Financial emergencies can come anytime without knocking at our doors. Whether it is an unexpected health crisis, a damaged cell phone, or a fender bender, many unplanned expenses often occur at the worst times. If you have been squirrelling away for good times, you might agree that even a small financial cushion can help tide over tough times and make you sleep a little better.

An economic downturn, job losses, or salary cuts may seem out of control. But you can still sail through by setting up a certain amount into your

emergency fund. This pre-planned fund can help you meet many unplanned expenses that are tough to handle otherwise.

Not sure about

how to create an emergency fund? Now is the opportune time to create one. Let us help you understand

emergency fund meaning for the better.

What is an Emergency Fund?

An emergency fund, also known as a contingency fund, refers to the cash reserve that you specifically set aside to deal with financial emergencies or unplanned expenses. You can use it for large or small unplanned payments, like car repairs, medical bills, or home repairs that are not a part of your regular expenses.

Building an emergency fund is an important decision related to a well-rounded financial plan. It ensures that your basic lifestyle does not get affected while facing financial burdens and you can stay afloat without having to resort to debt. In other words, an

emergency fund can help you avoid taking additional loans without clarity on repayment.

How Big Should Your Emergency Fund Be?

While learning

how to build an emergency fund in India, it is key to know that the amount can vary from one individual to another. The size of your fund largely depends on multiple factors, including your income, number of dependents, lifestyle, and existing debt. As a rule of thumb, you can have an amount that can cover essential household expenses for three to six months.

Another way to look at emergency fund size is to consider a recent unexpected situation you've faced and how much it cost. This will give you an idea of how much money you may set aside for an

emergency fund.

How to Build an Emergency Fund?

Given below are a few simple steps to help you get started with building an

emergency fund:

1.Set a realistic goal of setting aside a specific amount by the end of a year or two. The earlier you start, the easier it will be to reach that goal and then plan forward

2.Decide on a monthly commitment based on your goal and then create systems to make the required contributions. You can open a separate bank account or set up automatic recurring transfers

3.Keep a check on your monthly spending and cut unnecessary expenses

4.Reallocate lump sum receivables like bonuses at work or tax refunds towards your

emergency fund

Where to Park Your Emergency Fund?

Once you have built an emergency fund, there are a few options you can choose to park the funds you have, one of which is a liquid fund. It is a category of mutual fund schemes that invests primarily in debt and money-market securities having residual maturity of less than 91 days. The structure of these funds makes them a good option to park money for shorter periods.

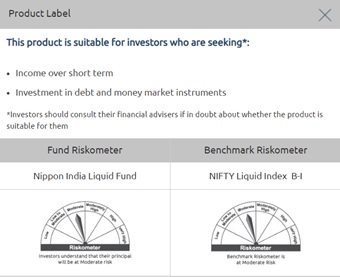

Since they invest in short-term fixed income securities and have the potential offer a slightly higher return than traditional instruments . Their low minimum investment criteria and high liquidity make them an ideal choice to park your emergency fund. As a recommendation, you can benefit from selecting Nippon India Liquid Fund to invest your emergency funds.

Conclusion

Think of

building an emergency fund as investing in a parachute that can save your life when faced with a freefall. Irrespective of your income, it is advisable to learn

how to create an emergency fund. After all, even a small financial cushion is better than having no such cushion at all.

Generic Disclaimer

Disclaimer: The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their associates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.