Most big companies in the market today had humble beginnings. They only became successful after a period of time. At the initial stage, when these companies were small, they had to deal with their share of volatility in performance as they take their steps to success. Companies at this nascent stage are known as small-cap companies, and mutual fund investing in such companies can be done via small-cap mutual funds. Let’s find out all about it in more detail.

What are Small Cap Mutual Funds?

Broadly, companies are categorised into three types based on the size of their market capitalisation. Market capitalisation or market cap is the value of total shares trading in the stock market of that respective company. The bigger market cap denotes the larger size of the company and vis a viz. The Securities and Exchange Board of India (SEBI) has grouped the first 100 companies in terms of market capitalisation as large-cap companies. The companies ranking between 101 to 250 in terms of market cap size are defined as mid-cap companies. And those ranking 251 and onwards are considered small-cap companies.

Equity mutual funds , which invest at least 65% of funds in small-cap companies, are categorised as small-cap mutual funds. These are the smallest companies listed on the exchange. Now that you know what is small cap fund, let’s see how they work.

How do Small-Cap Equity Funds work?

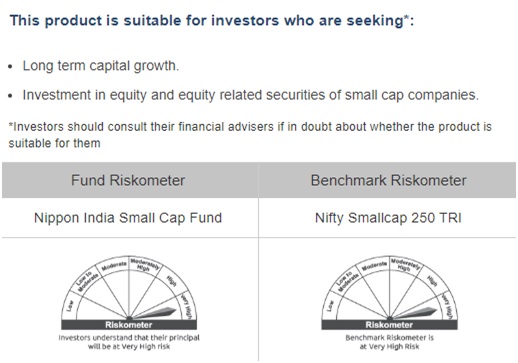

As per SEBI regulations, small-cap equity funds invest primarily in equity or equity-related instruments of small-cap companies. The main objective of these schemes is to have the potential to generate higher returns in the long run. For example, the investment objective of refore, there are higher chances of these companies suffering from losses at such times, which could negatively affect these Nippon India Small Cap Fund is primarily to generate long-term capital appreciation by Investing in equity and equity related securities of small cap companies.

स्मॉल-कैप फंड की विशेषताएं

Small-cap companies can have a good growth potential compared to well-established large companies, provided the imperatives are in place. Therefore, investment in these companies through small-cap mutual funds can give you the potential of earning higher returns in the long run. However, since these companies are at an early stage of development, they are more likely to go through ups and downs as different market phases occur. Hence these funds tend to be more volatile. Therefore, although small-cap mutual fund returns might appear attractive, there is a factor of risk and volatility associated with them.

Advantages of Investing in Small-Cap Funds

Better growth potential:

Small-cap funds may display the tendency of having more growth potential than large-cap and mid-cap funds as these schemes invest in small and young companies with a bigger room for expansion. Small-cap companies have more ability to scale their operations, unlike large-cap firms, which might be experiencing stable yet stagnant growth.

विविधता:

Investing in a small-cap mutual fund can help you diversify your investment portfolio.

Undiscovered opportunities:

Small-cap companies are generally under-researched as they are at a nascent stage of business. Although these companies have relatively less experience, they have much to discover and many opportunities to experimentwith. So, if you are willing to take risks and be a part of a potentially big company from an early stage, small-cap funds might be a treat for you.

Who Should Invest in Small Cap Mutual Funds?

Investors with a high-risk appetite

As small-cap mutual funds are considered risky and volatile, they are unsuitable if you have a conservative or moderate risk appetite. Typically, small-cap firms are more prone to risk during crisis; therefore, there are higher chances of these companies suffering from losses at such times, which could negatively affect these mutual fund returns.

Investors willing to build a corpus for long-term financial goals

If your goal is to create wealth in the long run, build a retirement kitty or accumulate sum for a child’s brighter future, you can consider investing in small-cap mutual funds. Given a long-time horizon, small-cap funds may average out the impact of volatility on the portfolio as the stocks of underlying companies can possibly get stronger and better over a period of time.

