Mutual funds in India have gained a lot of traction because they offer a simple way to invest your money. Investors take comfort in the fact that their money is in the able hands of a fund manager.

However, it’s still good to retain some degree of control over your investments. Supervision helps you stay in the know of what’s happening with your investments. It helps avoid surprises and panic-induced mutual fund redemptions, which can sometimes mean losing your capital. Therefore, it’s advisable to be mindful of triggers that actually warrant selling your mutual fund units.

This article will walk you through five triggers you may want to look out for before you redeem your mutual funds.

Reaching financial goal

While some investors plan for mutual fund redemption when they reach their financial goals such as education, marriage, retirement, etc., some may take a non-goal-oriented approach and sell their investments when they believe the market has peaked.

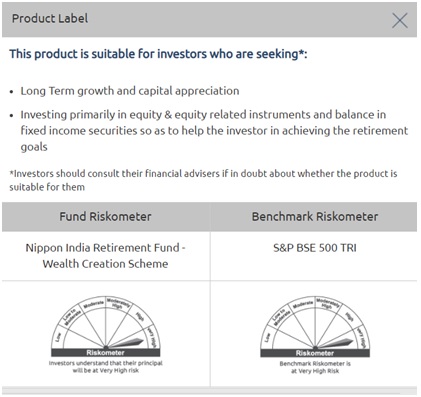

For example, say you invest in Nippon India Retirement Fund-Wealth Creation Scheme with a 30-year horizon to accumulate your retirement corpus. If you’ve achieved your goal a little sooner, you should consider redeeming your investment.

If your estimated holding period has ended and you haven’t reached your goal, it’s time to pull up a SIP calculator to see how many more monthly contributions you’ll need to make to achieve your target.

Rebalancing your portfolio

As an investor, you need to aim for a pre-set asset allocation ratio that helps maintain your portfolio’s overall risk below a certain threshold. If the assetallocation ratio changes because of movements in the prices of assets you hold, youshould ideally rebalance your portfolio.

For example, your current asset- allocation ratio (i.e., the proportion of the value of your investments) is 50:50 for debt and equity instruments. If the price of equities in your portfolio drops, your asset mix could change to, say, 70:30. In such a case, you may consider resetting your asset mix to 50:50 by redeeming the units of debt funds and investing the proceeds into an equity fund.

Realigning investments and risk profile and goals

Your portfolio’s assets could change in value. Or as you grow older, your financial goals may change.

Both these things could warrant considering redeeming the mutual funds. For instance, say you’ve been investing in mutual funds to save for a car. However, you’ve been able to do well in business and you can now afford a car with your own savings (without using the invested amount). In addition, since you have more income, you can now afford to take a little more risk in your investments

This may justify the redemption of units of mutual funds that are currently aligned with your previous risk profile and reinvesting the proceeds in mutual funds that are suitable with your new risk profile.

Change in the economic or regulatory environment

Mutual funds of India operate in a dynamic environment. The regulatory authorities could introduce structural reforms, the ministry could change tax regulations, etc. When this happens, it could potentially impact your mutual fund’s structure or influence its environment.

For instance, in January 2018, when the finance minister reintroduced LTCG, it translated to a big change for mutual funds and their investors. If you have other, more tax-efficient options where you’d rather invest, that could warrant mutual fund redemption on your part.

Facing financial stress or an emergency

Financial stress is another trigger that could lead you to redeemyour mutual funds. When you are under financial difficulty, your risk appetite gets impacted. Facing financial stress may reduce your risk-taking ability, and so, you may have to reconsider your portfolio asset allocation.

You may even have an emergency that you need funds for. Ideally, you should have an emergency fund, preferably invested in a liquid fund, so that you don’t have to take a hit if the markets aren’t in good shape when you need the money, and you don’t have to redeem the equity or long-term debtmutual fund units.

Closing thoughts

Ultimately, you should take a logical approach to redemptions rather than an emotional one. A few triggers certainly warrant a redemption, but a little extra diligence at the time of investment and a proactive approach to monitoring can keep surprises at bay.

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.