आमतौर पर जब आपको अपना वार्षिक बोनस मिलता है तो आप क्या करते हैं? इसे भविष्य के कुछ लक्ष्यों के लिए अलग रखें, इसे पारंपरिक इन्वेस्टमेंट इंस्ट्रूमेंट में सुरक्षित रखें, या कुछ लोन के प्री-पेमेंट के लिए इसका उपयोग करें, अधिकार? अगर इस पैसे को तीन से छह महीनों की अल्पकालिक अवधि के लिए पार्क करने का विकल्प था तो क्या होगा? और अगर आप ऐसे इन्वेस्टमेंट से रिटर्न अर्जित कर सकते हैं, तो क्या होगा? शानदार लगता है, क्या यह नहीं है? ठीक है, ठीक है. यहां आपके अतिरिक्त निधियों के लिए एक पार्किंग स्थान है जो पहुंच और लाभदायक दोनों ही हो सकते हैं. अल्ट्रा-शॉर्ट-टर्म फंड/अल्ट्रा शॉर्ट ड्यूरेशन फंड.

अल्ट्रा शॉर्ट ड्यूरेशन फंड क्या हैं?

अल्ट्रा-शॉर्ट-टर्म फंड डेट म्यूचुअल फंड का एक प्रकार है जो तीन से छह महीनों की मेच्योरिटी वाली सिक्योरिटीज़ में इन्वेस्ट करता है. ये फंड ओपन-एंडेड डेट स्कीम हैं, अर्थात निवेशक इन स्कीमों में किसी भी समय अपने फंड को निवेश और निकाल सकते हैं. यह क्लोज-एंडेड स्कीम के विपरीत है जहां निवेशक केवल विशिष्ट अवधियों के दौरान ही स्कीम में प्रवेश या बाहर निकल सकते हैं. इसलिए, अल्ट्रा-शॉर्ट-टर्म फंड में ट्रांज़ैक्शन करना आसान और सुविधाजनक हो सकता है.

एक और कारण क्यों अल्ट्रा शॉर्ट ड्यूरेशन फंड इन्वेस्टमेंट से फंड एक्सेस करना आसान हो सकता है क्योंकि इन स्कीमों का उद्देश्य ट्रेजरी बिल, मनी मार्केट इंस्ट्रूमेंट, कमर्शियल पेपर, डिपॉजिट सर्टिफिकेट आदि जैसे अत्यधिक लिक्विड डेट इंस्ट्रूमेंट में निवेश करना है. अब जब आप अल्ट्रा-शॉर्ट-टर्म डेट फंड की बुनियादी बातें समझ गए हैं, आइए देखते हैं कि ये फंड कैसे काम करते हैं.

अल्ट्रा शॉर्ट-टर्म म्यूचुअल फंड कैसे काम करते हैं?

भारत में सभी पारस्परिक निधियों की तरह, अल्ट्रा शॉर्ट-टर्म म्यूचुअल फंड को भारतीय प्रतिभूति और विनिमय बोर्ड (सेबी) द्वारा विनियमित और निगरानी की जाती है. सेबी द्वारा निर्धारित नियम, विनियम और दिशानिर्देश निवेश में पारदर्शिता सुनिश्चित करते हैं और निवेशकों के हितों को सुरक्षित रखते हैं.

SEBI नियमों के अनुसार, ये स्कीम मुख्य रूप से 3-6 महीनों की मेच्योरिटी के साथ डेट सिक्योरिटीज़ में इन्वेस्ट करती हैं. इस कम परिपक्वता के कारण, अल्ट्रा-शॉर्ट-टर्म फंड में निवेश को कम जोखिम माना जा सकता है. कम जोखिम वाले इन्वेस्टमेंट का एक और कारण यह है कि इन फंड की अंतर्निहित सिक्योरिटीज़ प्राइवेट कंपनियों के स्टॉक या इक्विटी में इन्वेस्ट करने की तुलना में तुलनात्मक रूप से कम अस्थिर होती हैं.

