Mr. Verma and Mr. Sharma were sipping a hot cup of tea on a cold morning and were discussing how over the years gold prices have kept increasing. Just then Rohan, Mr. Verma's son, walked in and joined the discussion. He brought to their notice Gold FOFs. They were curious to understand how it works and what would be the benefits.

Gold FOFs – Meaning

A Gold FOF is a passive fund which invests in Gold Exchange Traded Fund (ETF). So, they have all the features of any other mutual fund like SIP option, lump sum option, small investment and withdrawal at any time but with the underlying asset being gold ETF which further invest in physical gold.

Rohan then introduced them to

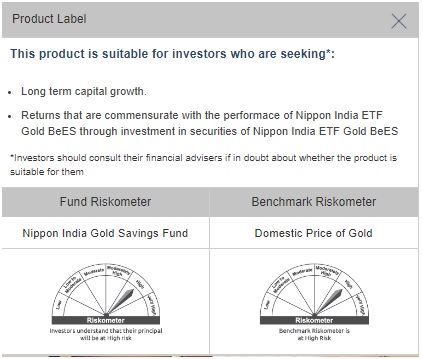

Nippon India Gold Savings Fund and highlighted the benefits of investing in Gold FOFs.

Top reasons to invest in Gold FOFs

1. Gold will likely stand the test of time

As history has witnessed, all forms of investment may fall and rise, but gold will likely stand the test of time and may provide returns. Hence, even in the worst of crises, gold may still hold some value.

2. Gold is money

For over 3000 years gold has been a store of value, and stands as the oldest currency. Although it is no longer used as a currency, it holds great tradeable value. It helps to increase the wealth over a period of time.

3. Gold serves a hedge against inflation

Gold may help in beating

inflation . Over the last decade, gold prices have quadrupled, although inflation has exceeded the interest rate. So having gold in your portfolio, helps in mitigating risk at inflationary times.

4. Gold is a simple form of investment

From a highly educated person to a simple wage earner, investing in gold is understood by all. It is not complex like cryptocurrency or stocks.

5. Gold FOFs ensures hassle-free storage

With gold based mutual funds like Nippon India Gold Savings Fund Scheme holding a gold investment in the portfolio means no storage costs, no risk of holding the investment at home nor paying bank safekeeping charges. Although the scheme will have charges it would not carry the risk of holding physical gold.

6. Gold FOFs diversify the Portfolio

Having gold in your investments means your portfolio stands diversified. A diverse portfolio may ensure cushioning your losses, as a fall in one asset can be mitigated by profit in the other. It is being wise and not burying all your treasure in one place.

7. Gold FOFs can be started with a small amount

While buying gold in a decent quantity can be out of reach, investing small amounts periodically is doable and can help in realising this dream.

8. Gold FOF is less volatile comparatively

While the stock market fluctuates rather rapidly with changes in any economic, monetary or geopolitical crisis, gold based mutual funds are relatively resilient.

9. No Demat account required

There are no additional charges to be incurred for opening a Demat account since gold based mutual funds are like any other mutual funds .

Conclusion

Mr. Sharma and Mr. Verma were delighted to learn how gold is looked at as a great investment option by youngsters rather than a piece of jewellery that is an heirloom.

Disclaimer

The Investors will be bearing the recurring expenses of the scheme, in addition to the expenses of underlying scheme i.e Nippon India ETF Gold BeES. SIP stands for Systematic Investment Plan wherein you can regularly invest a fixed amount at periodical intervals & aim for better benefits over a period of time through power of compounding.

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.