Mutual Funds are certainly subject to market risks, reading of the offer document carefully is the statutory warning and an advice before investing. Hence, it makes the investors alert and fearful at the same time. This implies, while mutual funds are risky yet good investing option, an investor must know well and have in-depth knowledge of choosing and then investing in mutual funds.

Knowledge of different fund types, their performances, lock-in period, risk involved, return rates and income/growth can all contribute towards a better decision of choosing a fund type that is trending and suits your need as well. Trending can be gauged and computed, what suits you is how you should approach on what’s best for you to invest. To pick the most appropriate fund you must answer the below:

What are your financial goals?

Before you put your funds in a scheme, ask yourself about the financial expectations. Whether it is long-term gains or regular income?

The money earned is for acquiring an asset, an experience, or is it for your

retirement plans? How quickly you’d need your money back, can you plot it for a couple of years or would you need it shortly, maybe in a few days? These and few more questions are a must to track your expectations and goals from your finances and investments.

What’s the bar of your risk tolerance?

Next in line is to know your appetite for risk? Can you take the volatilities of the market? Can you keep your cool and not get impulsive to drastic switches in the value of your portfolio? Can you experiment and take the plunge towards higher risks in your aim for higher gains? Or are you conservative and would prefer stability?

What are the fund types and size of funds you’d like to invest in?

This is more like a combination of the above two questions, so if you as an investor are willing to take a fair amount of risk and can set apart your funds for a long-term, then you must go for long-term funds that offer capital appreciation. These are volatile in nature and hence bear the potential of better and higher rewards over time. But, on the contrary, if you are aiming at moderate income, then debt as income funds should do the trick. Also, to have the best of both worlds, the other way is to invest in

balanced funds that invest both in stocks and bonds.

Once you are sorted, you must trust a good and a reputed Asset management company (AMC) like Nippon India Mutual Fund (NIMF), which is one of India’s leading and fastest growing mutual fund houses. The funds designed by NIMF are aimed to offer stable income, create wealth and push growth. The AMC is said to manage the funds of investors wisely and help them in accomplishing their financial goals. 5 Top trending mutual funds of Nippon India Mutual Funds are as follows:

