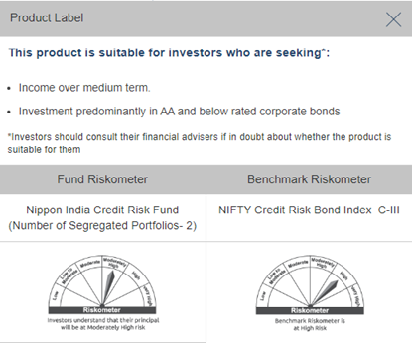

এএমএফআই-এর সংজ্ঞা অনুযায়ী, ক্রেডিট রিস্ক ফান্ড কর্পোরেট বন্ডের অন্তত 65% কর্পাস বিনিয়োগ করে যা সর্বোচ্চ রেটযুক্ত ইন্সট্রুমেন্টের নীচে রয়েছে. উদাহরণস্বরূপ, নিপ্পন ইন্ডিয়া ক্রেডিট রিস্ক ফান্ড (বিভাজিত পোর্টফোলিওর সংখ্যা- 2) হল একটি ডেট স্কিম যা মূলত এএ এবং নীচের রেটিংযুক্ত কর্পোরেট বন্ডে বিনিয়োগ করছে.

এখানে মনে রাখতে হবে এমন একটি গুরুত্বপূর্ণ বিষয় হল যে, যদিও ক্রেডিট রিস্ক ফান্ডে নির্দিষ্ট পরিমাণ ক্রেডিট রিস্ক থাকে, তবে এগুলির উচ্চ রিটার্নের সম্ভাবনা রয়েছে.

ক্রেডিট রিস্ক মিউচুয়াল ফান্ড কীভাবে কাজ করে?

সাধারণত, ডেট ফান্ড বন্ডে বিনিয়োগ করে, এবং প্রতিটি বন্ডকে ক্রেডিট কোয়ালিটির উপর ভিত্তি করে একটি ক্রেডিট রেটিং দেওয়া হয়. এই ঋণের মান আর্থিক শক্তি, প্রশাসন এবং ঋণের যোগ্যতার উপর ভিত্তি করে নির্ধারিত হয়, অর্থাৎ বন্ড ইস্যু করা কোম্পানির লোন পরিশোধ করার ক্ষমতা. এই উপাদানগুলি যত শক্তিশালী হবে, কোম্পানির ক্রেডিট কোয়ালিটি তত বেশি এবং এর দ্বারা বন্ডটি তত বেশি হবে. কর্পোরেট বন্ডের সর্বোচ্চ ক্রেডিট রেটিং হল AAA/A1+, তারপরে AA+, AA, A, BBB, BB+ এবং আরও অনেক কিছু.

ক্রেডিট রিস্ক ডেট ফান্ড হল এমন এক ধরনের ডেট মিউচুয়াল ফান্ড যা মূলত AA বা তার কম ক্রেডিট রেটিং সহ বন্ডে বিনিয়োগ করে. এর অর্থ হল ক্রেডিট-রিস্ক ফান্ডের আন্ডারলাইং সিকিউরিটি ইস্যু করা কোম্পানিগুলির উচ্চ-রেটেড বন্ডের তুলনায় অধিক ক্রেডিট রিস্ক থাকে. ফলস্বরূপ, তারা সংযুক্ত উচ্চ ঝুঁকির জন্য আরও ভাল রিটার্ন অফার করে. ক্রেডিট রিস্ক ফান্ডের ক্ষেত্রে উচ্চ রেটিংযুক্ত বন্ডে বিনিয়োগ করা অন্যান্য ডেট মিউচুয়াল ফান্ডের তুলনায় আরও ভাল রিটার্ন আয় করার সম্ভাবনা থাকে. ফান্ডের অন্তর্নিহিত সিকিউরিটিগুলি ভালভাবে পারফর্ম করার সময় এই ফান্ডগুলি ন্যায্যভাবে নিয়মিত ডিভিডেন্ড অফার করতে পারে. এগুলি আপনার ছোট থেকে মধ্যমেয়াদী আর্থিক লক্ষ্য অর্জনে সহায়তা করার জন্য সম্ভাবনা বহন করে.

