Money and emotions often go hand in hand. Many times, investors may find it difficult to have a practical view towards their mutual fund investments because after all, their life savings are at stake. Having said that, emotional decisions regarding your

investments can be irrational and can result in loss. The volatility risk associated with the stock markets may make an investor restless, but the important thing to remember here is that if you feel compelled to make a decision each time the market

fluctuates, then you are not giving your capital an opportunity to grow.

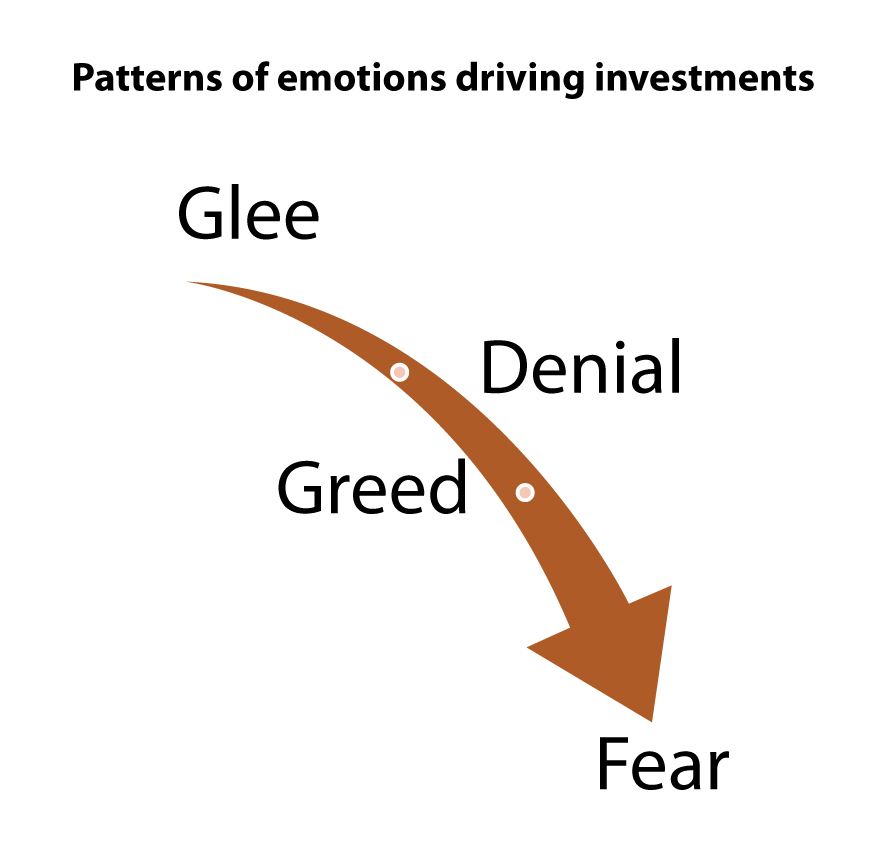

Glee and Greed may go hand in hand when the markets are performing exceptionally well. You see that the value of your investments is at an all-time high and out of sheer excitement, may end up investing in mutual funds when the Net Asset Value is high, thus resulting in the purchase of a much lower number of units with a given amount of investment. However, it ideally should be the other way around, i.e. you buy more when the markets are low.

It is ironic that an emotion like fear which is on the opposite spectrum as compared to glee, may also result in you buying or selling mutual fund units, being overcome by emotions. For example, if you have invested Rs 1,00,000 in an equity mutual fund;

now, when you see the markets going down, you may get scared looking at the virtual value of the loss you are making. However, this loss will remain virtual till the time you actually sell and book this loss. And this is what many investors may end

up doing, owing to the fear of the market falling further. What you need to remind yourself is that the market is cyclical in nature, and the ups and downs are inevitable.

If you have invested in a mutual fund scheme that has seen returns below the category benchmark for a long continuous period of time, many investors can be in denial that it may have been a loss-making decision after all. You may have earned better returns

in the beginning, but it is not advisable to be in denial and stick to that performance memory while making further losses.

How to avoid emotional investing?

The above mentioned are only a few of the many emotions that may drive your investment decisions. If you identify with these emotional investing trends, then it is time for a hard stop. Below are some tips to help you wean the emotions off from your investing

journey-

Invest via SIP

Investing via the systematic investment plan in a mutual fund scheme may help in spreading your costs and risks, over a period of time. Since it requires you to

invest a fixed sum of amount at periodic intervals, you end up buying more units when the markets are down and vice versa, thereby averaging out your purchase NAV. This

principle is called rupee cost averaging (RCA ). For example, if you have Rs 5,00,000 to invest, then rather than timing the market to see when to

invest this lump sum money; you can invest it in 10 chunks of Rs 50,000 every month. If the market is low in a particular month, then you buy a higher number of units and vice versa. Hence, your emotions are at bay.

Monitor portfolio performance regularly

Your portfolio’s value may go through many ups and downs until you decide to redeem the investments. Checking the performances of the schemes you are invested in every single day, may cause anxiety and fear of the unknown. Having said that, you also need

to monitor the portfolio performance in order to ensure that you are on the right course to achieve your life goals. Hence, its advisable to fix a time period, ideally quarterly, to review the performance of the schemes you are invested in and make

any changes, if required, basis the performance analysis.

Focus on your goals and asset allocation

As long as you are investing in the schemes that match your goals and investment horizon, you need not worry about the everyday performance of the schemes. You can instead focus on how close you are to your goal, and if you have diversified enough in

order to hedge risks. Asset allocation is an important factor in diversification wherein you decide which asset type will have what kind of an allocation

in your portfolio. You may get in touch with your financial advisor for further advice on asset allocation.

When we mix emotions with investments, we may end up compromising the heights to which we can take our mutual fund investments, by sheer patience and a will to stay invested. When you think long-term, it is easier to let go of the short-term fluctuations

in the market for a larger objective of achieving your goals. Happy investing!

"ABOVE INFORMATION IS ONLY FOR UNDERSTANDING, IT IS NOT DIRECTLY OR INDIRECTLY RELATED TO THE PERFORMANCE OF ANY SCHEME OF Nippon India Mutual Fund. THE VIEWS EXPRESSED HEREIN CONSTITUTE ONLY THE OPINIONS AND DO NOT CONSTITUTE ANY GUIDELINES OR RECOMMENDATION ON ANY COURSE OF ACTION TO BE FOLLOWED BY THE READER. THIS INFORMATION IS MEANT FOR GENERAL READING PURPOSES ONLY AND IS NOT MEANT TO SERVE AS A PROFESSIONAL GUIDE FOR THE READERS."

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully