We all know what they say about being spoilt for choices, which may be true for new-age investors. With a gamut of investment options, making the right choice can be confusing, and this is where asset allocation can offer you a streamlined route to your financial goals.

Whether you use an asset allocation calculator in India, consult a financial advisor, or make your own decisions, there are some things you may need to know about asset allocation. Keep reading to find what these are.

What is asset allocation?

When you invest in mutual funds, you get various types of asset classes — equity, fixed income, cash and cash equivalents, real estate, gold, etc. Asset allocation refers to the distribution of your investments across these asset classes. It helps you reduce your investment risk, as it is generally rare for two asset classes to fare the same in every market condition. Different asset classes provide different growth at a given point in time. Hence, by diversifying your portfolio, you can reduce risk and also possibly grow your wealth.

You can have three types of portfolios with different combinations of asset classes – aggressive, moderate, and conservative. An aggressive portfolio - up to 65% stocks, 25% bonds, and 10% cash or cash equivalents - can be suitable for long-term goals. A moderate portfolio - up to 50% stocks, 30% bonds, and 20% cash or cash equivalents - can provide moderate growth and modest defence against inflation and may be suitable for mid-term goals. Lastly, a conservative portfolio - 25% stocks, 50% bonds, and 25% cash or cash equivalents - can be ideal if you are retired or nearing retirement and prefer risk-averse options.

Understand your goals:

Each asset class caters to a unique investment goal. For instance, equity funds may be ideal for long-term goals and you can invest in them through SIP. The thing about SIPs is that they allow you to make small, regular investments over time, making them ideal for long-term investments. Likewise, debt funds may be more suitable for short-term goals. For example, liquid funds are commonly used to park emergency funds. You can use an asset allocation calculator in India and invest in mutual funds according to your financial goals.

Assess your risk appetite:

If you are an aggressive investor and open to risks, you may include more equity funds in your portfolio. But if you want to invest in mutual funds with low risks, debt funds may be more suitable. Choosing your asset allocation according to your risk tolerance level ensures that you get maximum portfolio returns with proper diversification. Depending on your risk appetite, you can choose from an aggressive, moderate, and conservative portfolio. It may help to use a risk analyser to make a well-informed decision.

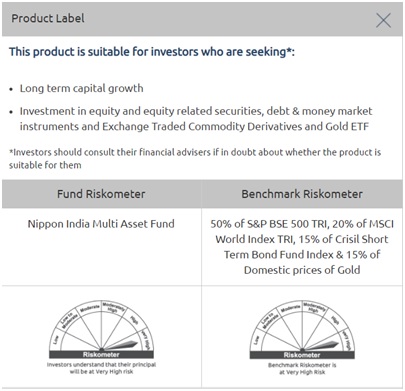

You can also add a Nippon India Multi Asset Fund, offering a wide asset allocation in gold, equity, debt, etc., to your portfolio. These funds work on three approaches:

View-based: The fund manager invests more heavily in one asset class and allocates little to the other. However, if the fund manager chooses the incorrect asset class, the returns could be low.

Model-based: Here, a quant-based model picks asset classes that are likely to outperform and those that may not. However, this may not be conclusive, as several factors can come into play when picking an asset class.

Constant allocation: Here, the portfolio is rebalanced frequently, and the allocation is distributed to all asset classes to earn risk-adjusted returns. This can be an effective approach to maximise returns.

Be mindful of taxation:

Taxation of different funds also impacts your final profits. You pay short-term capital gains tax on debt funds held for not more than 36 months as per your income tax slab. Long-term capital gains tax is levied at a flat rate of 20% with indexation in the case of debt investments held for more than36 months. Short-term capital gains tax levied on equity funds held for not more than 12 months is charged at a flat rate of 15%. Long-term capital gains on equity of up to Rs 1 lakh are tax-exempt. However, any gains over this limit are levied with a 10% tax with no indexation benefit.

To sum it up

The right asset allocation can differ for different people, and this is why it helps to determine your goals and needs before you create your portfolio. Once you have these figured out, you can create a well-diversified portfolio using an asset allocation calculator in India.

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, affiliates or representatives (“entities & their affiliates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

The asset allocation calculator results are for illustration purpose only. Please get in touch with a professional advisor for a detailed suggestion. The calculations are not based on any judgments of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as a promise on minimum returns and/or safeguard of capital. While utmost care has been exercised while preparing the calculator, NIMF does not warrant the completeness or guarantee that the achieved computations are flawless and/or accurate and disclaims all liabilities, losses and damages arising out of the use or in respect of anything done in reliance of the calculator. The examples do not purport to represent the performance of any security or investments. Given the individual nature of tax consequences, each investor is advised to consult his/her professional tax/financial advisor before making any investment decision.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.