In the last five decades or so, technology has grown by leaps and bounds around the world, including in India. It has come a long way from bulky desktop computers to laptops and tablets, from telephone instruments to nimble smartphones and so on. Today, many companies seem to be investing in technology to automate processes and streamline operations in their respective field. Artificial intelligence,in this regard,appears to be the latest buzzword doing the rounds.

In the world of data, particularly, algorithms and complex models built to process large quantities of data are changing the way companies operate. But what exactly are quant funds? And how do they work? This article will seek to give some flavour on them based on which an informed decision can be made.

What are Quant Funds?

.

A quant fund is a type of mutual fund that uses mathematical and statistical models or pre-determined algorithms to arrive at an investment decision based on which trades can be carried out. Since these proprietary system-basedmodels are structured around certain criteria, no human judgement is involved. The fund manager builds the portfolio based on the output generated from these mathematical models.

How Does a Quant Fund Work?

Since quant funds use algorithms, it involves making certain inputs based on rules that result in an output. The fund manager will accordingly make investment decisions based on the output generated. It must be noted that while there is not much human judgement involved in running a quant fund, a significant amount of thought has likely gone in while designing the quant fund itself before its launch. It also means that the fund manager can streamline the algorithms or make certain changes in the models as and when required.

Quant funds can come in various avatars and be designed based on parameters such as valuation ratios, market capitalisation, sectoral indicators, etc. They could be either single-parameter quant funds or multi-parameter quant funds. In the case of single-parameter quant funds, the factor can either be a certain ratio like price to earnings , a quality indicator like return on equity, or a measure of volatility such as beta. Multi-parameter quant funds can be more complex because two or more factors are involved.

Thus, while operating quant funds, a universe is first defined; this could be the BSE 200, the BSE 500, or any other index. Next, after applying the quant model, this universe is probably narrowed down to a list of 50 companies. After this, the companies are likely ranked based on the quant factor post which the fund manager constructs the investment portfolio that more or less replicates the results of the model.

Significance of Quant Mutual Funds

The essential significance of quant funds lies in the way it eliminates human bias. For example, suppose the primary quant factor is to select companies with robust growth potential and healthy balance sheets. In that case, the system automatically rejects heavily leveraged companies or whose profits have grown poorly. The results generated are unbiased, given that a consistent approach is followed across market cycles. Thus, it can ensure that the investments are not based on sentiments but on rationale embedded in the model.

Additional Read: What are Small Cap Funds ?

Benefits of investing in Quant Mutual Funds

Investing in quant mutual funds has its share of benefits. These are listed below:

• Human judgement tends to be irrational because there are times when decisions can be made based on sentiments, which can affect a fund’s returns. Because quant funds rely on a system-based approach, the risk of human bias is reduced.

• Quant funds can be scalable based on how they are built, with the capability to analyse large amounts of data in short period of time.

• Decision-making tends to be a faster process because the fund relies on quantitative models.

• Management fees tend to be lower since these funds are predominantly passive.

How to invest in Quant Mutual Funds?

The process of investing in quant funds is the same as investing in any other mutual fund scheme. Once you have selected the quant fund of your choice, you can invest in them either directly through the fund house or through mutual fund distributors. You could also consider investing in Nippon India Quant Fund.

To conclude

Quant funds can be an option for investors with a long-term investment horizon, given that the data-driven strategy of these funds can take time to deliver returns. Investors looking to diversify their mutual fund portfolios can also consider these funds.

Disclaimer:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their affiliates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

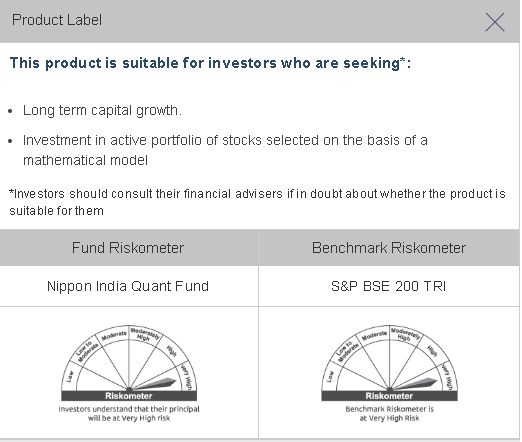

PRODUCT LABEL

Mutual Fund Investments are subject to market risks, read all the scheme related documents carefully.