अल्ट्रा शॉर्ट टर्म फंड स्कीम में इन्वेस्टमेंट पर रिटर्न की गणना नेट एसेट वैल्यू (एनएवी) में फंड के बदलाव के आधार पर की जाती है, जो मार्केट में प्रचलित ब्याज़ दरों के आधार पर उतार-चढ़ाव करता है. हालांकि, इन फंड द्वारा जनरेट किए गए रिटर्न की भविष्यवाणी की जा सकती है क्योंकि पूंजी निश्चित मेच्योरिटी के साथ इंस्ट्रूमेंट के संपर्क में आती है.

लिक्विड फंड और अल्ट्रा-शॉर्ट ड्यूरेशन फंड के बीच अंतर

अल्ट्रा शॉर्ट-टर्म फंड 3-6 महीनों की मेच्योरिटी वाली सिक्योरिटीज़ में इन्वेस्ट करने वाली डेट स्कीम हैं. दूसरी ओर, तरल निधियां, कम परिपक्वताओं वाली प्रतिभूतियों में निवेश करने का लक्ष्य रखती हैं. जैसा कि नाम से पता चलता है, तरल निधियों का प्राथमिक उद्देश्य तरलता प्रदान करना है, अर्थात निवेशकों को निधियों तक आसान पहुंच. इसलिए, लिक्विड म्यूचुअल फंड आमतौर पर 91 दिनों तक की मेच्योरिटी के साथ डेट सिक्योरिटीज़ में इन्वेस्ट करते हैं. अंतर्निहित प्रतिभूतियों की परिपक्वता अवधि के अलावा, तरल निधि और अति-अल्ट्रा-शॉर्ट अवधि निधि के बीच कोई प्रमुख अंतर नहीं है. कराधान नियम दोनों ऋण योजनाओं के लिए समान हैं. निवेशकों को उनके निवेश उद्देश्य और क्षितिज के अनुसार फंड चुनना चाहिए.

आपको अल्ट्रा-शॉर्ट-ड्यूरेशन फंड में क्यों इन्वेस्ट करना चाहिए?

● आसान लिक्विडिटी

पारंपरिक निवेश विधियों के विपरीत, जहां निधियों की समय से पहले निकासी के लिए शास्ति है, अल्ट्रा-शॉर्ट अवधि म्यूचुअल फंड उनकी तुलना में उच्च और आसान तरलता प्रदान करते हैं. ये फंड किसी भी लॉक-इन अवधि को नहीं लेते हैं और छोटी अवधि में सामान्य रिटर्न प्रदान करने का लक्ष्य रखते हैं.

● कम जोखिम वाले निवेश

जैसा कि ऊपर बताया गया है, अल्ट्रा-शॉर्ट-टर्म फंड ऋण प्रतिभूतियों जैसे ट्रेजरी बिल, सरकारी प्रतिभूतियां, वाणिज्यिक कागजात आदि में निवेश करते हैं जो अपेक्षाकृत स्थिर उपकरण होते हैं और इक्विटी की तुलना में तुलनात्मक रूप से कम अस्थिरता वाले होते हैं. इसके अलावा, सिक्योरिटीज़ की कम होल्डिंग अवधि आपके अन्य जोखिमों जैसे ब्याज़ दर जोखिम, अवधि जोखिम या क्रेडिट जोखिम को कम करती है.

● बेहतर रिटर्न की संभावना

हालांकि अल्ट्रा-शॉर्ट-टर्म म्यूचुअल फंड द्वारा जनरेट किए गए रिटर्न की गारंटी नहीं दी जाती है, लेकिन वे पारंपरिक इन्वेस्टमेंट इंस्ट्रूमेंट की तुलना में अपेक्षाकृत बेहतर और अधिक प्रिडिक्टेबल रिटर्न प्रदान करते हैं.

