Have you ever wondered that when the market returns are equally available for everyone, why is it that the returns garnered by every retail investor differ? The answer lies in your emotions. This may hold more truth for your equity investments since they may change according to investor sentiments. To gain perspective, let us understand how equity markets work. The long-term returns of an equity market depend on the growth and earnings of the companies you are invested in. In simpler words, you are putting your money on the companies that you think are going to grow. As the earnings grow, the share prices increase and so do the returns. However, in the short-term, the share prices fluctuate almost every moment, and this is driven by the change in sentiment. This is where your returns may differ from another investor; the answer lies in how you react to these frequent changes. More often than not, these reactions are driven by emotions, irrespective of whether you are investing in direct equity or in equity mutual funds.

This is not an Indian phenomenon alone. A DALBAR study shows the difference between the returns earned by individual investors in comparison to the returns provided by the S&P 500 (one of the most followed benchmarks of the US stock market). As per the report, the return of the index over a 30-year period that ended in Dec 2013 was 11.11% whereas the individual investor returns for the same period were only 3.69%. This is because of the lack of investors staying invested and discontinuing investments due to short-term changes in market situations.

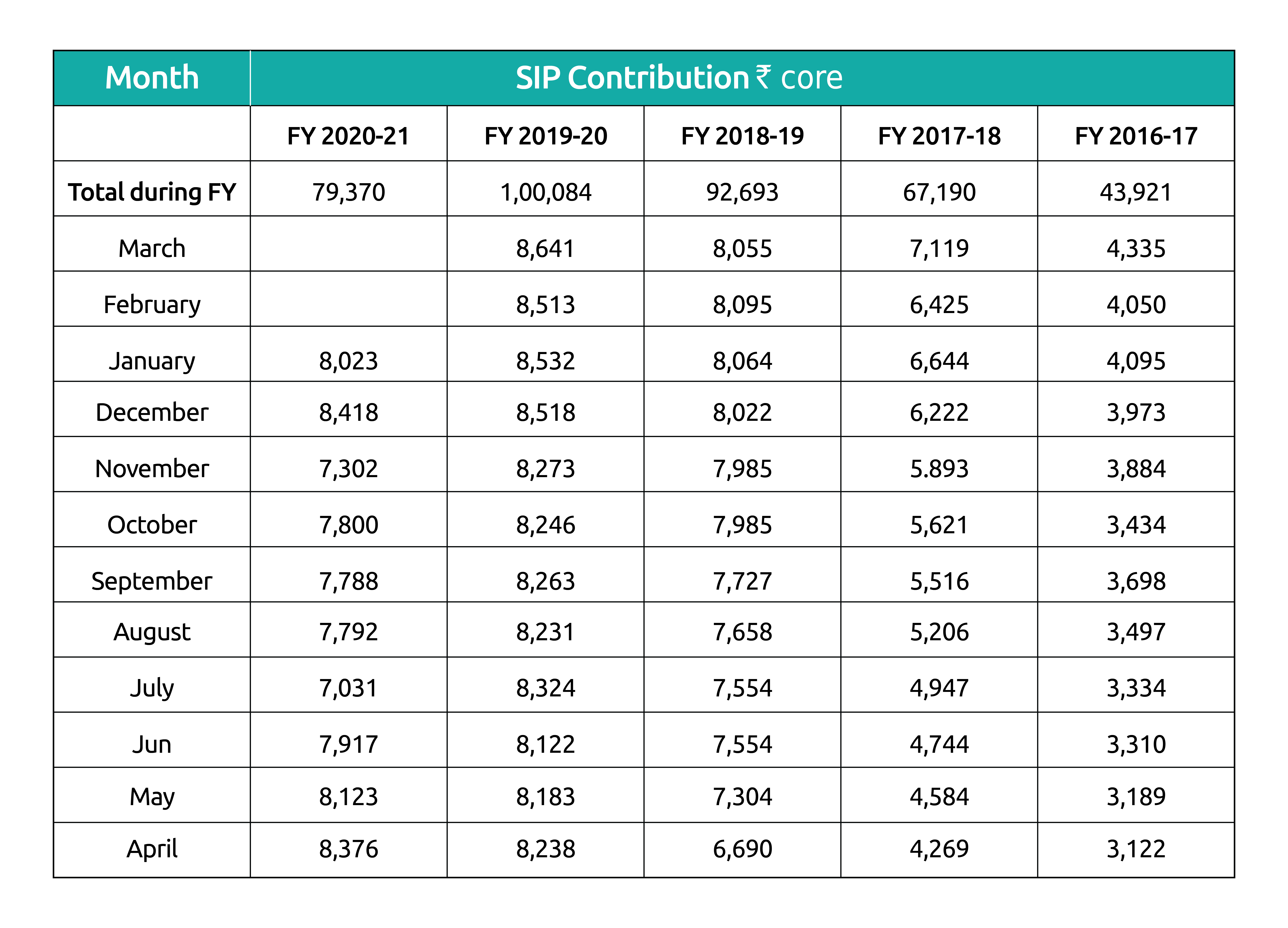

Consider the below data published by AMFI (Association of Mutual Funds India) on the total SIP contribution over the last few years-

Now let us look at this in the wake of the recent pandemic which hit us full force in Mar’20. Till March, the SIP contribution was increasing consistently and starting Apr’20 it reduced considerably till very recently. Why this happened is when the pandemic hit, the market crashed owing to changing sentiment and increasing apprehensions which resulted in investors discontinuing their SIPs. As the markets started rising again, the

SIP inflow has increased. Basically, investors are pulling out when the NAVs (Net Asset Value, i.e. the per-unit cost of the mutual fund) are low. This is exactly opposite to the ideal buying behaviour.

What causes this emotional investor behaviour?

Fear of Missing Out (FOMO)

Investors often tend to feel that every change in the market should be followed by a reaction from them; else they will be missing out on some sort of advantage or lose money. As we have seen above, reacting in short-term to every market fluctuation may just result in you losing out on the returns.

