The need to create and manage a balance between different aspects is prevalent both in life and when planning investments. As an investor, you want to analyse your risk profile, income, and financial goals to determine balance before investing. However, if you are more interested in investing in mutual fund schemes, proceed wisely to fulfil your financial needs.

To simplify the mutual fund selection process based on this formula, you can invest in a balanced advantage fund. Let us take you through the concept of

balanced advantage funds in mutual funds further.

What are Balanced Advantage Funds?

A balanced advantage mutual fund is an open-ended scheme investing in equity and debt instruments.It falls into the category of hybrid mutual funds and involves dynamic asset allocation between equity and debt instruments as per the prevailing marketing conditions. This is why a

balanced advantage fund is also known as a dynamic asset allocation fund. The primary aim behind changing the allocation proportion of assets over time is to manage both returns and risk for investors.

How Do Balanced Advantage Funds Work?

Balanced advantage mutual funds are actively managed fund schemes designed to benefit investors with a diversified portfolio.For example, if the stock prices are quite high and going up, the fund manager may turn the asset allocation toward debt. On the other hand, the shift in asset allocation can be toward equities when the stock prices are low.

In short, the balanced advantage fund managers may generally shift the allocation to equity when the valuation is low and turn back to debt when the valuation of stocks is high. This approach may reduce the risk involved and can generate risk-adjusted returns for you. Take the case of

Nippon India Balanced Advantage Fund,which is suitable for long-term investments and wealth creation goals.

Benefits of Investing in Balanced Advantage Funds

1. The asset allocation strategy followed as per balanced advantage fund may help in portfolio diversification.

2. Since it involves investing money in different asset classes, a performing asset class may be found making up for the returns of underperforming assets.

3. You need not time the stock market as the asset allocation is based on the asset allocation rebalancing model.

4. You may receive tax-efficient returns with your investments in a balanced advantage fund. In

equity funds, STCG is taxed at 15%, while LTCG is tax-exempt up to Rs. 1 lakh per financial year.

Who Should Invest in a Balanced Advantage Fund?

You can choose to invest in a balanced mutual fund if

● You are looking for equity exposure with lower volatility

● You want to invest in multiple asset classes to diversify your portfolio among both equity and debt instruments

● You have a long-term investment horizon in mind

● You are new to investing in

mutual funds and are learning the fundamentals of investments

FAQs

What are balanced advantage funds?

In balanced advantage mutual funds, the allocation in different asset classes (equity and debt) is managed dynamically as per market conditions.

What is dynamic asset allocation?

In correlation with balanced advantage funds, dynamic asset allocation meansshifting capital from one asset class to another based on the ups and downs in the market. A higher asset allocation toward equity happens when the market is down and vice versa.

How is equity allocation decided?

At its core, asset allocation means deciding where to put investors’ money to work as per the fund’s objective. The decision for higher equity allocation in a balanced advantage mutual fund is made strategically depending on market conditions.

Do balanced advantage funds have a fixed frequency of rebalancing?

The funds have flexibility to invest across asset classes in proportion based on mandate of the respective schemes and then dynamically alter the mix of equity and debt.

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their associates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

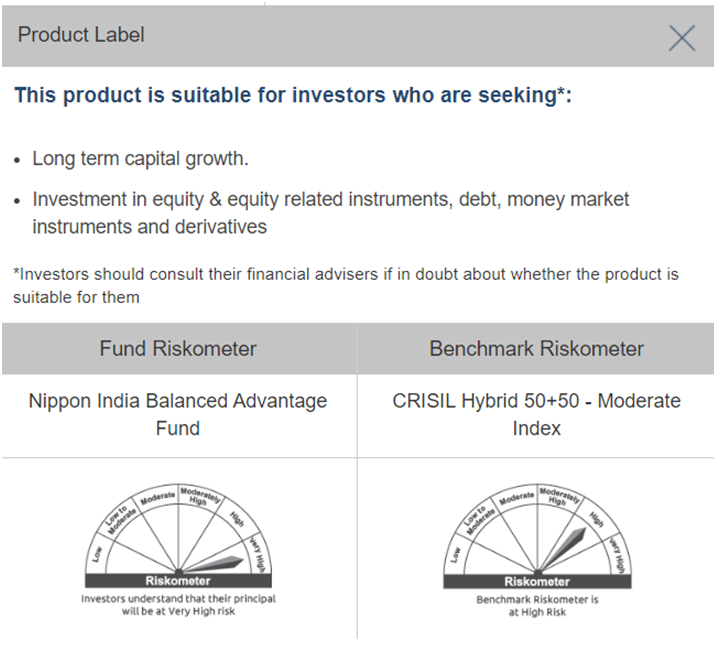

PRODUCT LABEL

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.