अल्ट्रा-शॉर्ट ड्यूरेशन डेट फंड पर टैक्स

चूंकि अल्ट्रा-शॉर्ट-ड्यूरेशन फंड डेट म्यूचुअल फंड हैं, इसलिए इन स्कीमों पर ऋण श्रेणियों के कराधान नियमों का उपयोग किया जाता है. इसका मतलब है कि अगर आप 36 महीनों तक के अल्ट्रा शॉर्ट-टर्म फंड में इन्वेस्टमेंट करते हैं, तो इन्वेस्टमेंट पर अर्जित रिटर्न को शॉर्ट-टर्म कैपिटल गेन माना जाएगा और आपकी टैक्सेबल इनकम में जोड़ा जाएगा. इस प्रकार आपके टैक्स स्लैब रेट के अनुसार इन लाभों पर टैक्स लगाया जाएगा.

अगर आपका अल्ट्रा शॉर्ट-टर्म डेट फंड इन्वेस्टमेंट 36 महीनों से अधिक समय के लिए होल्ड किया जाता है, तो लाभ को लॉन्ग-टर्म कैपिटल गेन माना जाएगा. ऐसे लाभों पर सभी डेट म्यूचुअल फंड के इंडेक्सेशन के बाद 20% टैक्स लगाया जाता है. इसलिए, अल्ट्रा-शॉर्ट-टर्म स्कीम में लॉन्ग-टर्म इन्वेस्टमेंट आपको इंडेक्सेशन लाभ प्राप्त करने में मदद कर सकता है .

हालांकि, 1 अप्रैल 2023 से लागू, फाइनेंस बिल 2023 ने निर्दिष्ट म्यूचुअल फंड स्कीम में किए गए निवेश के लिए लॉन्ग टर्म कैपिटल गेन पर इंडेक्सेशन लाभ हटा दिया है. ऐसी स्थिति में, किसी भी पूंजी अभिलाभ को प्रकृति में अल्पकालिक माना जाएगा और धारण अवधि के बावजूद निवेशक के लागू कर दर स्लैब के अनुसार कर लगाया जाएगा. यह प्रावधान केवल 1 अप्रैल 2023 को या उसके बाद किए गए किसी भी नए निवेश के लिए मान्य है.

“Specified Mutual Fund” means a Mutual Fund scheme which does not invest more than 35% in equity shares of domestic companies.

अल्ट्रा-शॉर्ट-ड्यूरेशन फंड में किसे इन्वेस्ट करना चाहिए?

कुछ महीनों की अल्पकालिक अवधि के लिए एकमुश्त राशि निर्धारित करना चाहने वाले निवेशक अल्ट्रा-शॉर्ट-टर्म म्यूचुअल फंड में निवेश करने पर विचार कर सकते हैं. ये स्कीम छोटे निवेश क्षितिज वाले निवेशकों के लिए उपयुक्त हैं.

एसटीपी (सिस्टमेटिक ट्रांसफर प्लान) सुविधा का विकल्प चुनने वाले निवेशकों के लिए अल्ट्रा-शॉर्ट-टर्म फंड भी उपयुक्त हैं. एसटीपी आपको एक म्यूचुअल फंड स्कीम से दूसरी स्कीम में एक निश्चित राशि ट्रांसफर करने की अनुमति देता है.

उदाहरण के लिए, अगर आपके पास लंबी अवधि के लिए इन्वेस्ट करने के लिए एकमुश्त राशि है, तो आप इसे एक बार में इक्विटी फंड में डालने के बजाय, अल्ट्रा-शॉर्ट-टर्म फंड और शिड्यूल एसटीपी में इन्वेस्ट कर सकते हैं जो आपकी पसंद की इक्विटी स्कीम में समय-समय पर एक निश्चित राशि ट्रांसफर करेगा. इस तरह, आप रुपये की औसत लागत का अधिकतम लाभ उठा सकते हैं और डेट और इक्विटी स्कीम दोनों में इन्वेस्टमेंट पर रिटर्न अर्जित कर सकते हैं.

