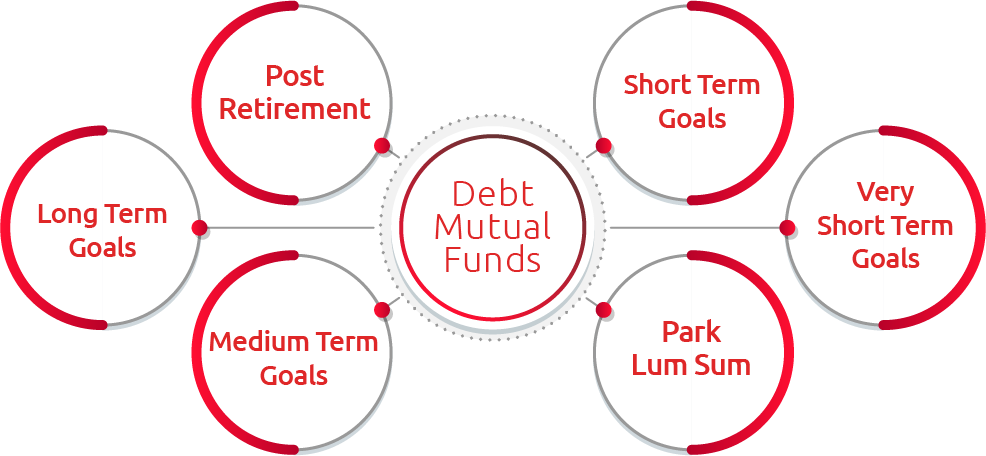

Your life goals may vary depending on which life-stage you are in. If you are a young professional in your 20s, your long-term goals may not be very clearly defined yet, but you may have a lot of short-term goals to fulfil. On the

other hand, in your late 30s, your plan may change considerably, given that your liabilities increase, and your long-term goals seem more important. Investing in debt funds can benefit you in every stage of life and for almost

any kind of goal.

Debt funds are ideally used for short and medium-term goals but can be used for long-term investments as well by the risk-averse investors. They may not be able to create the amount of wealth that an equity mutual fund may give you

an opportunity to create, but a debt mutual fund can be a relatively safer investment option if higher returns are not a priority. There are two modes of investing in debt funds Systematic Investment Plan (SIP) and Lumpsum. When

you invest via SIP, you invest a pre-decided amount at regular intervals in the debt fund; whereas, when you invest via lump sum, you make a one-time investment in the fund.

Your choice of debt mutual funds is unique to your goals and should not get affected by what the world or other investors say about the debt mutual funds for lump sum investment or the debt funds for better returns.

You should make your own decisions based on your customised needs with the help of a debt fund calculator.

Let us look at how to invest in debt funds effectively as per your various goalsYou can read more about the types of debt funds It might be relevant

Very-short term goals (< 1 year)

Goals like parking your funds for a short period of time because of excess cash or investing for your child’s annual school fee fall under this category. These goals will require you

to have minimal risk associated with your investment, and hence, Liquid funds, Overnight funds, Ultra Short Duration funds or money market funds may be more ideal. The returns you receive from these funds are relatively more stable

and may have high liquidity.

Short-term goals (1-3 years)

Buying a new car, saving for the down payment of your house, an international vacation etc. are the short-term goals we are talking about. You can invest in Short Duration debt fund, Corporate

Bond fund or Banking & PSU fund. These funds have a higher return potential than the categories mentioned above. You can read more about achieving short term goals with debt funds,

Medium-term goals (3-5 years)

Marriage, creation of an emergency fund or a big function in your family can be a few examples of your medium-term goals. Here, because of the longer investment horizon, you may be open

to a slightly higher risk exposure (if your risk appetite allows, and if it does, then Dynamic Bond fund and Medium Duration debt fund can be good bets for you. The dynamic bond fund invests across securities and changes its allocation

as per the market scenario. Gilt funds that invest in Government securities are also apt for investors with an investment horizon of 3 years and above.

Long-term goals (5-7, >7 years)

Children’s education, marriage, etc. are the goals in this category. You can also invest in Long Duration debt Funds. These funds are more sensitive to interest rate changes due to a

higher duration, hence being a bit higher on the risk. The dynamic Bond fund also is quite a popular fund in this category of goals.