ক্রেডিট রিস্ক ফান্ডে বিনিয়োগের সুবিধা

● ভাল রিটার্ন

ক্রেডিট রিস্ক ফান্ডের ক্ষেত্রে উচ্চ রেটিংযুক্ত বন্ডে বিনিয়োগ করা অন্যান্য ডেট মিউচুয়াল ফান্ডের তুলনায় আরও ভাল রিটার্ন আয় করার সম্ভাবনা থাকে. ফান্ডের অন্তর্নিহিত সিকিউরিটিগুলি ভালভাবে পারফর্ম করার সময় এই ফান্ডগুলি ন্যায্যভাবে নিয়মিত ডিভিডেন্ড অফার করতে পারে. এগুলি আপনার ছোট থেকে মধ্যমেয়াদী আর্থিক লক্ষ্য অর্জনে সহায়তা করার জন্য সম্ভাবনা বহন করে.

● করের সুবিধাগুলি

ক্রেডিট রিস্ক ফান্ড হল ডেট মিউচুয়াল ফান্ড, তাই সেগুলিতে আপনার ট্যাক্স স্ল্যাব অনুযায়ী ট্যাক্স ধার্য করা হয়.

ক্রেডিট রিস্ক ফান্ডে বিনিয়োগের অসুবিধা

● ক্রেডিট রিস্ক

সিকিউরিটিজ অ্যান্ড এক্সচেঞ্জ বোর্ড অফ ইন্ডিয়া (সেবি) নিয়মাবলী অনুযায়ী, ক্রেডিট রিস্ক ফান্ড কমপক্ষে এএ এবং নীচে রেট করা বন্ডগুলিতে সম্পদের 65% বিনিয়োগ করে. যেহেতু কোম্পানিগুলি তুলনামূলকভাবে বেশি ক্রেডিট ঝুঁকি নিয়ে থাকে, তাই এই স্কিমে আপনার বিনিয়োগ নির্দিষ্ট স্তরের ক্রেডিট ঝুঁকির সাপেক্ষে হয়.

● তুলনামূলকভাবে কম তরল

ক্রেডিট রিস্ক ডেট ফান্ডের আন্ডারলাইং বন্ডের ক্রেডিট কোয়ালিটির কারণে, এই বন্ডগুলি সহজেই মার্কেটে বিক্রি করা যাবে না. সুতরাং, ক্রেডিট রিস্ক ফান্ডের অন্যান্য ডেট ফান্ডের তুলনায় লিকুইডিটি লিমিটেশন থাকতে পারে, বিশেষত উচ্চ-ক্রেডিট-কোয়ালিটির পেপারে বিনিয়োগকারী.

ক্রেডিট রিস্ক মিউচুয়াল ফান্ডে কারা বিনিয়োগ করবেন?

● ফিক্সড-ইনকাম বিনিয়োগ থেকে আরও ভাল রিটার্ন খুঁজছেন এমন বিনিয়োগকারীরা

যদি আপনি বেশিরভাগ ফিক্সড-ইনকাম বিনিয়োগের তুলনায় তুলনামূলকভাবে ভাল রিটার্ন আয় করার লক্ষ্য রাখেন, তাহলে ক্রেডিট রিস্ক ফান্ড আপনার বিনিয়োগের উদ্দেশ্যে একটি ভাল পছন্দ হতে পারে.