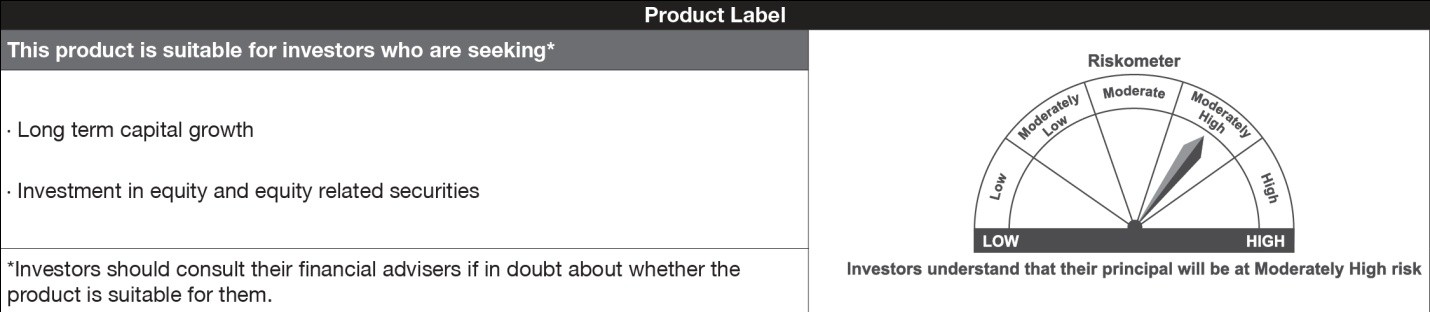

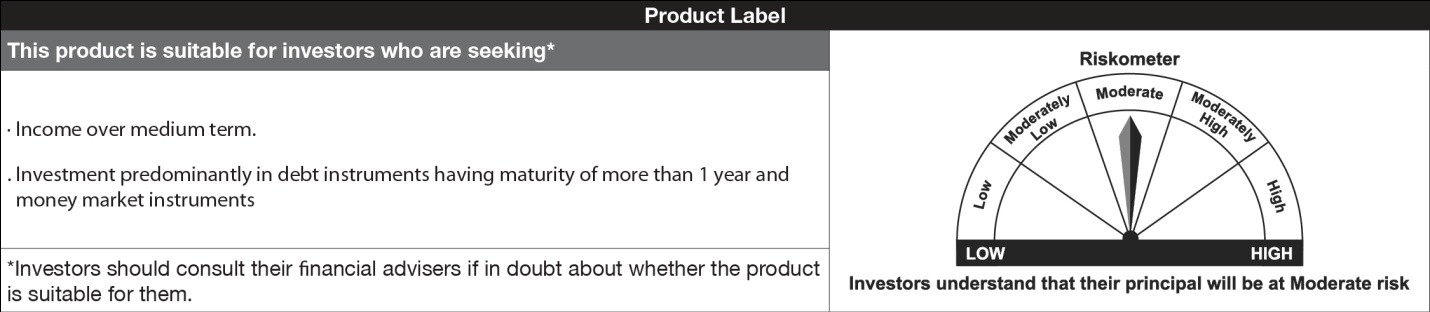

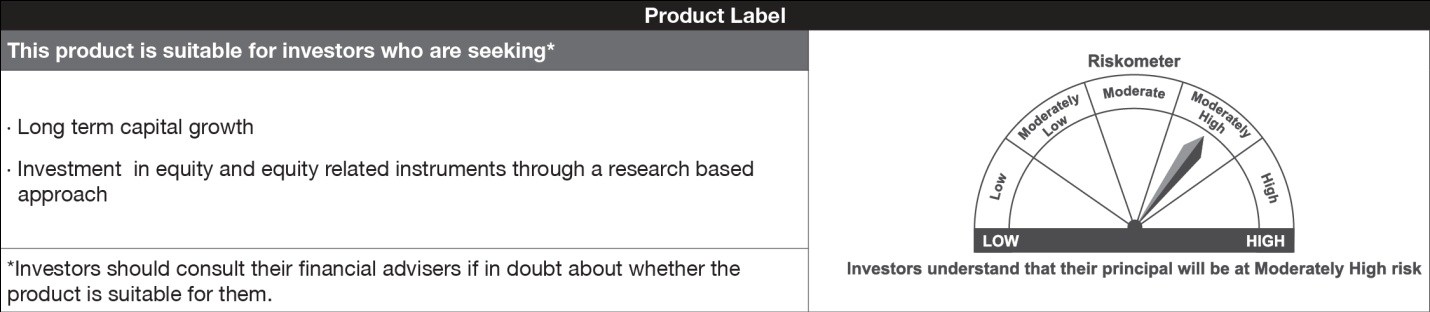

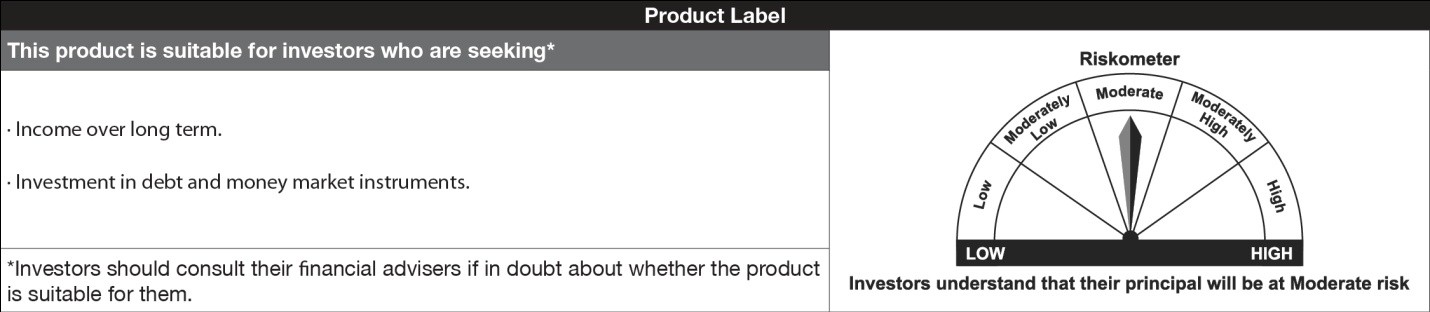

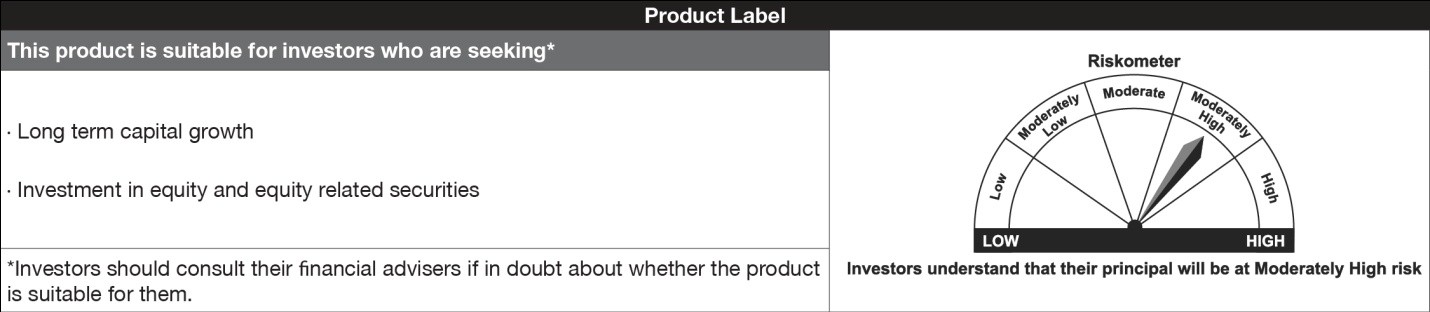

Product Labels are as follows:

1. Nippon India Equity Opportunities Fund- Growth

(Equity Diversified)

2. Nippon India Regular Savings Fund- Debt Plan Growth

(Income-Medium Term)

3. Nippon India Growth Fund- Growth

(Equity- Mid Cap)

4. Nippon India Dynamic Bond Fund- Growth

(Income-Long term)

5. Nippon India Tax saver (ELSS) Fund- Growth

(Equity-ELSS)

Disclaimers

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Certain factual and statistical information (historical as well as projected) pertaining to Industry and markets have been obtained from independent third-party sources, which are deemed to be reliable. It may be noted that since NAM INDIA (Formerly known as Reliance Nippon Life Asset Management Limited) has not independently verified the accuracy or authenticity of such information or data, or for that matter the reasonableness of the assumptions upon which such data and information has been processed or arrived at; NAM INDIA (Formerly known as Reliance Nippon Life Asset Management Limited) does not in any manner assures the accuracy or authenticity of such data and information. Some of the statements & assertions contained in these materials may reflect NAM INDIA’s (Formerly known as Reliance Nippon Life Asset Management Limited)views or opinions, which in turn may have been formed on the basis of such data or information.

Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision. None of the Sponsor, the Investment Manager, the Trustee, their respective directors, employees, affiliates or representatives shall be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.