Investors wishing to invest in future midcap companies at low rates

Many mid-cap or large-cap companies wereonce small-cap companies trying to make a mark in the market. Those with strong business ideas, innovative offerings, strong foundations and disciplined approaches could make it to the bigger league. But initially, they were underrated and undervalued. So, if you are willing to invest in such gems, which could be a multi-bagger tomorrow, small-cap mutual funds are an opportunity to invest in them at an attractive price today.

How to Invest in Small Cap Funds

You can start investing in small-cap funds online through the mutual fund’s website or by contacting a mutual fund distributor.Once your KYC verification is done, investing in small-cap mutual funds is a very simple and hassle-free process.

Things Investors Should Consider Before Investing in Small-Cap Funds

वोलैटिलिटी

Small-cap mutual funds are most likely affected by even the slightest fluctuation in the stock market. And investing in such schemes for a short period of less than 3-5 years may not be sufficient to mitigate the impact of market volatility.

Possibility of higher returns in the long term

Although small-cap funds are risky, they have the potential to grow aggressively and maygive you higher returns than other market-cap funds.

Not all small-cap companies have the potential to become big

It is true that small-cap firms are potential mid-caps of tomorrow, but the company’s future depends on its financial foundation, future plans and several other factors. Companies with a weak foothold and poor strategies may not be able to survive a market downturn or tough times.

Tax on Small Cap Mutual Fund

Return generated from Small-cap mf is liable for equity funds taxation. The taxation rule depends on the holding period of investment. If you are holding the investment in a small-cap mutual fund upto 12 months, the returns generated are called short-term capital gains (STCG). These are taxed at 15% in the case of equity funds. The gains earned on investments held for more than 12 months are long-term capital gains (LTCG), and if these gains exceed the limit of Rs. 1 lakh in a year, they will be taxed at 10%.

So, if you are looking to build long-term wealth by investing in growth-oriented small-cap companies and are willing to take high risks, a small-cap mutual fund is just the right choice for you.

डिस्क्लेमर:

यहां दी गई जानकारी केवल सामान्य पढ़ने के उद्देश्यों के लिए है और व्यक्त किए जा रहे विचार केवल राय बनाते हैं और इसलिए इन्हें पाठकों के लिए दिशानिर्देश, सिफारिशें या पेशेवर मार्गदर्शक के रूप में नहीं माना जा सकता है. ये डॉक्यूमेंट, सार्वजनिक रूप से उपलब्ध जानकारी, आंतरिक रूप से विकसित डेटा और विश्वसनीय माने जाने वाले अन्य स्रोतों के आधार पर तैयार किए गए हैं. प्रायोजक, इन्वेस्टमेंट मैनेजर, ट्रस्टी या उनके निदेशक, कर्मचारी, सहयोगी या प्रतिनिधि ("संस्थाएं और उनके सहयोगी") ऐसी जानकारी की सटीकता, पूर्णता, पर्याप्तता और विश्वसनीयता की ज़िम्मेदारी या गारंटी नहीं लेते हैं. इस जानकारी के प्राप्तकर्ताओं को सलाह दी जाती है कि वे अपने स्वयं के विश्लेषण, व्याख्या और जांच पर भरोसा करें. किसी भी इन्वेस्टमेंट निर्णय पर पहुंचने के लिए पाठकों को स्वतंत्र प्रोफेशनल सलाहकार से परामर्श लेने की भी सलाह दी जाती है. इस सामग्री की तैयारी या जारी करने में शामिल व्यक्तियों सहित संस्थाएं और उनके सहयोगी, इस सामग्री में शामिल जानकारी से उत्पन्न होने वाले हानि के कारण, किसी भी प्रत्यक्ष, अप्रत्यक्ष, विशेष, आकस्मिक, परिणामी, दंडात्मक या अनुकरणीय नुकसान के लिए किसी भी तरह से उत्तरदायी नहीं होंगे. इस डॉक्यूमेंट के आधार पर लिए गए किसी भी निर्णय के लिए केवल प्राप्तकर्ता ही पूरी तरह से ज़िम्मेदार होंगे.

उत्पाद लेबल

म्यूचुअल फंड इन्वेस्टमेंट मार्केट जोखिमों के अधीन हैं, स्कीम से संबंधित सभी डॉक्यूमेंट को ध्यान से पढ़ें.