● বিনিয়োগকারীদের উচ্চ ঝুঁকি নেওয়ার ক্ষমতা রয়েছে

যেহেতু ক্রেডিট রিস্ক ফান্ড তুলনামূলকভাবে ঝুঁকিপূর্ণ এবং অস্থির, তাই আপনার এই ধরনের ঝুঁকি সহন করার ক্ষমতা থাকলেই আপনাকে শুধুমাত্র সেগুলিতে বিনিয়োগ করতে হবে. যদি আপনি কম-ঝুঁকি এবং স্থিতিশীল ডেট স্কিমে বিনিয়োগ করতে চান, তাহলে ক্রেডিট-রিস্ক ফান্ডে বিনিয়োগ করা বুদ্ধিমানের কাজ নয়.

● একটি মাঝারি-মেয়াদী বিনিয়োগের পরিধি রয়েছে এমন বিনিয়োগকারীরা

যদি আপনার বিনিয়োগের পরিধি 2 থেকে 3 বছর পর্যন্ত হয়, তাহলে ক্রেডিট রিস্ক ফান্ড আপনার জন্য একটি উপযুক্ত বিকল্প হতে পারে. তবে, এটি বিবেচনা করছে যে আপনার কাছে উচ্চ ঝুঁকি সহনশীলতাও রয়েছে.

আপনি এখানে নিপ্পন ইন্ডিয়া ক্রেডিট রিস্ক ফান্ড (আলাদা পোর্টফোলিওর সংখ্যা- 2) দেখতে পারেন, এবং যদি আপনি উপরের মানদণ্ডগুলি পূরণ করেন, তাহলে আপনি মিনিটের মধ্যে বিনিয়োগ করতে পারেন!

ক্রেডিট রিস্ক ফান্ডে বিনিয়োগ করার আগে যে বিষয়গুলি বিবেচনা করতে হবে

● আন্ডারলাইং সিকিউরিটি ডিফল্ট ঝুঁকির সাপেক্ষে

আগে যেমন ব্যাখ্যা করা হয়েছে, বন্ড ইস্যু করা কোম্পানিগুলির ক্রেডিট যোগ্যতা (ক্রেডিট রিস্ক ফান্ডের) গড় বা কম. এর অর্থ হল এই কোম্পানিগুলি মূল পরিমাণ পরিশোধের জন্য ডিফল্ট করতে পারে. সুতরাং, ক্রেডিট রিস্ক ফান্ডের আন্ডারলাইং সিকিউরিটি ডিফল্ট ঝুঁকির সাপেক্ষে হয়.

● আন্ডারলাইং সিকিউরিটির ক্রেডিট রেটিং পরিবর্তিত হতে পারে

রেটিং এজেন্সিগুলি নিয়মিতভাবে বন্ডের ক্রেডিট রেটিং রিভিউ এবং আপডেট করে. সুতরাং, এটি বাধ্যতামূলক নয় যে বর্তমানে খারাপভাবে রেটিং দেওয়া বন্ডগুলি সর্বদা একই রেটিং করবে. সুতরাং, ক্রেডিট রিস্ক ফান্ডের আন্ডারলাইং সিকিউরিটির ক্রেডিট রেটিং স্থায়ী নয়. সিকিউরিটিগুলি আপগ্রেড বা ডাউনগ্রেড করলে ক্রেডিট রিস্ক মিউচুয়াল ফান্ডের পারফরমেন্সকে প্রভাবিত করতে পারে.

ক্রেডিট রিস্ক ফান্ডের ট্যাক্সেশন

যদি আপনার আল্ট্রা শর্ট-টার্ম ডেট ফান্ডে 36 মাসের বেশি সময়ের জন্য বিনিয়োগ করা হয়, তাহলে লাভগুলি লং-টার্ম ক্যাপিটাল গেইন হিসাবে বিবেচনা করা হবে. সমস্ত ডেট মিউচুয়াল ফান্ডের ইন্ডেক্সেশানের পরে এই ধরনের লাভের উপরে 20% ট্যাক্স ধার্য করা হয়. সুতরাং, আল্ট্রা-শর্ট-টার্ম স্কিমে লং-টার্ম বিনিয়োগ আপনাকে ইন্ডেক্সেশানের সুবিধা পেতে সাহায্য করতে পারে.

