The importance of gold is ingrained into the psyche of most Indians. Gold is not only an essential component of weddings but also important as an investment. Gold is considered a store of value and a hedge against financial uncertainties and economic turmoil.

While owning physical gold is one method of gaining a foothold in the gold market, you can also have a presence in gold digitally, which includes gold mutual fund Systematic Investment Plan (SIP). This article will provide more colour on the various aspects of gold fund SIPs. Gold Fund is a Gold Fund of Fund (FOF) investing in the underlying Gold ETF.

What is Gold Fund SIP?

If buying a big amount of digital gold is too daunting, investors can consider opting for gold fund SIP. Gold Fund SIP allows you to invest in gold funds in smaller manageable amounts at regular intervals, which could be weekly, monthly, etc.

Thus, if your gold fund SIP is monthly, then your gold fund investment will be as per the monthly instalment date. Assuming that your monthly instalment is Rs 2,000, then this amount will be used to purchase a units of Gold Fund at an applicable NAV on your selected date.

Features of Gold Fund

No demat required: Like any other mutual funds SIPs, gold fund do not require opening a demat account.

Fixed amount: Through the gold fund via SIP route, you can decide whether the specified amount will be monthly, quarterly, or any other option. Depending on your goals with respect to how much gold you want in your portfolio, you can also zero in on the investment tenure.

Easy liquidity: Investors can purchase and redeem units in gold fund like they would for other mutual funds.

How does Gold Fund SIP work?

A gold fund SIP operates like other SIPs in mutual funds, where you can invest in the fund at regular intervals. With SIPs, you can also reap the advantages of rupee cost averaging and benefit from investing across all the market cycles. Similarly, gold prices can also fluctuate, and through the SIP route, the price of gold begins to average out.

What are the benefits of Gold Fund SIP?

Smaller amounts: An investment in gold fund via SIP is an affordable option for an investor for whom buying physical gold or digital gold through the lumpsum route is too cumbersome. You can make an investment of as low as Rs.100 through the SIP route.

Portfolio diversification: Adding gold to your basket of investments can help you diversify your overall portfolio, and gold can offer a convenient method of doing so. Gold acts as a hedge against inflation and is considered a store of value, particularly when overall markets are a tad volatile.

Building wealth steadily: Investing in gold can help you build your gold portfolio steadily over a longer time horizon.

How to invest through the Gold via SIP route?

In Gold, you are not required to open a demat account. Since a gold fund SIP operates like other SIPs in mutual funds, the method is similar, where you put in a fixed amount at regular intervals. Gold funds can be purchased directly through the mutual fund house or through the mutual fund distributors.

You can also invest through the SIP route in Nippon India Gold Savings Fund by clicking here.

FAQs

1.) What is gold SIP?

In a gold fund through SIP route, you can buy gold by investing a fixed amount at regular intervals. This can be weekly, monthly, quarterly and so on.

2.) How do you make a SIP in gold?

To make a SIP in gold, decide on the amount you wish to invest at regular intervals along with the investment horizon. A gold SIP can be made either directly through the mutual fund house or with the help of mutual fund distributors.

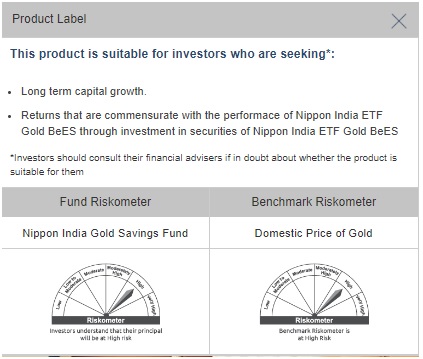

PRODUCT LABEL

The Investors will be bearing the recurring expenses of the scheme, in addition to the expenses of underlying scheme i.e Nippon India ETF Gold BeES.

SIP stands for Systematic Investment Plan wherein you can regularly invest a fixed amount at periodical intervals & aim for better benefits over a period of time through power of compounding.

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.