Healthcare and pharma are crucial sectors in any economy. Whether it’s a developed or emerging country, a strong healthcare system plays an important role in its economic development. This also means that the pharma sector has the potential to stay ever-evolving and maypresent an interesting investment opportunity for its investors.And to tap into this evolving sector’s investment opportunities, pharma mutual funds are formed.

What is Pharma Mutual Fund?

Pharma mutual fund is a sectoral fund that primarily invests in companies belonging to the healthcare and pharma sectors. According to Securities and Exchange Board of India (SEBI) regulations, a sectoral fund should invest 80% of its total assets in equity & equity-related instruments of the respective sector.

For example, Nippon India Pharma Fund is an equity scheme investing in the pharma sector to generate returns by investing in equity and equity-related or fixed-income securities of pharma and other associated companies.

Advantages of Sectoral-Pharma Funds

Opportunity to invest in the leading pharma companies

Pharma mutual funds provide an opportunity to invest in some of the healthcare and pharma industry companies, which otherwise might be inaccessible for an average retail investor or will need expertise. As you know, a mutual fund pools money to invest in a basket of securities. This means the portfolio can consist of stocks of multiple companies, and purchasing even a single unit of the mutual fund can expose you to all the underlying stocks. By this means, if a pharmaceutical mutual fund is investing in, let’s say, the top five pharma companies listed on the stock exchange, you can have exposure to all of them at once by starting even a small Systematic Investment Plan (SIP) in that scheme.SIP stands for Systematic Investment Plan, wherein you can regularly invest a fixed amount at periodic intervals and aim for better benefits over a period of time through the power of compounding.

Exposure to the growing sector

The advancement in medical science, changing lifestyle patterns, and rising demand for new medicines &vaccines due to the growing number of diseases are some of the key reasons the healthcare and pharma sector is growing. Also,the low cost of production combined with strong R&D has made India a crucial destination for medical exports. Considering all of this,investing in a pharma mutual fund could be a prudent step to participate in the growth journey of this sector.

Possibility of higher returns in the long run

The pharma sector mutual fund has the potential to generate higher returns when stayed invested for the long term. Investing regularly in a disciplined manner in such schemes can help you build a corpus for your long-term goals like retirement, your child’s future etc.

Additional Read: What are Sectoral Funds?

Who Should Invest in Pharma Mutual Fund?

Investors with a high-risk tolerance

As a Pharma-based

mutual fund is a sectoral fund, there’s a concentration risk associated with such a scheme. This means the entire portfolio might suffer from volatility when the respective sector faces a downturn due to focusing on one specific sector. Since there’s no diversification in the fund’s portfolio, the losses may not be offset by the performance of other sectors or themes. Therefore, investors who can take high-risk and stay invested despite the sector’s underperformance should consider investing in a pharma fund.

Investors with a long-term investment horizon

Economy and sectors tend to move in a cycle, which means what is underperforming today might outperform tomorrow. These ups and downs are inevitable for any sector, but the key is to remain patient and stay invested in going through different phases of the economic cycle. Thus, if you are an investor who can invest for a longer durationin the pharma sector, the pharma sector fund is a suitable scheme for you.

Investors believing in the growth of the pharma sector

If you think that healthcare and pharma sectors are essential for the economic growth of the country and believe thatIndia can potentially have a consumption market big enough to sustain, you should invest in the pharma mutual fund

Factors to Consider Before Investing in Pharma Mutual Fund

Defensive sector

There are two types of sectors in any given economy. Defensive and cyclical. Defensive sectors or stocks are not easily affected by the economic downturn and might continue to perform steadily, irrespective of the financial state of the economy. Cyclical stocks, on the other hand, are those which are directly impacted by the economic downtrend and their performance boosts in a rising economic condition.

Concentration risk involved

Pharma sector mutual funds carry concentration risk as the SEBI mandates pharma mutual funds to invest at least 80% of their total assets in only one sector.

How to invest in Pharma sector mutual funds?

You can start investing in pharma mutual funds online through any mutual fund website that offers Pharma themed funds or by contacting a mutual fund distributor. After KYC verification, investing in pharma sector mutual funds is very simple and quick.

When you invest through a mutual fund distributor, you invest in regular schemes, which may have a slightly higher expense ratio. Whereas, if you invest directly through a website or offline, there will not be any commission charges reserved for the distributor, and you spend comparatively low on expense ratio while investing in the scheme.

If you see potential in India’s pharma sector and want to participate in the growth journey of pharma companies, investing in a pharma mutual fund is a good practice.

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

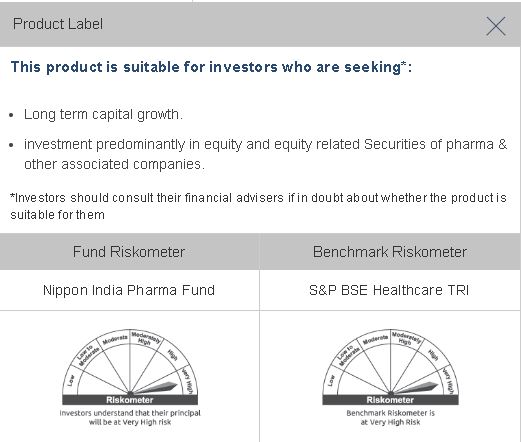

PRODUCT LABEL

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.