Herd Mentality

It’s often seen that you hear a couple of colleagues/friends/family members discussing a mutual fund that has worked for them and get influenced. First, let us understand they may not be investing experts, just like you. Second, what works for them may not work for you, since each investor’s goals, risk-taking ability, and the investmentjourney is different.

Chasing Performance everyday

A very common mistake is to get influenced by market news and aiming to get great returns every single day. This is an ideal situation which is almost impossible to achieve. But what you do achieve in the process, is the loss of return because you do not stay invested for long enough in one

mutual fund.

Disregard to market patterns

Even before the pandemic, there have been situations when the market has crashed, and if you look at the pattern, it always picks up. It is a cyclical behaviour. Hence, purely based on past experience, you should not disregard the fact that the market is likely to jump back up.

Lack of goal planning

At times, you may not know why you are investing. For example, investing for retirement can be a long-term goal for which you know you need to stay invested with an aim to build the corpus. But if the goal isn’t clear, you may end up making impulsive decisions and redeem before its time.

In conclusion-

Investing is not about fear or emotions; investing needs practicality in your approach. But we understand that emotions are unavoidable. Hence, you should aim at building a system that helps us to minimize the impact of emotions. Investing with the help of a financial advisor or mutual fund distributor may help some of the investors retain focus on the longevity of the investments. Set rules for yourself and stick to them no matter what. If you are finding it hard to time the market, invest via SIP (systematic investment plan) which reduces the need to time it. You end up buying more units when the NAV is low and buying lesser when the NAV is higher.

It is advisable to not let your emotions drive your investments, whether the market is in your favour or against it. Make informed decisions that are based on research and not hearsay.

ABOVE ILLUSTRATIONS ARE ONLY FOR UNDERSTANDING, IT IS NOT DIRECTLY OR INDIRECTLY RELATED TO THE PERFORMANCE OF ANY SCHEME. THE VIEWS EXPRESSED HEREIN CONSTITUTE ONLY THE OPINIONS AND DO NOT CONSTITUTE ANY GUIDELINES OR RECOMMENDATION ON ANY COURSE OF ACTION TO BE FOLLOWED BY THE READER. THIS INFORMATION IS MEANT FOR GENERAL READING PURPOSES ONLY AND IS NOT MEANT TO SERVE AS A PROFESSIONAL GUIDE FOR THE READERS.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully