In a diversified investment portfolio, investors typically tend to have a mix of debt mutual funds and equity mutual funds. Although debt funds are likelier to be less risky than equity funds, it does not mean that they are completely immune from volatility. In the shorter term, debt funds can be volatile largely due to changes in interest rates and this impact can vary across different kinds of debt funds.

In such a scenario, the concept of Macaulay Duration might come in handy since it’s a parameter that takes into account the impact of a change in interest. This article will seek to explain the salient points of the Macaulay Duration concept.

What Is the Macaulay Duration?

Macaulay Duration measures the time taken by an investor to recover his invested money in a bond after taking into account interest receipts and principal repayment. For this purpose, the present cash flows from the bond are considered.

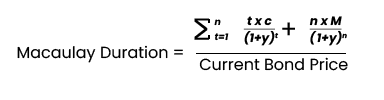

Macaulay Duration Formula

where:

t=Respective time period

C=Periodic coupon payment

y=Periodic yield

n=Total number of periods

M=Maturity value

Factors that Affect Macaulay Duration

One of the main disadvantages of Macaulay Duration is that it assumes the relationship between interest rates and bond prices to be linear. But the reality is different. Typically, there tends to be a deviation from a linear relationship which in other words is termed convexity. In simpler terms, this means that the relationship between the two is more of a curve rather than a straight line.

Furthermore, Macaulay Duration can be effective only when the change in interest rates is small. When the interest rate change is larger, the relationship becomes more convex and this measure of Duration may not work.

To conclude

While Macaulay Duration is one of the concepts used when managing

debt funds , this measure is not likely to work in isolation, and other factors will need to be analyzed as well.

Additional Read:

What is PEG Ratio?

Disclaimer:

Helpful information for investors: All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to be verified on SEBI website under 'Intermediaries/ Market Infrastructure Institutions'. For redressal of your complaints, you may please visit

www.scores.gov.in . For more info on KYC, change in various details & redressal of complaints,visit

mf.nipponindiaim.com/InvestorEducation/what-to-know-when-investing.htm This is an investor education and awareness initiative by Nippon India Mutual Fund.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.