The AUM (Assets under Management) of the Indian mutual fund industry have grown more than five times over a span of 10 years and stand at ₹37.72 trillion (Source: AMFI website:

https://www.amfiindia.com/research-information/amfi-monthly) as on December 31, 2021. This is mostly due to the increase in general public awareness towards mutual funds as a means of wealth creation. Most people think of mutual funds simply as an investment tool that gives higher returns than other traditional investment instruments. But if we tell you there’s an option to save taxes, besides wealth creation, while investing in mutual funds?

ELSS or Equity-linked Savings Scheme is one such product that has been gaining investors’ attention. Let’s find out more:

What is ELSS and how is it different from other funds?

An ELSS is an equity-oriented mutual fund that also provides tax benefit. By investing in an

ELSS, you can claim a tax deduction of up to Rs. 1,50,000 from your gross income under Section 80C of the Income Act, 1961. Moreover, around 80% of the corpus in ELSS is invested in equities and equity-related instruments, which means you may get returns linked to the stock market's performance. Like other mutual fund schemes, ELSS are managed by fund managers. Thus, even if you don’t have complete knowledge of the stock markets, you can invest and potentially earn better returns than traditional tax-saving instruments. Some prominent features of ELSS are:

Lock-in Period

There is a lock-in period of 3 years from the date on which an amount is invested in ELSS. Compared to other tax-saving instruments, this is the shortest lock-in period.

Flexibility in investing

The investment can be made anytime in lump sum or through

SIP (Systematic Investment Plan). One can start investing with an amount as low as ₹500 and may increase the amount later. There is no upper limit on the amount invested. However, in case of both lump-sum investment and SIP, the redemption date is to be calculated as 3 years from the date on which units are purchased. Investing using the SIP method gives you the benefit of ‘averaging’ since fewer units will be bought at high price levels and more at lower price levels bringing the average price down.

ELSS Tax Benefit

Individuals and HUFs (Hindu Undivided Family) are allowed a deduction of up to Rs. 1.5 lakhs by investing in ELSS. For example, assuming you fall in the highest tax bracket, the amount that can be saved:

(1,50,000*30%) + 4% health and education cess= Rs. 46,800

In addition, long-term capital gains (LTCG) of up to ₹1 Lakh from

equity funds are exempt from tax; if the amount exceeds, it is taxed at 10%.

Note: Deduction under 80C can be claimed only if the investor has opted for Old Tax Regime.

Wealth Creation

ELSS has two-fold benefits — capital appreciation and the

ELSS Tax Benefit. The amount of tax saved can be reinvested in the

ELSS which can again earn returns, thereby growing your wealth and helping you reach your financial goals.

ELSS funds offer both Income Distribution cum Capital Withdrawal (IDCW) and growth option for investments.

Growth option: Gains are available to the investor only at the time of redemption.

Income Distribution cum Capital Withdrawal option: Dividends can be paid in a timely manner only from the distributable surplus earned by the fund.

Income Distribution cum Capital Withdrawal re-investment option: The dividends are reinvested in the

ELSS fund. This is beneficial if there is an uptrend in the market that is likely to continue, and you don’t have any need for income from the investments.

Whichever option you select, the end result is wealth creation along with tax saving and money saved is money earned! While investing through SIP can inculcate disciplined investment habits and help you invest in a structured manner. Even investing a lump-sum may grow along with the market and potentially earn better returns.. Mutual fund investments are subject to market volatility it is advisable to take a safe and sound decision after considering your investment horizon and risk appetite.

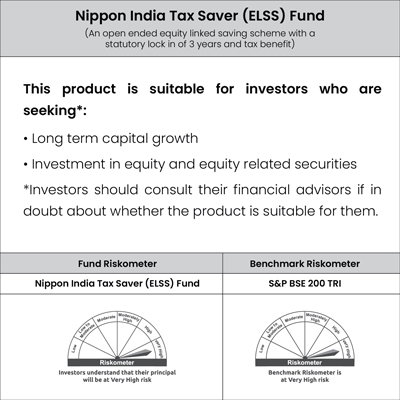

(An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit)

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.