The day Nidhi received her first paycheck, her happiness knew no bounds. She immediately started dreaming of the goodies she would buy and the fun things she would do. No one can blame her; who wouldn't be elated with their first paycheck? It is your first step towards financial freedom, and even if you earn twice the amount in your next job, your first job salary will still be the most special. But is it wise to spend all that you earn? Read on to know a few things to do with your first salary:

Go Debt Free

Clearing off all dues is the first step to a peaceful life. It is advisable to start paying off your debt burden as early as possible to avoid interest build-up. Be it education loans, money borrowed from acquaintances, or any other debt burden, start clearing it as soon as you start earning. Although your first salary may not be enough to fulfil them all, you can plan how much you'll pay off every month after considering all your expenses.

Learning About Money Management

Money management is a technique that teaches you ways to make your money yield more from the different investment options available. Knowing about this art and starting it early in your career can help you in future. It can help you manage your income right from the first paycheck, and you will have ample time to learn from your mistakes. This is because the financial implications of mistakes would be less now than in later stages of your career.

Kick-start Your Investment Journey

With money comes responsibility, and making wise decisions and starting your investment journey is advisable. You can start by investing in

mutual funds. Read up to know more about what they are and how they operate.

Your investment decisions depend on your goals, investment horizon, and risk appetite. Since you are still young and may have fewer financial burdens, you can look at long-term investments and showcase higher risk appetite for better potential returns. You need to plan for the shares of your earnings that you wish to spend, save, and invest.

Start an SIP (Systematic Investment Plan)

If you plan to invest in mutual funds and don't know much about them, you don't want to risk investing in a lump sum; you can start with a Systematic Investment Plan (SIP). By signing up for a SIP, you can invest a fixed amount of your choice (as low as Rs 500) at a regular interval (monthly or weekly). By starting with a smaller amount, you can still put aside some money for spending (utilities or luxury) yet get to start investing as well.

Also, assuming you are young, it will inculcate the habit of financial discipline and goal planning early in life. If you wish to buy a car in 3-4 years, you can start saving in a SIP and achieve your goal once you have saved enough. You can even check the online

SIP calculator to know how much you would need to invest to achieve any goal.

Get Yourself a Health Insurance

Sudden hospitalisation or other expenses related to health may distort your savings and affect your financial goals. Health insurance is a cover against medical expenses. Taking health insurance cover at an early age can also help you to save on the hefty premium by getting a good bargain due to the age factor. Also, you may be able to claim a tax deduction under Section 80D of the Income Tax Act, 1961.

Building an Emergency Fund

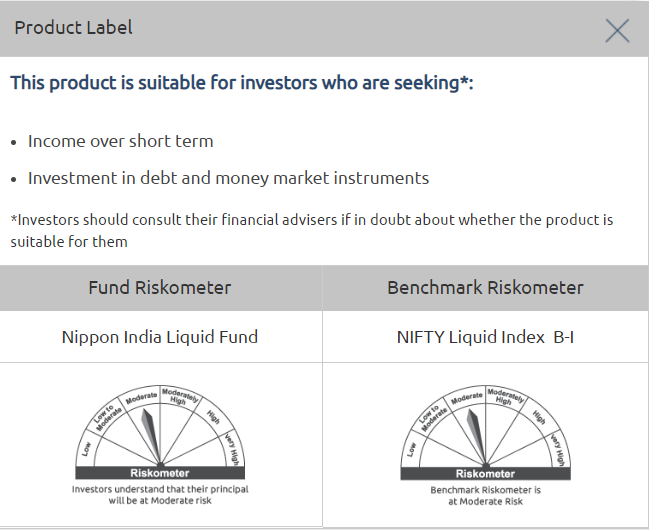

Life is unpredictable. Uncertain events such as major household repairs, vehicle breakdowns, health emergencies, or other unforeseen events may occur at any time. Therefore, you need to create an emergency fund that covers your living expenses for the next six months. You can invest in

liquid funds, which are open-ended debt funds with a residual maturity of up to 91 days for individual securities. You can redeem these funds anytime and utilise them in an emergency.

Conclusion

Taking sound investment decisions at the right age would benefit you in the future. Although it may sound too much to do, considering it is your first salary, a little research and guidance can help you in the longer run.

Disclaimer: The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their associates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Disclaimer: The SIP Calculator results are based on an assumed rate of return. Please get in touch with your professional advisor for a detailed suggestion. The results are based on an assumed rate of return. The calculations are not based on any judgments of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as promise on minimum returns and/or safeguard of capital. While utmost care has been exercised while preparing the calculator, NIMF does not warrant the completeness or guarantee that the achieved computations are flawless and/or accurate and disclaims all liabilities, losses and damages arising out of the use or in respect of anything done in reliance of the calculator. The examples do not purport to represent the performance of any security or investments. In view of individual nature of tax consequences, each investor is advised to consult his/ her own professional tax/ financial advisor before taking any investment decision.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.