যদি বিনিয়োগ 36 মাসের বেশি সময়ের জন্য করা হয়, তাহলে লাভগুলি লং-টার্ম ক্যাপিটাল গেইন হিসাবে বিবেচনা করা হবে. এই ধরনের লাভের উপরে ইন্ডেক্সেশানের পরে 20% ট্যাক্স ধার্য করা হয়.

তবে, 1 এপ্রিল 2023 থেকে কার্যকর, ফাইন্যান্স বিল 2023 নির্দিষ্ট মিউচুয়াল ফান্ড স্কিমে বিনিয়োগ করার জন্য লং টার্ম ক্যাপিটাল গেইন-এর ইন্ডেক্সেশান বেনিফিট অপসারণ করেছে. এই ধরনের ক্ষেত্রে, যে কোনও ক্যাপিটাল গেইনকে প্রকৃতির স্বল্পমেয়াদী হিসাবে বিবেচনা করা হবে এবং হোল্ডিং পিরিয়ড ছাড়াও বিনিয়োগকারীর প্রযোজ্য ট্যাক্স রেট স্ল্যাব অনুযায়ী ট্যাক্স ধার্য করা হবে. এই ব্যবস্থাটি শুধুমাত্র 1 এপ্রিল 2023 তারিখে বা তার পরে করা যে কোনও নতুন বিনিয়োগের ক্ষেত্রে প্রযোজ্য.

“Specified Mutual Fund” means a Mutual Fund scheme which does not invest more than 35% in equity shares of domestic companies.

প্রায়শই জিজ্ঞাসিত প্রশ্নাবলী

1. ক্রেডিট রিস্ক কী?

ক্রেডিট রিস্ক হল লোনের ঋণগ্রহীতার সাথে যুক্ত ঝুঁকি. এটি ঋণগ্রহীতার ঋণ/লোনের পরিমাণ ফেরত দেওয়ার অক্ষমতা নির্দেশ করে. ফিক্সড-ইনকাম সিকিউরিটি ডিফল্টের ইস্যুকারীর ক্ষেত্রে, মিউচুয়াল ফান্ড সম্পূর্ণভাবে বকেয়া পরিমাণ গ্রহণ নাও করতে পারে, যা স্কিমের এনএভি-এর উপর নেতিবাচকভাবে প্রতিফলিত হতে পারে.

2. কর্পোরেট বন্ড ফান্ড এবং ক্রেডিট রিস্ক ফান্ডের মধ্যে পার্থক্য কী?

একটি কর্পোরেট বন্ড ফান্ড এবং ক্রেডিট রিস্ক ফান্ডের মধ্যে মূল পার্থক্য হল তারা যে ঝুঁকি নিয়ে এসেছেন তার মধ্যে. তুলনামূলকভাবে, একটি কর্পোরেট বন্ড ফান্ড মূলত উচ্চ-মানের বন্ডে বিনিয়োগ করে, যা তাদের তুলনামূলকভাবে স্থিতিশীল রিটার্ন তৈরি করতে সাহায্য করতে পারে. একই সাথে, ক্রেডিট রিস্ক ফান্ড মূলত কম ক্রেডিট রেটিং সহ সিকিউরিটিতে বিনিয়োগ করে যার ফলে অস্থির এবং উচ্চ-ঝুঁকিপূর্ণ রিটার্ন হতে পারে.

3. ক্রেডিট রিস্ক ফান্ড কি ডেট ফান্ড?

হ্যাঁ, ক্রেডিট রিস্ক ফান্ড হল এক ধরনের ডেট মিউচুয়াল ফান্ড. এই স্কিমগুলি মূলত নীচের উচ্চ-রেটযুক্ত ইন্সট্রুমেন্ট সহ ফিক্সড-ইনকাম সিকিওরিটিতে বিনিয়োগ করে.

