A classroom typically consists of all types of students. Some are good in academics but weak in sports; some are strong in sports but average in academics. Then there are some who surprise the teachers and the class with their above-average performance despite everyone’s belief. Credit Risk Funds are the last type of student with the surprise factor hidden in them.

So, let’s first understand the credit risk fund in detail.

What are credit risk funds?

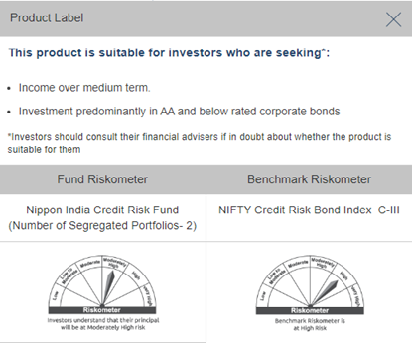

As per AMFI’s definition, Credit Risk funds invest at least 65% of the corpus in corporate bonds that are below the highest-rated instruments. For instance, Nippon India Credit Risk Fund (NUMBER OF SEGREGATED PORTFOLIOS- 2) is a debt scheme predominantly investing in AA and below-rated corporate bonds.

An important thing to note here is that although credit risk funds carry a certain extent of credit risk, these have high return potential.

How Does Credit Risk Mutual Fund Work?

Typically, debt funds invest in bonds, and each bond is given a credit rating based on the credit quality. This credit quality is determined based on financial strength, governance, and creditworthiness, i.e. the ability to repay a loan of the company issuing the bonds. The stronger these components, the higher the credit quality of the company and, thereby, the bond. A Corporate bond’s highest credit rating is AAA/A1+, followed by AA+, AA, A, BBB, BB+ and so forth.

Credit risk debt funds are a type of debt mutual fund that primarily invests in bonds with a credit rating of AA or lower. This means that the companies issuing the underlying securities of credit-risk funds carry a higher credit risk than higher-rated bonds. As a result, they tend to offer better returns in return for the higher risk associated. Credit risk funds carry the potential to earn better returns than other debt mutual funds investing in higher-rated bonds. These funds may also offer fairly regular dividends when the fund’s underlying securities perform well. They carry the potential to help you achieve your short to medium-term financial goals.

Advantages of Investing in Credit Risk Funds

● Better returns

Credit risk funds carry the potential to earn better returns than other debt mutual funds investing in higher-rated bonds. These funds may also offer fairly regular dividends when the fund’s underlying securities perform well. They carry the potential to help you achieve your short to medium-term financial goals.

● Tax benefits

As credit risk funds are debt mutual funds, they are taxed as per your tax slab.

Disadvantages of Investing in Credit Risk Funds

● Credit risk

As per the Securities and Exchange Board of India (SEBI) regulations, credit risk funds invest at least 65% of assets in bonds rated AA & below. As such companies carry relatively higher credit risk, your investment in these schemes is subject to a certain level of credit risk.

● Relatively less liquid

Due to the lower credit quality of the underlying bonds of credit risk debt funds, these bonds cannot be easily sold in the market. Therefore, credit risk funds may have liquidity limitations as compared to other debt funds, especially those investing in high-credit-quality papers.

Who Should Invest in a Credit Risk Mutual Fund?

● Investors seeking better returns from fixed-income investments

A credit risk fund can be a good choice for your investment objective if you aim to earn comparatively better returns than most fixed-income investments.

● Investors having a higher risk appetite

As credit risk funds are relatively riskier and volatile, you should invest in them only if you have the appetite to tolerate such risk. If you want to invest in a low-risk and stable debt scheme, investing in a credit-risk fund is not prudent.

● Investors having a medium-term investment horizon

If your investment horizon is up to 2 to 3 years, credit risk funds can be a suitable option for you. However, this is considering that you also have a higher risk tolerance.

You can go through Nippon India Credit Risk Fund (NUMBER OF SEGREGATED PORTFOLIOS- 2) here, and if you meet the above criteria, you can invest within minutes!

Things to Consider Before Investing in Credit Risk Funds

● Underlying securities are subject to default risk

As explained earlier, the creditworthiness of companies issuing bonds (of credit risk fund) is average or lower. Meaning these companies may default on repaying the principal amount. Therefore, underlying securities of credit risk funds are subject to default risk.

● Credit rating of the underlying securities may change

The rating agencies regularly review and update the credit ratings of bonds. Therefore, it is not mandatory that the bonds which are currently rated poorly will carry the same rating forever. Therefore, the credit rating of the underlying securities of the credit risk fund is not permanent. Upgrading or downgrading the securities can impact the performance of the credit risk mutual funds.

Taxation of credit risk funds

If your ultra short-term debt fund investment is held for more than 36 months, the gains will be considered long-term capital gains. Such gains are taxed at 20% after indexation for all debt mutual funds. Therefore, long-term investment in ultra-short-term schemes can help you avail of indexation benefits.

If investment is held for more than 36 months, the gains will be considered long-term capital gains. Such gains are taxed at 20% after indexation.

However, w.e.f 1 April 2023, The Finance Bill 2023 has removed indexation benefit on long term capital gain for the investment made in specified mutual fund schemes. In such case, any capital gains would be considered as short term in nature and taxed as per applicable tax rate slab of the investor irrespective of the holding period. This provision is applicable only for any fresh investments made on or after 1 April 2023.

“Specified Mutual Fund” means a Mutual Fund scheme which does not invest more than 35% in equity shares of domestic companies.

FAQs

1. What is credit risk?

Credit risk is the risk associated with a borrower of the loan. It indicates the inability of the borrower to pay back the debt/loan amount. In case the issuer of fixed-income securities defaults, the mutual fund may not receive the due amount in full, which may reflect negatively on the NAV of the scheme.

2. What is the difference between a corporate bond fund and a credit risk fund?

The key difference between a corporate bond fund and a credit risk fund is that of the risk they carry. Comparatively, a corporate bond fund invests primarily in high-quality bonds, which can help them generate relatively stable returns. At the same time, credit risk funds invest predominantly in securities with a lower credit rating which can result in volatile and high-risk returns.

3. Is a credit risk fund a debt fund?

Yes, a credit risk fund is a type of debt mutual fund. These schemes invest predominantly in fixed-income securities with below the higher-rated instruments.

4. What is interest rate risk in debt funds?

Interest rate risk is associated with changes in interest rates that impact the value of fixed-income security. Typically, interest rates in the economy and prices of fixed-income securities share an inverse relationship. When interest rates rise, prices of previously issued fixed-income securities may fall and vice versa.

Additional Read: What are Corporate Bonds?

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material, shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

PRODUCT LABEL

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.