In the last five decades or so, technology has grown by leaps and bounds around the world, including in India. It has come a long way from bulky desktop computers to laptops and tablets, from telephone instruments to nimble smartphones and so on. Today, many companies seem to be investing in technology to automate processes and streamline operations in their respective field. Artificial intelligence,in this regard,appears to be the latest buzzword doing the rounds.

In the world of data, particularly, algorithms and complex models built to process large quantities of data are changing the way companies operate. But what exactly are quant funds? And how do they work? This article will seek to give some flavour on them based on which an informed decision can be made.

WHAT ARE QUANT FUNDS?

.

A quant fund is a type of mutual fund that uses mathematical and statistical models or pre-determined algorithms to arrive at an investment decision based on which trades can be carried out. Since these proprietary system-basedmodels are structured around certain criteria, no human judgement is involved. The fund manager builds the portfolio based on the output generated from these mathematical models.

How Does a Quant Fund Work?

Since quant funds use algorithms, it involves making certain inputs based on rules that result in an output. The fund manager will accordingly make investment decisions based on the output generated. It must be noted that while there is not much human judgement involved in running a quant fund, a significant amount of thought has likely gone in while designing the quant fund itself before its launch. It also means that the fund manager can streamline the algorithms or make certain changes in the models as and when required.

Quant funds can come in various avatars and be designed based on parameters such as valuation ratios, market capitalisation, sectoral indicators, etc. They could be either single-parameter quant funds or multi-parameter quant funds. In the case of single-parameter quant funds, the factor can either be a certain ratio like price to earnings , a quality indicator like return on equity, or a measure of volatility such as beta. Multi-parameter quant funds can be more complex because two or more factors are involved.

Thus, while operating quant funds, a universe is first defined; this could be the BSE 200, the BSE 500, or any other index. Next, after applying the quant model, this universe is probably narrowed down to a list of 50 companies. After this, the companies are likely ranked based on the quant factor post which the fund manager constructs the investment portfolio that more or less replicates the results of the model.

Significance of Quant Mutual Funds

The essential significance of quant funds lies in the way it eliminates human bias. For example, suppose the primary quant factor is to select companies with robust growth potential and healthy balance sheets. In that case, the system automatically rejects heavily leveraged companies or whose profits have grown poorly. The results generated are unbiased, given that a consistent approach is followed across market cycles. Thus, it can ensure that the investments are not based on sentiments but on rationale embedded in the model.

अतिरिक्त जानकारी: What are Small Cap Funds ?

Benefits of investing in Quant Mutual Funds

Investing in quant mutual funds has its share of benefits. These are listed below:

• Human judgement tends to be irrational because there are times when decisions can be made based on sentiments, which can affect a fund’s returns. Because quant funds rely on a system-based approach, the risk of human bias is reduced.

• Quant funds can be scalable based on how they are built, with the capability to analyse large amounts of data in short period of time.

• Decision-making tends to be a faster process because the fund relies on quantitative models.

• Management fees tend to be lower since these funds are predominantly passive.

How to invest in Quant Mutual Funds?

The process of investing in quant funds is the same as investing in any other mutual fund scheme. Once you have selected the quant fund of your choice, you can invest in them either directly through the fund house or through mutual fund distributors. You could also consider investing in Nippon India Quant Fund.

समाप्त करने के लिए

Quant funds can be an option for investors with a long-term investment horizon, given that the data-driven strategy of these funds can take time to deliver returns. Investors looking to diversify their mutual fund portfolios can also consider these funds.

डिस्क्लेमर:

यहां दी गई जानकारी केवल सामान्य पढ़ने के उद्देश्यों के लिए है और व्यक्त किए जा रहे विचार केवल राय बनाते हैं और इसलिए इन्हें पाठकों के लिए दिशानिर्देश, सिफारिशें या पेशेवर मार्गदर्शक के रूप में नहीं माना जा सकता है. ये डॉक्यूमेंट, सार्वजनिक रूप से उपलब्ध जानकारी, आंतरिक रूप से विकसित डेटा और विश्वसनीय माने जाने वाले अन्य स्रोतों के आधार पर तैयार किए गए हैं. प्रायोजक, इन्वेस्टमेंट मैनेजर, ट्रस्टी या उनके निदेशक, कर्मचारी, सहयोगी या प्रतिनिधि ("संस्थाएं और उनके सहयोगी") ऐसी जानकारी की सटीकता, पूर्णता, पर्याप्तता और विश्वसनीयता की ज़िम्मेदारी या गारंटी नहीं लेते हैं. इस जानकारी के प्राप्तकर्ताओं को सलाह दी जाती है कि वे अपने स्वयं के विश्लेषण, व्याख्या और जांच पर भरोसा करें. किसी भी इन्वेस्टमेंट निर्णय पर पहुंचने के लिए पाठकों को स्वतंत्र प्रोफेशनल सलाहकार से परामर्श लेने की भी सलाह दी जाती है. इस सामग्री की तैयारी या जारी करने में शामिल व्यक्तियों सहित संस्थाएं और उनके सहयोगी, इस सामग्री में शामिल जानकारी से उत्पन्न होने वाले हानि के कारण, किसी भी प्रत्यक्ष, अप्रत्यक्ष, विशेष, आकस्मिक, परिणामी, दंडात्मक या अनुकरणीय नुकसान के लिए किसी भी तरह से उत्तरदायी नहीं होंगे. इस डॉक्यूमेंट के आधार पर लिए गए किसी भी निर्णय के लिए केवल प्राप्तकर्ता ही पूरी तरह से ज़िम्मेदार होंगे.

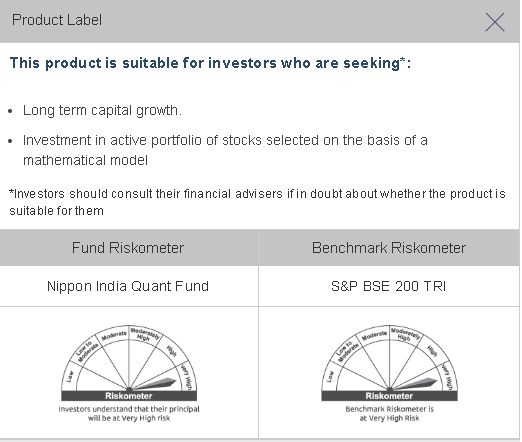

उत्पाद लेबल

म्यूचुअल फंड इन्वेस्टमेंट मार्केट जोखिमों के अधीन हैं, स्कीम से संबंधित सभी डॉक्यूमेंट को ध्यान से पढ़ें.