For newcomers in the world of investing, terms like market volatility can get them worried about what will happen to their hard-earned money. The market has many components, and it can take years for investors to learn how to invest safely and at the right time. However, even then, the market can still be difficult to predict.

This is why many investors choose mutual funds.

Mutual funds help you participate in the market with minimal knowledge and expertise. While every mutual fund is unique and different, balanced advantage funds have recently caught the fancy of investors.

What are balanced advantage funds?

Balanced advantage funds are a

type of mutual fund that invests in equities and debt instruments. These funds are dynamic, which means fund managers have the liberty to allocate more investments to equities or debt based on market conditionsand subject to asset allocation limits specified in the respective Scheme Information Document.

In an expensive market, where stocks trade at high prices, they may increase exposure to debt instruments, and vice versa. Therefore, when the equity market becomes expensive, your funds may be moved into the relatively less volatile debt market (also called rebalancing the portfolio) depending upon the fund manager’s view.

The fund manager essentially sells equity and related securities to rebalance the portfolio and buys debt securities. Traditional fund managers do not have this freedom as they operate on a predefined equity to debt ratio. However, balanced advantage fund managers have some leeway in how they structure their portfolio, so they have more flexibility in how much of their portfolio they allocate to debt vs. equity.

This makes balanced advantage funds worth considering for long-term investors. Wealth creation and protection are equally valuable for such funds.

Benefits of balanced advantage funds

● Fund managers can increase their allocation to equity when they think there are opportunities in the market. The investment performs well if the market improves, which boosts investors’ portfolios. Once the stock price becomes extremely high, fund managers may shift the capital into debt instruments. The dynamic switch from one asset class to another ensures investors do not suffer when either asset underperforms.

● Balanced advantage funds also offer the right tools to create a wealth corpus. The dynamic allocation ensures the fund invests in the right asset at the right time. Doing it consistently protects investors from volatility and helps them earn returns.

Together, both these features aid in long-term wealth creation.

How to invest in balanced advantage funds?

You can invest in balanced advantage funds through a

Systematic Investment Plan (SIP) or lump-sum investment. The former allows you to invest small amounts regularly, while the latter works well if you need to invest a significant amount at once.

SIPs are especially popular as they help compound wealth and inculcate the habit of investing. If you’re wondering how to start SIP investment, you can begin with the

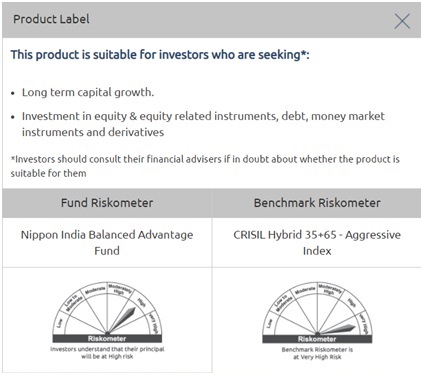

Nippon India Balanced Advantage Fund. From the fund’s performance to its top holdings, it has all the details you need to invest.

Also, you can use the

SIP calculator to know the estimated returns on your investments. The SIP calculator evaluates your financial goal to present the SIP amount needed to turn it into reality.

Wrapping up

Long-term investors worried about the volatility in the market can consider investing in balanced advantage funds. With a dynamic investment strategy, balanced advantage funds ensure your capital faces lesser volatility and stays secure.

Disclaimer

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Disclaimer: The SIP Calculator results are based on an assumed rate of return. Please get in touch with your professional advisor for a detailed suggestion. The results are based on an assumed rate of return. The calculations are not based on any judgments of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as promise on minimum returns and/or safeguard of capital. While utmost care has been exercised while preparing the calculator, NIMF does not warrant the completeness or guarantee that the achieved computations are flawless and/or accurate and disclaims all liabilities, losses and damages arising out of the use or in respect of anything done in reliance of the calculator. The examples do not purport to represent the performance of any security or investments. In view of individual nature of tax consequences, each investor is advised to consult his/ her own professional tax/ financial advisor before taking any investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.