Many Indian companies have made a significant mark in the global markets, and if they are listed in India, investors can easily invest in them either directly by purchasing their stocks or through a slew of mutual funds that cater to the domestic market.

But what if you are keen to invest in some of the stellar companies abroad? Is there a way for you to participate in their potential growth prospects? Yes, there is, by investing in international mutual funds. This article will explain the various aspects of international funds, their advantages, and what you need to consider before investing in them.

What are International Mutual Funds?

An international fund is a mutual fund that invests in stocks, fundsor debt instruments of companies listed outside India. As with any other mutual fund, an investor puts his money in the fund for which he is allotted units. The fund manager then invests in the international markets either by directly purchasing securities and building a portfolio or by investing in a foreign fund with a portfolio of foreign companies’ stocks.

Features of International Mutual Funds

Here are some of the salient features of international mutual funds:

Diversification: International mutual funds offer investors an option to diversify their portfolios. An investor with a basket of predominantly domestic-focused investments might consider expanding their portfolios to international markets.

Higher risk: While International funds may offer the possibility of higher returns, but it also means that the risk profile is likely to be higher.

Fund management: Fund managers of international mutual funds will be required to stay active and attuned to the happenings in the global markets when they are running the fund. Their expertise and years of experience in managing these types of funds can come in handy.

Advantages of Foreign Funds

Geographical diversification:At any given point in time, different markets perform differently. Thus, geographical diversification Can minimize potential risk because strong performance in another international market can offset a slowdown in one market.

Portfolio diversification: If you are an investor with a predominantly domestic portfolio and wish for some exposure to international markets, then thesefunds can give you the advantage of diversifying your overall investment portfolio.

Who should invest in International Mutual Funds?

• Equity investors with good domestic market exposure anda well-diversified portfolio could consider investing in the international markets. Ideally, international mutual funds could be a better option for seasoned investors than for those who have just begun their investment journey.

• If you are looking for a way to capitalise on the growth story of global leaders whose stocks or debt instruments are not listed on the Indian markets, then international mutual funds are an option.

• Globally, every country’s economy will have its share of ups and downs. However, these may not necessarily occur simultaneously; some countries could be staring at a slowdown, but there will be others amid an economic upswing. Accordingly, different markets may perform differently at a particular point in time,and therefore investing in international mutual funds could help leverage opportunities in different markets.

• International mutual funds can be considered by those investors who have a long-term investment horizon, typically 5 years or more.

Factors to consider before investing in Foreign Funds

These are some factors to keep in mind before investing in foreign funds:

• It is preferable to have some knowledge about the international financial markets and the way they function.

• Evaluate the international mutual fund thoroughly regarding track record, various risks involved, allocation to sectors, and so on.

• The investment objective of the international mutual fund must ideally align with your financial goals.

• Select those funds that invest in international markets that tend to be relatively stable compared to others.

How to invest in International Funds?

Investing in international funds is similar to investing in any other mutual fund scheme. Once you have selected the international mutual fund of your choice, you can invest in them either directly through the fund house or through mutual fund distributors. Either way, you will be required to complete the Know Your Customer (KYC) process. You could also consider investing in Nippon India US Equity Opportunities Fund.

Taxation on International Mutual Fund

International mutual funds are taxed similarly to debt mutual funds in India. This means that the holding period matters. If your holdings are for less than 3 years, then gains from the sale of the units will be treated as short-term capital gains. This will be added to your overall income and will attract tax depending on your tax bracket.

If the holdings are for more than 3 years, then they are treated as long-term capital gains which will be taxed 20% after indexation.

However, w.e.f 1 April 2023, The Finance Bill 2023 has removed indexation benefit on long term capital gain for the investment made in specified mutual fund schemes. In such case, any capital gains would be considered as short term in nature and taxed as per applicable tax rate slab of the investor irrespective of the holding period. This provision is applicable only for any investments made on or after 1 April 2023.

“Specified Mutual Fund” means a Mutual Fund scheme which does not invest more than 35% in equity shares of domestic companies.

সব শেষে বলা যায়

International funds are an option to consider if you have a long-term investment horizon, an appetite for higher risk, and financial goals that align with the fund’s objectives.

অতিরিক্ত পড়ুন: ব্যালেন্সড অ্যাডভান্টেজ ফান্ড কী?

অস্বীকারোক্তি:

এখানে তথ্য শুধুমাত্র সাধারণভাবে পড়ার উদ্দেশ্যে এবং দৃষ্টিভঙ্গি শুধুমাত্র বিশ্বাসযোগ্য মতামতের জন্য প্রকাশ করা হচ্ছে এবং তাই পাঠকদের জন্য এটি নির্দেশিকা, সুপারিশ বা প্রফেশনাল গাইড হিসাবে বিবেচিত হবে না. সর্বজনীনভাবে উপলব্ধ তথ্য, অভ্যন্তরীণভাবে পাওয়া তথ্য এবং বিশ্বাসযোগ্য অন্যান্য উৎসের ভিত্তিতে ডকুমেন্ট প্রস্তুত করা হয়েছে. স্পনসর, ইনভেস্টমেন্ট ম্যানেজার, ট্রাস্টি বা তাদের কোনও ডিরেক্টর, কর্মচারী, সহযোগী বা প্রতিনিধি ("সংস্থা এবং তাদের সহযোগী") এই ধরনের তথ্যের নির্ভুলতা, সম্পূর্ণতা, পর্যাপ্ততা এবং বিশ্বাসযোগ্যতার জন্য কোনও দায়বদ্ধতা গ্রহণ করে না বা ওয়ারেন্ট দেয় না. এই তথ্যের প্রাপকদেরকে তাদের নিজস্ব বিশ্লেষণ, ব্যাখ্যা এবং অনুসন্ধানের উপর নির্ভর করার পরামর্শ দেওয়া হচ্ছে. একটি অবহিত বিনিয়োগের সিদ্ধান্ত নেওয়ার জন্য পাঠকদের স্বাধীন পেশাদার পরামর্শ নেওয়ার পরামর্শ দেওয়া হচ্ছে. এই মেটেরিয়ালের প্রস্তুতি বা ইস্যু করার সাথে জড়িত ব্যক্তি এবং তাদের সহযোগী এই উপাদানে অন্তর্ভুক্ত তথ্যের কারণে হওয়া কোনও মুনাফাজনিত ক্ষতি সহ যে কোনও প্রত্যক্ষ, পরোক্ষ, বিশেষ, আনুষ্ঠানিক, পরিণামস্বরূপ, শাস্তিমূলক বা অনুকরণীয় ক্ষতির জন্য কোনওভাবেই দায়বদ্ধ থাকবে না. এই ডকুমেন্টের ভিত্তিতে নেওয়া যেকোনও সিদ্ধান্তের জন্য শুধুমাত্র প্রাপক সম্পূর্ণরূপে দায়ী থাকবেন.

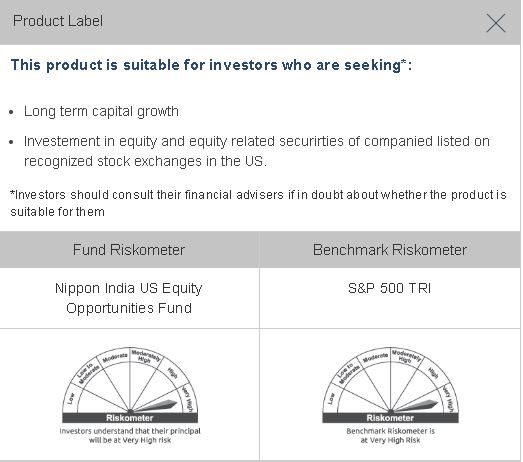

প্রোডাক্টের লেবেল

মিউচুয়াল ফান্ড বিনিয়োগ মার্কেটের ওঠাপড়ার মতো ঝুঁকির উপরে নির্ভরশীল, স্কিম সম্পর্কিত সমস্ত ডকুমেন্ট ভালো ভাবে পড়ে নিন.