4. ডেট ফান্ডে সুদের হারের ঝুঁকি কী?

সুদের হারের ঝুঁকি সুদের হারের পরিবর্তনের সাথে সংযুক্ত যা স্থায়ী-আয়ের নিরাপত্তার মূল্যকে প্রভাবিত করে. সাধারণত, অর্থনীতিতে সুদের হার এবং ফিক্সড-ইনকাম সিকিউরিটির মূল্য একটি বিপরীত সম্পর্ক শেয়ার করে. যখন সুদের হার বৃদ্ধি পায়, তখন পূর্বে ইস্যু করা ফিক্সড-ইনকাম সিকিউরিটির মূল্য পড়তে পারে এবং এর বিপরীত দিক থেকেও বিপরীত হতে পারে.

অতিরিক্ত পড়ুন: কর্পোরেট বন্ড কী??

অস্বীকারোক্তি:

এখানে তথ্য শুধুমাত্র সাধারণ পড়ার উদ্দেশ্যে ব্যবহার করা হয়েছে এবং দৃষ্টিভঙ্গিগুলি শুধুমাত্র মতামত গঠন করা হচ্ছে এবং সুতরাং পাঠকদের জন্য নির্দেশিকা, সুপারিশ বা পেশাদার গাইড হিসাবে বিবেচনা করা যাবে না. সরকারীভাবে উপলব্ধ তথ্য, অভ্যন্তরীণভাবে উন্নত তথ্য এবং অন্যান্য উৎসের ভিত্তিতে ডকুমেন্টটি প্রস্তুত করা হয়েছে বিশ্বাসযোগ্য. স্পনসর, ইনভেস্টমেন্ট ম্যানেজার, ট্রাস্টি বা তাদের যে কোনও ডিরেক্টর, কর্মচারী, সহযোগী বা প্রতিনিধি ("সংস্থা এবং তাদের সহযোগী") এই ধরনের তথ্যের নির্ভুলতা, সম্পূর্ণতা, পর্যাপ্ততা এবং বিশ্বাসযোগ্যতার জন্য কোনও দায়বদ্ধতা গ্রহণ করে না বা ওয়ারেন্টি দেয় না. এই তথ্যের প্রাপকদেরকে তাদের নিজস্ব বিশ্লেষণ, ব্যাখ্যা এবং অনুসন্ধানের উপর নির্ভর করার পরামর্শ দেওয়া হচ্ছে. জেনেশুনে সঠিক বিনিয়োগের সিদ্ধান্ত নেওয়ার জন্য পাঠকদের স্বাধীন পেশাদারের সাথে পরামর্শ করার সুপারিশ করা হচ্ছে. এই উপাদানের প্রস্তুতি বা ইস্যু করার সাথে জড়িত ব্যক্তি সহ সংস্থা এবং তাদের সহযোগী, এই উপাদানের অন্তর্ভুক্ত তথ্য থেকে উদ্ভূত হারিয়ে যাওয়া মুনাফার কারণে কোনও প্রত্যক্ষ, পরোক্ষ, বিশেষ, আনুষ্ঠানিক, পরিণামস্বরূপ, শাস্তিমূলক বা অনুকরণীয় ক্ষতির জন্য কোনওভাবেই দায়বদ্ধ হবে না. এই ডকুমেন্টের ভিত্তিতে নেওয়া যেকোনও সিদ্ধান্তের জন্য শুধুমাত্র প্রাপক সম্পূর্ণরূপে দায়ী থাকবেন.

প্রোডাক্টের লেবেল

মিউচুয়াল ফান্ড বিনিয়োগ মার্কেটের ওঠাপড়ার মতো ঝুঁকির উপরে নির্ভরশীল, স্কিম সম্পর্কিত সমস্ত ডকুমেন্ট ভালো ভাবে পড়ে নিন.