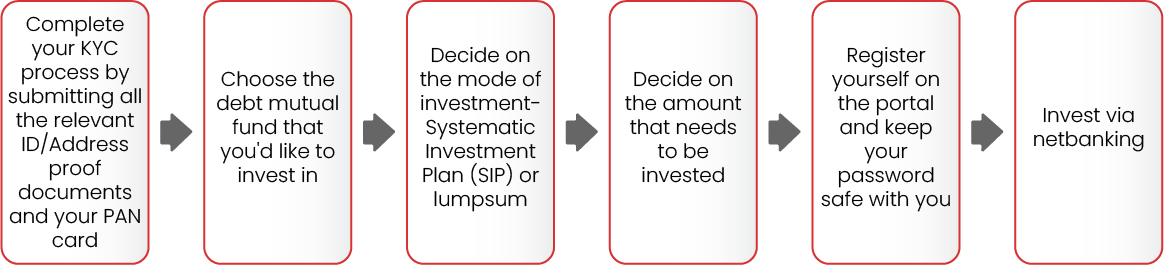

Investing in debt funds is easy once you decide which route you want to take. You can either invest directly with the fund house or through a mutual fund distributor. In the latter case, they may have their own investing portal. However,

the below steps are common in both the routes�

Once you have invested, a new folio number will be created, and you will receive an email from the fund house with the details of your investment. Thereafter, the fund house will keep sending you regular updates about the fund or any changes in its investment

objective, expense ratio, etc.

KYC is a mandatory requirement before you invest in any financial instrument as per the directive from the Securities and Exchange Board of India (SEBI). To know more about KYC,