अल्ट्रा-शॉर्ट-ड्यूरेशन फंड में इन्वेस्ट करते समय विचार करने लायक कारक

● संबंधित जोखिम

डेट म्यूचुअल फंड निवेश की एक बुनियादी अवधारणा यह है कि अंतर्निहित प्रतिभूतियों की होल्डिंग अवधि जितनी अधिक होगी, ब्याज दर आंदोलन से नकारात्मक रूप से प्रभावित होने की संभावना उतनी ही अधिक होगी. इसे अवधि जोखिम कहा जाता है. इसलिए, लंबी मेच्योरिटी अवधि वाले डेट इन्वेस्टमेंट ब्याज़ दर साइकिल से प्रभावित होने की संभावना अधिक होती है.

इसके अलावा, अल्ट्रा-शॉर्ट-टर्म म्यूचुअल फंड में निवेश करते समय क्रेडिट जोखिम पर विचार किया जाना चाहिए. अगर फंड मैनेजर में फंड पोर्टफोलियो में कम क्रेडिट-रेटेड इंस्ट्रूमेंट शामिल हैं, तो इस फंड में आपका इन्वेस्टमेंट क्रेडिट जोखिम के संपर्क में आता है.

● योजना का रिकॉर्ड ट्रैक करें

अपने पिछले निष्पादन के आधार पर म्यूचुअल फंड स्कीम में निवेश शुरू करना बुद्धिमानी नहीं है. तथापि, निधि प्रबंधन के ट्रैक रिकॉर्ड के आधार पर एक योजना का मूल्यांकन करना एक अच्छी प्रथा हो सकती है. चेक करें कि विभिन्न आर्थिक चक्रों में निधि कैसे निष्पादित की गई है. स्कीम और फंड हाउस का ट्रैक रिकॉर्ड चेक करने से यह सुनिश्चित होगा कि आपका इन्वेस्टमेंट एक विश्वसनीय अल्ट्रा-शॉर्ट-टर्म डेट फंड में है.

● निवेश का उद्देश्य और अवधि

निवेश लक्ष्यों और क्षितिज को ध्यान में रखते हुए चाहे वह कोई भी निवेश हो, अत्यंत महत्वपूर्ण है. अगर आपका इन्वेस्टमेंट अवधि एक वर्ष से कम है, तो निप्पॉन इंडिया अल्ट्रा-शॉर्ट ड्यूरेशन फंड जैसे अल्ट्रा-शॉर्ट-टर्म फंड में इन्वेस्ट करना समझदारी है.

● फंड मैनेजमेंट/एक्सपेंस रेशियो की लागत

प्रत्येक म्यूचुअल फंड में कुछ फंड मैनेजमेंट फीस होती है, जिसे एक्सपेंस रेशियो भी कहा जाता है . हालांकि सेबी के नियमों ने इस शुल्क को 1.05% पर सीमित किया है, लेकिन किसी भी अल्ट्रा-शॉर्ट-टर्म डेट फंड में इन्वेस्ट करने से पहले यह एक महत्वपूर्ण कारक है. स्कीम का खर्च अनुपात जितना कम होगा, आपके पोर्टफोलियो में थोड़ा अधिक रिटर्न दिखाई दे सकता है.

अल्ट्रा शॉर्ट-टर्म म्यूचुअल फंड में निवेश कैसे करें?

आप अल्ट्रा-शॉर्ट-टर्म म्यूचुअल फंड में इन्वेस्ट करने के लिए लंपसम इन्वेस्टमेंट मोड या एसआईपी सिस्टमेटिक इन्वेस्टमेंट प्लान* रूट का विकल्प चुन सकते हैं. इन स्कीम में इन्वेस्टमेंट की कोई अधिकतम सीमा नहीं है, और आप कम से कम रु. 500 से भी शुरू कर सकते हैं. अभी इन्वेस्ट करने के लिए, हमारे निप्पॉन इंडिया अल्ट्रा शॉर्ट ड्यूरेशन फंड पेज पर जाएं.

