What does your daily meal consist of? It consists of a combination of proteins, carbs, and fat to provide you with healthy portions of different types of nutrients. Now apply the same concept to investing. When you choose different types of investment avenues for creating a portfolio, it is called asset allocation. It is the process of dividing up your investments into different asset classes like equity, debt, cash, and alternative asset classes such as real estate and gold.

When asset allocation is applied to

mutual funds, it helps you diversify your investments and minimize risks. Thus, just like balanced nutrition is important to stay physically healthy, a diversified mutual funds portfolio is important to maintain your financial health.

Let’s look at few asset allocation strategies:

Strategy # 1 – Strategic asset allocation

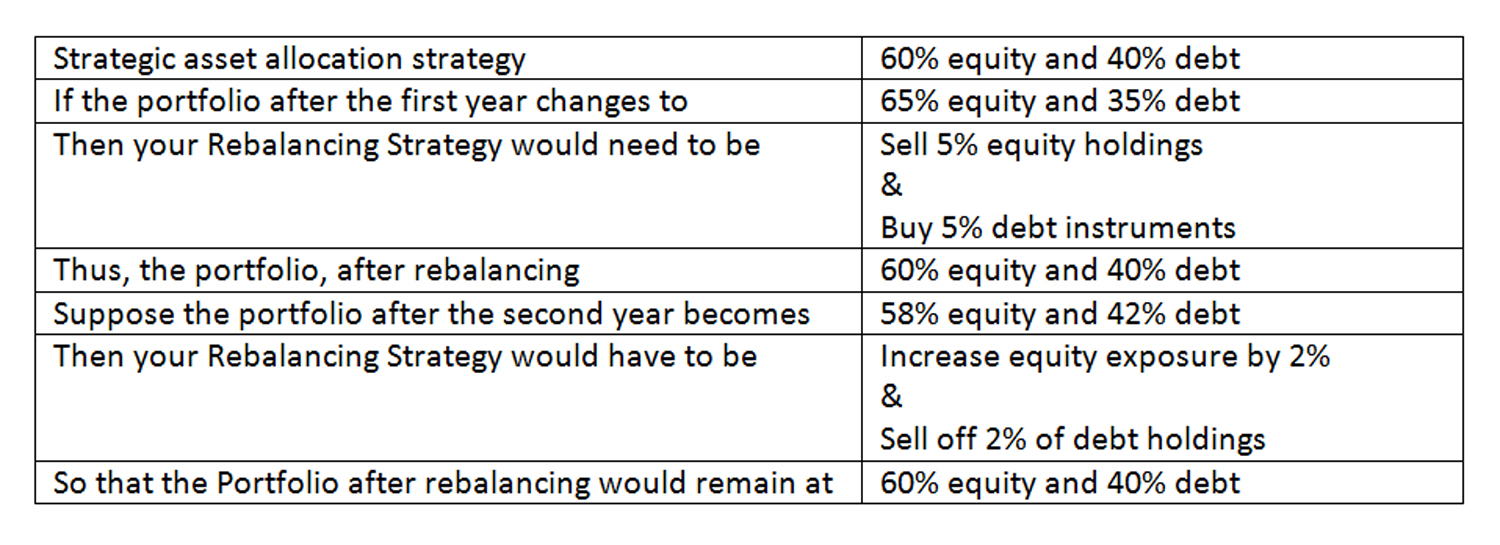

This is a fixed asset allocation strategy wherein you determine your equity and debt exposure and then stay fixed on the ratio. With the change in the market, on the ratios getting affected, you need to rebalance your portfolio periodically to ensure that the specified ratio is maintained.

Let us assume that you have chosen 60% equity and 40% debt. Here’s how rebalancing would work -

The strategy is also called the buy and hold strategy, as the allocation remains static with rebalancing done only to achieve the desired allocation. The biggest advantage of this strategy is the investment discipline, irrespective of the market condition. Ideally, a portfolio rebalancing should be done once a year.

Strategy #2 – Tactical asset allocation

This is a flexible variant of the strategic allocation strategy that allows you to alter the allocation to cash in on favourable markets. Again, it would help if you decided on a specific asset allocation ratio. After that, if you find conducive market conditions, you can change the ratio to make quick short-term gains.

Say your asset allocation ratio is 60% equity and 40% debt. If the stock market is performing well and the rise is expected to continue for the next few months, you can increase equity exposure. The equity allocation could become 80% with 20% debt. On the other hand, if the equity market is expected to fall or debt is expected to give high returns, you could reduce equity exposure to minimize risks or maximise returns. Your equity allocation would temporarily reduce to 40% from the previous 80%, and the debt allocation will increase from the previous 20%.

Thus, the tactical strategy works on your ability to read and understand market movements and is often called momentum-based strategy. You change your allocation for the short term to maximise returns or minimize risks. However, in a normal situation, the asset allocation is more or less pre-decided.

Strategy #3 – Dynamic asset allocation

The most popular asset allocation strategy is dynamic asset allocation. This is when you don’t have a fixed allocation ratio but invest your money as per market movements. So, in an upward market trend, you would favour higher equity exposure, while in a downward trend, you would be cautious and invest primarily in debt. You can also do the opposite to buy low and sell high. Unlike tactical asset allocation, here, you do not get fixated on the % allocation to each asset. Rather, you take dynamic calls depending on the market situation.

Dynamic asset allocation is suitable for seasoned and proactive investors who keep changing their asset allocation. If you can keep up-to-date with market trends, this strategy might give you attractive returns.

To wrap it up

When investing in mutual funds, it is advisable to choose your

asset allocation strategy depending on your risk appetite and knowledge of the markets. Remember, for the tactical and dynamic strategy to work; you need a good understanding of the market. The strategic allocation is suitable for long-term investors who don’t know or want to time the market. You can also switch your strategies if you want to ensure that you get the maximum returns on your invested money.

While the article mentions only 3 strategies, there might be many more which might be used by the investors/ fund managers from time to time

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their associates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully