Mutual fund schemes are popular investment options among almost every age groups. However, when you look at the traditional Indian investment mindset, you cannot undermine the value of gold. At the convergence of these two aspects lies gold mutual funds. By investing in these funds, you are investing in gold as an asset class without physically possessing it.

At its core, a Gold FOF is an open-ended fund,primarily aiming to create wealth for investors by utilising gold as a commodity. Its Net Asset Value (NAV) may get influenced by the gold price movement in the market, which is why it is important to evaluate gold fund performance before investing.

Let’s dive deeper into Gold FOF performance evaluation.

3 Things to Consider to Check Gold FOFPerformance

As an investor, you can select any of the Gold FOFin the market, like Nippon India Gold Savings Fund. But to check whether the selected fund is suitable for your portfolio, consider the following things:

1. Comparative fund performance

Several fund houses are available in the Indian mutual fund market, each with different categories of mutual fund schemes . Here, it is important that you pick up funds from a similar category (Gold FOF) offered by other Asset Management Companies (AMCs) for return comparison and not with equity or debt funds.

2. Historical fund performance

Another important aspect of evaluatingGold FOF performance is to check how the selected fund has performed in different market conditions.

While analysingGold FOF’s historical performance, remember that its past performance does not guarantee future returns. Similarly, the bad performance of a gold fund in the last year does not mean it cannot perform well in the future. Therefore, a 360-degree analysis of the selected fund is essential before investing.

3. Expense ratio

The expense ratio can affect the NAV (Net Asset Value) of the Gold FOF and hence, theGold FOF performance. In general, a higher expense ratio is expected to cut down the overall returns.

Gold FOF investments are often considered low-risk investment prospects. However, they tend to work well during market disruptions, which is why evaluating Gold FOFs performance can be a good idea for most investors.

Note: Investors will be bearing the recurring expenses of the scheme, in addition to the expenses of underlying Scheme, i.e. Gold ETF.

Disclaimer:

The information herein is meant only for general reading purposes, and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

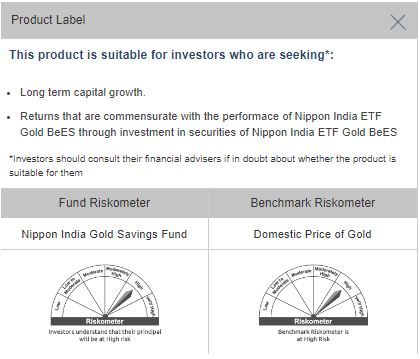

PRODUCT LABEL

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.