आप किसी भी एएमसी की वेबसाइट या निवेश पोर्टल के माध्यम से अल्ट्रा-शॉर्ट-ड्यूरेशन फंड में आसानी से निवेश करना शुरू कर सकते हैं. आपका केवाईसी सत्यापन पूरा होने के बाद, निवेश शुरू करना एक आसान, झंझट-मुक्त प्रक्रिया है. ऑनलाइन प्लेटफॉर्म के साथ, अब यह मॉनिटर करना और अपने इन्वेस्टमेंट को भी रिडीम करना बहुत आसान है.

बॉटम लाइन यह है कि अगर आप अपने सरप्लस को पार्क करने या शॉर्ट अवधि के लिए स्थिर और सुरक्षित इंस्ट्रूमेंट में इन्वेस्ट करने के लिए कम जोखिम वाले इन्वेस्टमेंट विकल्प की तलाश कर रहे हैं, तो अल्ट्रा-शॉर्ट-टर्म फंड सही विकल्प हो सकते हैं.

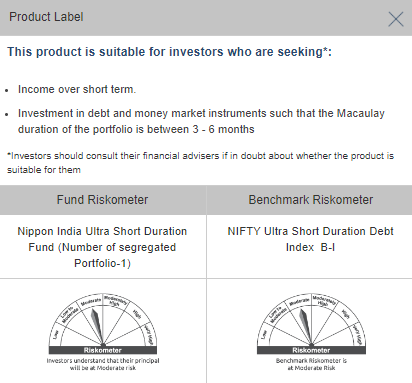

उत्पाद लेबल

*एसआईपी का मतलब है सिस्टमेटिक इन्वेस्टमेंट प्लान. इसमें आप एक निश्चित अवधि के अंतराल पर, किसी तय राशि को नियमित रूप से इन्वेस्ट कर सकते हैं और कंपाउंडिंग रिटर्न के माध्यम से बेहतर लाभ पा सकते हैं.

डिस्क्लेमर:

यहां दी गई जानकारी केवल सामान्य पढ़ने के उद्देश्यों के लिए है और व्यक्त किए जा रहे विचार केवल राय बनाते हैं और इसलिए इन्हें पाठकों के लिए दिशानिर्देश, सिफारिशें या पेशेवर मार्गदर्शक के रूप में नहीं माना जा सकता है. ये डॉक्यूमेंट, सार्वजनिक रूप से उपलब्ध जानकारी, आंतरिक रूप से विकसित डेटा और विश्वसनीय माने जाने वाले अन्य स्रोतों के आधार पर तैयार किए गए हैं. प्रायोजक, इन्वेस्टमेंट मैनेजर, ट्रस्टी या उनके निदेशक, कर्मचारी, सहयोगी या प्रतिनिधि ("संस्थाएं और उनके सहयोगी") ऐसी जानकारी की सटीकता, पूर्णता, पर्याप्तता और विश्वसनीयता की ज़िम्मेदारी या गारंटी नहीं लेते हैं. इस जानकारी के प्राप्तकर्ताओं को सलाह दी जाती है कि वे अपने स्वयं के विश्लेषण, व्याख्या और जांच पर भरोसा करें. किसी भी इन्वेस्टमेंट निर्णय पर पहुंचने के लिए पाठकों को स्वतंत्र प्रोफेशनल सलाहकार से परामर्श लेने की भी सलाह दी जाती है. इस सामग्री की तैयारी या जारी करने में शामिल व्यक्तियों सहित संस्थाएं और उनके सहयोगी, इस सामग्री में शामिल जानकारी से उत्पन्न होने वाले हानि के कारण, किसी भी प्रत्यक्ष, अप्रत्यक्ष, विशेष, आकस्मिक, परिणामी, दंडात्मक या अनुकरणीय नुकसान के लिए किसी भी तरह से उत्तरदायी नहीं होंगे. इस डॉक्यूमेंट के आधार पर लिए गए किसी भी निर्णय के लिए केवल प्राप्तकर्ता ही पूरी तरह से ज़िम्मेदार होंगे.

म्यूचुअल फंड इन्वेस्टमेंट मार्केट जोखिमों के अधीन हैं, स्कीम से संबंधित सभी डॉक्यूमेंट को ध्यान से पढ़ें.